|

Drug firms' 2Q profits rise

|

|

July 20, 2000: 4:48 p.m. ET

But share prices fall amid profit-taking, passage of drug imports bill

By Staff Writer Martha Slud

|

NEW YORK (CNNfn) - Three of the largest U.S. drug makers posted double-digit profit increases for the second quarter Thursday, but their stocks slid nevertheless amid profit-taking and jitters over Senate passage of a bill that would ease imports of cheaper drugs to the United States.

Eli Lilly and Co., Bristol-Myers Squibb Co. and American Home Products Corp. all met or exceeded quarterly profit expectations, fueled by strong sales of pharmaceuticals worldwide.

However, investors were more focused on Senate passage Tuesday of a bill that would permit pharmacists and wholesalers to import lower-priced prescription drugs from other countries that were manufactured in the U.S. Proponents of the bill say Americans routinely most pay higher prices for medications than people in Canada or Europe. The House of Representatives has approved a different version of the bill, making a compromise version necessary.

Pharmaceutical firms fear that such legislation could affect their profitability. The American Stock Exchange Pharmaceutical Index traded down about 1.6 percent Thursday in contrast to a broad rally among other market sectors.

"Most people don't think the bill will pass this year -- it's just a reminder of how much political rhetoric and pressure there is during an election year," Chase H&Q drug analyst Alex Zisson said of the drug legislation.

Many investors also are cashing out of stocks that have run up over the past several months, said CIBC World Markets analyst Mara Goldstein.

Lilly profit rises 15%

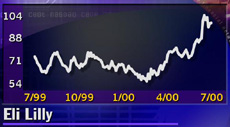

Eli Lilly (LLY: Research, Estimates) reported a 15 percent increase in second-quarter earnings to $666.2 million, or 61 cents per diluted share, from $576.4 million, or 52 cents per share, in the 1999 period.

The results -- which were boosted by a lower number of outstanding shares during the period -- exceeded the First Call consensus estimate of analysts by a penny per share.

Second-quarter sales rose 12 percent to $2.62 billion, despite a 9 percent drop in sales for the company's biggest-selling drug, antidepressant Prozac. The drug faces increasing competition. Second-quarter sales rose 12 percent to $2.62 billion, despite a 9 percent drop in sales for the company's biggest-selling drug, antidepressant Prozac. The drug faces increasing competition.

The company also said it expects Prozac sales to decline slightly for the rest of 2000.

Sales of heart drug ReoPro also fell, declining 9 percent to $104.5 million.

But sales of the company's second-biggest seller, anti-psychotic medication Zyprexa, jumped 40 percent. During the quarter, Lilly launched a new tablet formulation of the drug in Europe that disintegrates in a patient's mouth, making it easier to use. U.S. regulators have approved the new formulation, but it has not yet gone on the market in the United States.

Last month, Eli Lilly's stock jumped 18 percent in one day after the company announced a potential breakthrough in the development of a drug for sepsis, a deadly bacterial infection with no known drugs to treat it.

For the first six months of the year, net income rose 26 percent to $1.51 billion, or $1.38 per diluted share. First-half sales increased 10 percent to $5.07 billion.

Eli Lilly shares slid 2-7/8 to 95-7/8 at 4 p.m. ET.

Bristol-Myers meets estimates

New York-based Bristol-Myers (BMY: Research, Estimates) reported a 15 percent increase in second-quarter earnings to $1.1 billion, or 54 cents per diluted share, from $952 million, or 47 cents per share, a year earlier.

The results matched the First Call consensus estimate.

Sales rose 7 percent to $5.3 billion. Sales rose 7 percent to $5.3 billion.

Sales of diabetes treatment Glucophage, the company's biggest-selling product, soared 39 percent to $485 million, while sales of stroke medication Plavix increased 73 percent to $222 million.

Sales of cholesterol treatment Pravochol gained 7 percent, while sales of cancer drug Taxol rose 14 percent.

During the quarter, Bristol-Myers withdrew its application for a proposed heart pressure drug, Vanlev, after the U.S. Food and Drug Administration raised concerns about potentially severe side effects. The company reiterated Thursday that it hopes to reapply for FDA approval in mid-2001, pending successful completion of additional studies.

Second-quarter sales of the company's beauty care products declined 6 percent to $590 million, while medical device sales rose 5 percent to $440 million.

For the first six months of the year, net income rose 14 percent to $3.18 billion, or $1.15 per diluted share. Sales for the six months rose 8 percent to $10.5 billion.

Bristol-Myers stock dropped 1-7/8 to 50-1/2 at the end of trading Wednesday.

AHP: More fen-phen reserves needed

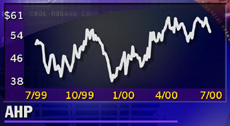

American Home Products (AHP: Research, Estimates) reported a 19 percent jump in second-quarter profit, aided by higher sales of antidepressant Effexor XR, arthritis treatment Enbrel and female hormone replacement therapy Premarin.

But the company also disclosed that it likely will need additional reserves to fund legal settlements with former users of the diet drug combination known as "fen-phen," which has been linked to heart valve damage and other health problems.

The company already has stowed away $4.75 billion to pay for a tentative class-action settlement as well as future payouts to people who pursue legal action on their own. The class-action settlement still requires approval by a federal court.

Madison, N.J.-based American Home Products earned $412.7 million, or 31 cents per diluted share, from $347.3 million, or 26 cents per share, in the year-earlier quarter, excluding one-time items in the 1999 period. There were no special items in the latest quarter.

The results matched the First Call estimate of Wall Street analysts. The results matched the First Call estimate of Wall Street analysts.

Second-quarter sales rose 16 percent to $3.19 billion. Pharmaceutical sales jumped 20 percent to $2.7 billion, while consumer health care sales were flat, rising 1 percent to $510 million.

"We have had an exciting 2000 first-half marked by key transactions and FDA approvals, which will allow AHP to continue to deliver strong sales and earnings-per-share growth," said CEO John R. Stafford.

During the quarter, AHP closed the sale of its Cyanamid Agricultural Products business to Germany's BASF for $3.8 billion in cash plus assumed debt.

That sale, as well a $1.8 billion cash payment from Warner-Lambert Co. in the first quarter in exchange for terminating their merger deal, has "improved liquidity to assist us in our efforts to expand our core pharmaceutical business and biotechnology products," Stafford said.

On a net basis, quarterly profit totaled $412.7 million, or 31 cents per diluted share, compared with $398.7 million, or 30 cents per share, for the year-earlier quarter.

For the first half of the year, net income including one-time items totaled $689.1 million, or 52 cents per share, from $1.05 billion, or 79 cents per share, in the year-earlier period.

Sales for the six months totaled $6.53 billion, up 17 percent from $5.6 billion in the 1999 first half.

American Home shares slipped 1-11/16 to 53-9/16 at 4 p.m. ET.

|

|

|

|

|

|

|