|

Bertelsmann buys CDNow

|

|

July 20, 2000: 4:55 p.m. ET

German media giant to buy online music retailer for $117M in cash

|

NEW YORK (CNNfn) - German media conglomerate Bertelsmann on Thursday swooped in to save troubled online music retailer CDNow Inc., agreeing to acquire the company for $3 per share in cash, or $117 million, the companies said.

The deal erases CDNow, a pioneering Internet retailer of CDs and music-related paraphernalia, from the growing list of young Web-based retail companies that experts expect to fail as they run out of cash and continue to bleed red ink.

While a highly trafficked site for music enthusiasts seeking albums, videos, T-shirts, and DVDs, the company losses have grown continuously as the cost of wooing new customers increased. In the first quarter ended in March, it reported that sales doubled to $43.6 million, but losses swelled to $37.8 million. While a highly trafficked site for music enthusiasts seeking albums, videos, T-shirts, and DVDs, the company losses have grown continuously as the cost of wooing new customers increased. In the first quarter ended in March, it reported that sales doubled to $43.6 million, but losses swelled to $37.8 million.

The Fort Washington, Pa.-based company has been seeking a merger or financial partner since March when Time Warner Inc. (TWX: Research, Estimates), the parent company of CNNfn, and Sony Corp. scrapped plans to merge their jointly owned Columbia House music venture with CDNow.

The takeover price represents only half of CDNow's projected revenue for the current year. It leaves the two founding brothers Jason and Matthew Olim with $17.4 million to share between them.

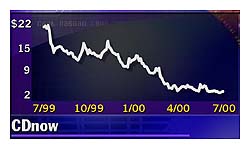

That's a far cry from the $203 million they were set to collect had the shares not fallen from their 35-1/2 high in April 1998.

"We have given our shareholders the best outcome, but of course it's hard to be delighted about valuations of vertical e-commerce companies," Jason Olim told Reuters in an interview. Olim acknowledged that the equity market's bellyfull of Internet stocks had knocked down the valuation of his company, noting that despite talks with several bidders, Bertelsmann had still offered the best deal.

"Bertelsmann has bought it very cheaply," said technology analyst Julien Roch at Lehman Brothers. "CDNow is one of the best known brand names and has always been in the top 10 of etail Web sites."

CDNow to get $42 million to pay off debt

Under the deal, Bertelsmann -- which holds one of the five largest recording companies in the world with its BMG Music unit - will advance to CDNow about $42 million to pay off existing loans to keep its operations on track.

The company will continue to operate under the CDNow brand, and will work with GetMusic, an online music joint venture between Bertelsmann's BMG Entertainment and Universal Music Group, to feature GetMusic's content.

Once the transaction closes, CDNow is to become Bertelsmann's primary engine for all music commerce across online, mobile and broadband platforms and evolving technologies such as digital downloading and streaming. Once the transaction closes, CDNow is to become Bertelsmann's primary engine for all music commerce across online, mobile and broadband platforms and evolving technologies such as digital downloading and streaming.

CDNow will continue to be headquartered in Fort Washington, and the management team is expected to remain with the company. Jason Olim, CDNow president, chief executive and co-founder, will report to Andreas Schmidt, president and CEO of Bertelsmann e-Commerce Group.

"Our agreement with Bertelsmann represents a successful conclusion to our extensive search for a merger partner," said Olim, who formed the company in 1994 and took it public in 1998.

CDNow (CDNW: Research, Estimates) shares rose on Thursday to 2-29/32, up 1/32, well off their 52-week high of 23-1/4.

-- from staff and wire reports.

|

|

|

|

|

|

CDNow

Getmusic

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|