|

U.S. confidence rebounds

|

|

July 25, 2000: 3:55 p.m. ET

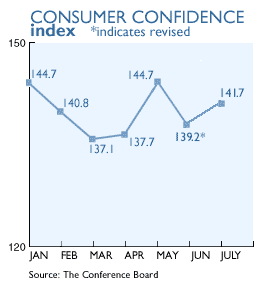

July confidence gauge rises to 141.7; June existing home sales jump

|

NEW YORK (CNNfn) - U.S. consumer confidence rebounded in July as Americans' outlook about finding jobs and the overall economy brightened, while sales of existing homes surged to their highest level in almost a year in June, reports said Tuesday.

The Conference Board said its gauge of consumer confidence rose to 141.7 in July from a revised 139.2 in June. Analysts polled by Briefing.com had expected a reading of 139. Consumer spending fuels two-thirds of the U.S. economy, so readings on consumer attitudes are closely watched by economists and policy makers. The Conference Board said its gauge of consumer confidence rose to 141.7 in July from a revised 139.2 in June. Analysts polled by Briefing.com had expected a reading of 139. Consumer spending fuels two-thirds of the U.S. economy, so readings on consumer attitudes are closely watched by economists and policy makers.

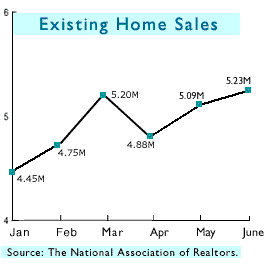

Separately, the National Association of Realtors said existing home sales rose 2.8 percent to an annual rate of 5.23 million units in June, above May's pace of 5.09 million units and the 5 million expected by economists. June's sales were at their highest level since August of last year, when sales ran at a pace of 5.30 million units.

Combined, the reports suggested that the Federal Reserve's series of inflation-fighting interest rate increases may not be having the desired effect of curbing consumer demand, even in the face of rising mortgage costs.

"These data leave confidence very close to its cycle high, and completely unaffected by higher interest rates," said Ian Shepherdson, chief U.S. economist with High Frequency Economics. "Together with the rise in home sales also reported today, the data sit very uneasily with Mr. Greenspan's dovish tone last week and again today."

Mixed signals for Greenspan

The reports came as Federal Reserve Chairman Alan Greenspan took center stage once again on Capitol Hill to enlighten members of the House Banking Committee with the Fed's semiannual review of the current state of the U.S. economy.

Greenspan's testimony was identical to remarks he made last week in Washington to the Senate Banking Committee, though he did take note of both sets of economic numbers, suggesting that the consumer confidence numbers in particular were useful for the Fed in its rate decisions.

At the same time, he noted that additional government data due to be released in the next several weeks -- reports on second-quarter wage costs, second-quarter growth and July unemployment, among others -- will provide key information for policy makers before their next meeting on Aug. 22.

"There's an awful lot of information" coming out that "clearly will have an impact" on the Fed's decision, Greenspan said.

Greenspan said last week that while the economy was exhibiting some signs of slowing, it still was too soon to conclude that the Fed's six interest rate increases over the past year were having the desired effect of slowing growth and keep inflation in check.

Existing home sales rebound

"Consumer confidence readings continue to indicate a strong overall economy," said Lynn Franco, director of the Conference Board's consumer research center. "Consumers are not only optimistic about current conditions, but their expectations for the next six months signal continued low unemployment and minimal inflationary pressures."

As for existing home sales, Dr. David Lereah, the NAR's senior chief economist, said they are expected to trend downward in the months ahead. As for existing home sales, Dr. David Lereah, the NAR's senior chief economist, said they are expected to trend downward in the months ahead.

"Although we may see some month-to-month fluctuations in both interest rates and home sales, we expect the overall level of sales to gradually decline," he said. "Existing home sales should be down more than 9 percent from last year's record, but we'll still end the year at fairly high levels."

According to Freddie Mac, the national average commitment rate for a 30-year, conventional, fixed-rate mortgage was 8.29 percent in June, down from 8.52 percent in May; it was 7.55 percent in June 1999.

The median price of an existing home rose to $139,800 in June, up 2.1 percent from $136,900 a year earlier. Half the homes sold for more than the median price and half for less. Existing home sales figures are based on closings, which usually come a month or two after the buyer signs a contract for the home.

|

|

|

|

|

|

|