|

Portfolio protection

|

|

July 25, 2000: 5:59 a.m. ET

A San Francisco investor lives frugally now so he can live large later

By Staff Writer Jennifer Karchmer

|

NEW YORK (CNNfn) - Brian McQuade is probably one of the few businessmen in San Francisco who doesn't own a cell phone. McQuade, 27, a consultant in the investment industry, is doing without some of today's luxuries - like buying a cell phone -- so he can enjoy his retirement days later on.

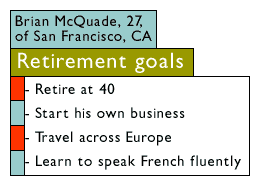

With dreams of opening his own business, traveling Europe, learning to speak new languages and maybe even starting a foundation, McQuade would like to retire at 40.

"I'd prefer to forgo instant gratification, partying, traveling or buying fancy cars today," said McQuade. "Being in the investment industry, I know what the value of the dollar can grow to by compounding. I'd prefer to own several homes at 40 (years old)."

Portfolio Rx is a weekly CNNfn.com feature that looks at issues like diversification, asset allocation and rebalancing. In each article, we will review an investor's long-term portfolio and ask financial experts to give their advice. If you want help with your nest egg, see below for more information. Portfolio Rx is a weekly CNNfn.com feature that looks at issues like diversification, asset allocation and rebalancing. In each article, we will review an investor's long-term portfolio and ask financial experts to give their advice. If you want help with your nest egg, see below for more information.

McQuade's nest egg begins with an inheritance he received 15 years ago when his father passed away. On top that income, he holds several mutual funds in his Roth IRA and 401(k) plans.

But even a sophisticated investor, like McQuade, who owns several different mutual funds might not realize he holds some of the same stocks or bonds. Overlapping, as it's called, occurs in many portfolios and can impede the growth of your nest egg. By reviewing your funds' holdings, you can make sure you've put together a diversified, and therefore, less risky plan, planners say.

Click here to read last week's Portfolio Rx on CNNfn.com!

Living penny-wise today ...

McQuade knows a thing or two about mutual fund investments. As a consultant in the investment field earning about $60,000 a year, he researches funds and their holdings to make sure they live up to their investment objective spelled out in the prospectus.

McQuade, originally from Vermont, got some of his training while working at Fidelity Investments in Boston and Barclays Global Investors before moving to the West Coast.  However, even an experienced investor like McQuade knows he could learn more about diversifying his retirement portfolio. However, even an experienced investor like McQuade knows he could learn more about diversifying his retirement portfolio.

As a single man living in a big city, he enjoys a night out on the town. However, McQuade makes a point of saving today so he can live high on the hog in his later years -- maybe even in Europe.

"I've always wanted to live in France. My mom is French-Canadian," McQuade said in a phone interview from his San Francisco office. "I've taken French courses and always wanted to be fluent, but given my career and I'm always working, I just have not been able to pursue that."

... to live large tomorrow

Dreaming of retiring at 40 doesn't necessarily mean McQuade is going to pack it in and relax. In fact, he'd like to continue working by starting his own business.

"I just don't see myself playing golf or on a cruise ship (during retirement)," he said. "I just want to have all this stuff set up for when the time comes."

With an estimated net worth over $500,000, McQuade is not the typical 27-year-old investor.

Check your mutual funds on CNNfn.com

He has $48,000 invested in a Roth IRA and a 401(k) plan. The majority of his assets are in the following American Funds: the Capital World Growth & Income Fund (CWGIX), Europacific Growth Fund (AEPGX), Growth Fund of America (AGTHX), New Economy Fund (ANEFX) and New World Fund (NEWFX).

He's invested $15,000 in the Vanguard Total Stock Market Index Fund (VTSMX) and holds about $138,000 in an American Legacy II annuity spread among growth, small cap, international and global growth investments.

As far as expenses go, McQuade lives fairly prudently spending most of his monthly income on rent ($782) and meals ($450). But the biggest bite comes from Federal taxes that he estimates around $900 a month.

In addition to his consulting salary, he receives about $400 a month from a rental property he owns in Cambridge, Mass., which has a $69,000 mortgage.

The doctor is in

While McQuade has accumulated quite a bit of savings and is on his way to a comfortable retirement depending on his budget later on, financial experts say his portfolio is lacking diversification, which is the key ingredient to cushion any nest egg from market volatility.

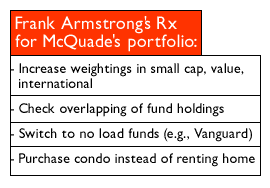

Certified financial planner (CFP) Frank Armstrong notes that the five American funds in McQuade's portfolio consist mainly of the same types of stocks- a red flag.

"He's not getting the kind of diversification he thinks because they're all in large company growth," said Armstrong, president of Managed Account Services in Miami, Fla. "If he held small company funds or value funds or foreign, he'd have wider diversification, and far lower risk."

Armstrong suggests McQuade invest in small cap, value and international funds to spread the risk of his portfolio around.

In addition, because most of his funds are large-cap oriented, they hold many of the same names.

For example, four of McQuade's funds hold stock of the kitchen and house wares supply store Lechters (LECH).

"There's a lot of overlap in his plan," Armstrong said. "You might as well hold an index fund."

Index: the way to go

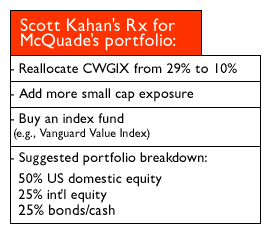

CFP Scott Kahan in New York agrees with the sentiment of holding an index fund, so he suggests the Vanguard Value Index Fund (VIVAX) since most of McQuade's holdings are in large cap stocks.

Also, Kahan points out that with $180,000 in the Capital World Growth & Income Fund (CWGIX), McQuade has almost 30 percent of his retirement nest egg devoted to one fund.

"The bottom line is, it's too much in that fund," said Kahan. "It's a good fund, but scale it back considerably."

Investors should have no more than 10 to 15 percent of their retirement money in one fund, Kahan suggests. So Kahan suggests the following breakdown in McQuade's portfolio given his age and risk level which can be more aggressive at this time:

-50 percent in U.S. domestic equity stocks

-25 percent in international stocks

-25 in bonds and cash.

While McQuade is living the single life now, down the road he may get married, have children and have different responsibilities.

"It is rare that you see a 27-year-old with this type of portfolio," Kahan said. "You see it more with people who are 50 or 55."

Although he has a well laid out plan for retirement, he'll have to take into consideration possible changes and be flexible, planners note.

"It's hard to plan out the next 60 years of his life because family situations change and he might have more expenses than he thought, such as college education," Kahan said.

Click here to read the latest Checks & Balances column, which appears Mondays in CNNfn.com's personal finance section!

So as McQuade plans for retirement, whether it's just 13 years away or 30, he would like to give back to the community and spend his days helping others.

"What would my life look like if I wasn't in a suit," McQuade said. "What would I be doing? Volunteering maybe."

* Disclaimer

If you would like to be considered for our Portfolio Rx feature, send an e-mail to retirement@cnnfn.com with the following information: your age, occupation, income, assets, debt and expenses, your retirement goals, such as when you wish to retire and what type of lifestyle you envision. Also include specifics about your long-term savings portfolio: your 401(k) and IRA accounts; which mutual funds, stocks and other securities you own; and information about any other source of retirement income you expect, such as a pension. If we choose your portfolio, we will use your information including your name in an upcoming story. Please include a daytime phone number so we may reach you.

|

|

|

|

|

|

|