|

Qualcomm plans spinoff

|

|

July 25, 2000: 4:20 p.m. ET

Wireless provider will separate its chipset and royalty businesses

By Staff Writers David Kleinbard & Michele Masterson

|

NEW YORK (CNNfn) - Wireless communications giant Qualcomm Inc. said Tuesday it will spin off to its shareholders the part of its business that makes chips and software for mobile phones.

San Diego, Calif.-based Qualcomm will sell less than 10 percent of the chip and software unit's stock in an initial public offering to create a trading market for the stock. Qualcomm will distribute the remainder of the unit's stock to Qualcomm shareholders in a second stage, to be completed by August 2001.

Qualcomm hasn't yet indicated the number of shares that will be sold or an estimated price for the stock. However, based on the valuation ratios of other rapidly growing communications chip makers, the Qualcomm unit is likely to have a market capitalization above $16 billion.

Qualcomm developed wireless technology, known as Code Division Multiple Access, that is used by about 57 million mobile phone subscribers worldwide, especially in North America, South America and Korea. The San Diego, Calif.-based company makes money by manufacturing chipsets used in mobile phones and licensing CDMA technology to other equipment makers.

The CDMA standard competes with one called Time Division Multiple Access, or variations of TDMA known as Global System for Mobile Communications (GSM). GSM, which dominates in Europe, now has about five times as many subscribers as CDMA.

Tuesday's announcement continues Qualcomm's trend away from being a company that makes physical products and toward one focused only on intellectual property licensing. Qualcomm previously exited the wireless phone and infrastructure businesses. After the spinoff, Qualcomm will retain more than 1,000 patents and patent applications relating to CDMA and will have 800 engineers.

At the same time, the new entity will be free to make software and chips for mobile phones based on both CDMA and GSM. Currently, Qualcomm's chip and software operations are wedded to the CDMA standard, preventing it from developing hardware for phones than can operate on both standards in the way that many phones can handle both analog and digital signals. At the same time, the new entity will be free to make software and chips for mobile phones based on both CDMA and GSM. Currently, Qualcomm's chip and software operations are wedded to the CDMA standard, preventing it from developing hardware for phones than can operate on both standards in the way that many phones can handle both analog and digital signals.

"After the spinoff, we will have more effective access to third-party technology," said Richard Sulpizio, who will be CEO of the new entity, temporarily called Spinco until Qualcomm can come up with a more creative name. "It will eliminate any conflict that we have had in the past with royalty business associated with Qualcomm."

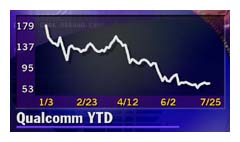

Qualcomm (QCOM: Research, Estimates) shares jumped 4-3/8 to 68 in late afternoon trading Tuesday.

Stronger negotiating position

"Basically this is separating the royalty and chipset business," Banc of America Securities analyst Mark McKechnie told CNNfn.com. "They need to do that to improve their positioning for both of those divisions for the new third-generation technology known as wide band CDMA."

"The Holy Grail of the handset business is to make a single chip that can handle CDMA and GSM," said Deutsche Banc Alex. Brown analyst Brian Modoff. "This company has the expertise to execute towards that goal."

In addition, Qualcomm will be in a stronger position to negotiate royalty fees with other mobile phone makers after the spinoff, Modoff said. Currently, Qualcomm needs intellectual property owned by other companies to make its mobile phone chipsets. Exiting the chip business erases that need.

"Nokia, Siemens, Alcatel, and Motorola will need something from Qualcomm, but Qualcomm won't need anything from them," Modoff said.

Qualcomm said it will assign some of its patents to Spinco. Spinco then will be able to use those patents to gain access to GSM technology through cross-licensing agreements with other companies.

Worth more than $16 billion

Both Qualcomm and Spinco will be sizeable companies in the wireless area after the spinoff. In the nine months ended June 25, Spinco had revenue of $965 million and earnings before taxes and the amortization of intangible items of $321 million, according to a filing made Tuesday with the Securities and Exchange Commission. It accounts for about 55 percent of Qualcomm's revenue and 30 percent of its earnings, according to analyst estimates.

Qualcomm's two-step spin-off of its chip and software unit resembles the procedure networking company 3Com used with its personal digital assistant unit Palm Inc. (PALM: Research, Estimates). Qualcomm said it expects the spinoff to be completed by August 2001.

Given the percentage of Qualcomm's earnings that come from Spinco and the valuation ratios of chip competitors, such as LSI Logic (LSI: Research, Estimates), the unit's market value could be in the $16 billion-to-$19 billion range, analysts said. All of Qualcomm now has a market value of about $50 billion.

Spinco's management team

Qualcomm Chairman and CEO Dr. Irwin M. Jacob will head Spinco as well. Sulpizio will be chief executive officer and Don Schrock will be president and chief operating officer.

According to the research firm Dataquest, Spinco is the world's largest maker of semiconductor products that doesn't have its own manufacturing facilities. To date, it has shipped systems for use in more than 100 million CDMA handsets worldwide.

Spinco is not alone in the market for mobile communications chips. It has to compete against Intel (INTC: Research, Estimates), LSI Logic, and Philips Electronics, to name a few companies. It also faces indirect competition from telecommunications equipment maker Lucent Technologies (LU: Research, Estimates) and the mobile communications leader Motorola Inc. (MOT: Research, Estimates).

Also, Spinco will be very exposed to the South Korean mobile phone market. Three of its four largest customers during last year were based in that country, the SEC filing made Tuesday said. Sales of mobile phones have plunged in South Korea over the past two months, after the government eliminated handset subsidies.

|

|

|

|

|

|

Qualcomm

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|