|

Xerox problems continue

|

|

July 26, 2000: 2:35 p.m. ET

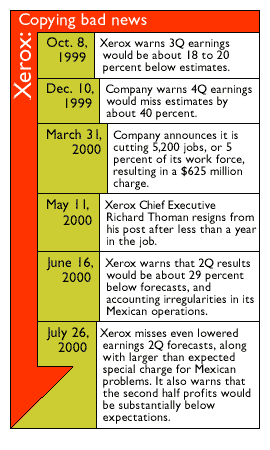

2Q profit misses targets as company issues fourth warning in 10 months

|

NEW YORK (CNNfn) - Xerox Corp. copied its record of earnings disappointments Wednesday by missing lowered second-quarter earnings forecasts and issuing its fourth warning on future results in less than 10 months.

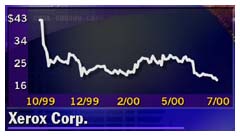

The announcement sent the stock down 3-3/16, or about 17.5 percent, to 15 in trading Wednesday. The stock is now 65 percent below its value before the first earnings warning in October.

The company did not give a new earnings range for the second half, saying only that third-quarter profit would be modest, and that results would be substantially below expectations.

Paul Allaire, the company's chairman and chief executive, told analysts that he believed the third quarter would be below the 24 cents it earned from operations in the second quarter, which would put it well below the 38 cents a share forecast for current period. He did not give similar comparison for the fourth-quarter results, but he said that the company would be challenged in the second half to repeat the 54 cents a share it earned in the first six months. Paul Allaire, the company's chairman and chief executive, told analysts that he believed the third quarter would be below the 24 cents it earned from operations in the second quarter, which would put it well below the 38 cents a share forecast for current period. He did not give similar comparison for the fourth-quarter results, but he said that the company would be challenged in the second half to repeat the 54 cents a share it earned in the first six months.

Analysts had been looking for earnings of 60 cents a share in the fourth quarter alone.

"We have more significant issues than we previously anticipated," said Allaire, who returned as CEO in May following the resignation of Rick Thoman. "We're confident about a turnaround, but the timing is clearly later."

The company said it earned $222 million, or 30 cents a diluted share, before special items in the quarter. But that result includes gains from asset sales that equaled 6 cents a share. So a majority of analysts say they believe the company earned only 24 cents a share in the period, or 20 percent below the previous forecast, according to earnings tracker First Call.

The second quarter's 30-cent consensus estimate had already been lowered from 42 cents after a June 16 earnings warning from the company.

Xerox also saw a much larger-than-anticipated special charge related to accounting irregularities in Mexico. Including that charge as well as the gain on sales, net income in the period came to $145 million, or 19 cents a diluted share. The 11-cent Mexico charge was roughly twice what the company said it anticipated when the problem was first revealed in the June earnings warning, and company officials admitted future charges to account for the problems are possible.

In the year-ago period, the company earned net income of $448 million, or 62 cents a share. In the year-ago period, the company earned net income of $448 million, or 62 cents a share.

Xerox (XRX: Research, Estimates) officials insisted they now are getting a handle on the problems.

"Though disappointing, these results reflect the difficulties found in our visits and reviews of operations around the world over the last two months. There is no doubt that the time required for recovery is longer than previously anticipated," said Anne Mulcahy, president and chief operating officer. "Stabilizing the situation has been our focus and much progress has been made, but achieving renewed growth will take more time."

But analysts were not convinced. They said that Xerox problems may be so ingrained that a turnaround may not occur until the second half of next year, if not later.

"I think Xerox has got a long way to go," said Ben Reitzes of PaineWebber. "The earnings performance and outlook are even worse than anticipated in the pre-release."

Reitzes said the company is being hurt by a technology-induced shift from copiers to printers for many office documents, and from too little of the company's revenue coming from growth areas such as color copiers or low-cost ink jet printers. Reitzes said the company is being hurt by a technology-induced shift from copiers to printers for many office documents, and from too little of the company's revenue coming from growth areas such as color copiers or low-cost ink jet printers.

"Page volumes are migrating to printers," Reitzes told CNNfn Wednesday. "We get things via e-mail and we print them out. As much as Xerox is an American icon and a great brand presence, we don't use its machines as much as we used to." (389KB WAV) (389KB AIFF)

Revenue in the quarter slipped 4 percent to $4.7 billion from $4.9 billion. The company said revenue would have only fallen 1 percent without the impact of changing exchange rates, which lowered earnings about 4 cents a share in the period.

"The direct sales force realignment continues to affect revenues, although sales force turnover rates in both the U.S. and Europe declined significantly from first quarter levels," the company said.

Allaire told analysts that the company is facing much more competition, especially for its core, upper-end black-and-white copiers. Sales in that segment dropped 11 percent in the quarter. But he insisted that improvements in the sales force and new products would help it stem the loss of business there.

For the first six months, the company posted earnings excluding special items of $442 million, or 64 cents a share, although charges for Mexico, restructuring and research and development resulted in a net loss of $98 million, or 17 cents a share. That compares with net income of $791 million, or $1.16 a diluted share, in the first half of 1999, when there were no special items.

Year-to-date revenue fell 1 percent to $9.1 billion from $9.2 billion.

|

|

|

|

|

|

Xerox

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|