|

Amazon tops estimates

|

|

July 26, 2000: 8:20 p.m. ET

Internet retailer beats earnings expectations, falls short on revenue

|

NEW YORK (CNNfn) - Internet retailing bellwether Amazon.com reported a second-quarter loss Wednesday that was smaller than analysts had expected, as its U.S. books, music and video segment achieved operating profitability.

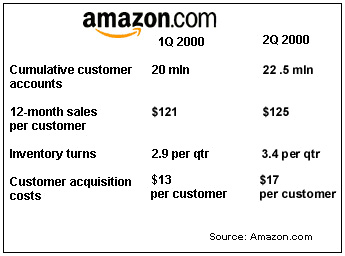

However, the results also indicated that Amazon's era of hyper-fast growth might be drawing to a close. Its second-quarter revenue was only $4 million higher than its first-quarter total, and 12-month sales per customer rose by only $4 versus the previous quarter.

For the quarter ended June 30, Seattle-based Amazon reported a pro forma loss of $115.7 million, or 33 cents per share, versus a loss of $82.8 million, or 26 cents per share, in the same period last year. Analysts had expected Amazon to lose 35 cents per share in the quarter, according to the earnings estimate tracker First Call.

Investors weren't impressed. Amazon's (AMZN: Research, Estimates) stock slipped 1-15/16 to 35-11/16 in late afternoon trading before the earnings were released and dropped another 2-1/2 to 33-9/16 in after-hours trading.

Revenue rose 84 percent to $578 million from $314 million in the year-ago second quarter. Its sales were up slightly from $574 million in the first quarter of 2000. The company ended the quarter with $908 million in cash, about $92 million less than it had at the end of the first quarter of this year.

The revenue growth rate of 84 percent was below Amazon's internal goal of 90 percent. Its sales also were slightly lower than Merrill Lynch analyst Henry Blodget's estimate of $585 million.

However, the company's gross margin during the quarter - which reached 23.5 percent - was a full percentage point higher than Blodget's estimate.

In an interview on CNNfn's Moneyline News Hour Wednesday evening, Amazon's chairman and chief executive Jeff Bezos said investors should focus on the progress the company is making toward achieving operating profitability instead of the lower-than-expected revenue for the quarter. In an interview on CNNfn's Moneyline News Hour Wednesday evening, Amazon's chairman and chief executive Jeff Bezos said investors should focus on the progress the company is making toward achieving operating profitability instead of the lower-than-expected revenue for the quarter.

"We're very proud of the year over year growth that we did see," Bezos said. "At the same time, we made progress in our operating loss as a percentage of sales, which is something we really wanted to do."

He also highlighted the $10 million operating profit Amazon managed to eke out of its U.S. books, music and DVD/video segment, which accounts for roughly two-thirds of its revenue. [283K WAV or 283K AIFF]

Other members of Amazon's management team said on a conference call Wednesday evening that the books and music segment will be profitable for the full year also.

Amazon's pro forma results don't include the amortization of goodwill and other intangible assets, stock-based compensation, and merger and acquisition-related costs. When those costs are included, the company's net loss swelled to $317.2 million, or 91 cents per share, from $138 million, or 43 cents, in the same period last year.

Added 2.5 million customer accounts

The Web retailer added 2.5 million customer accounts during the second quarter, bringing its total since inception to more than 22.5 million as of June 30. Trailing 12-month sales per customer reached $125, up from $108 for the same period a year ago and up from $121 in the first quarter. Its cost to acquire a customer declined to $17 from $19 in the second quarter of last year.

Warren Jenson, Amazon's chief financial officer, said the company expects its operating losses to be in the single digits as a percentage of sales by the fourth quarter of this year. He also forecast strong year-over-year sales growth. Warren Jenson, Amazon's chief financial officer, said the company expects its operating losses to be in the single digits as a percentage of sales by the fourth quarter of this year. He also forecast strong year-over-year sales growth.

"In addition we expect to end the year with roughly $1 billion in cash," Jenson said.

Galli says goodbye

Two Wall Street analysts downgraded the company Wednesday morning, citing the departure of a top executive and concerns that the company would report disappointing earnings after the closing bell.

On Tuesday, Joseph Galli, the former Black & Decker executive Amazon hired last year to be its chief operating officer, resigned to become chief executive of business-to-business firm VerticalNet Inc. On Tuesday, Joseph Galli, the former Black & Decker executive Amazon hired last year to be its chief operating officer, resigned to become chief executive of business-to-business firm VerticalNet Inc.

Galli told CNNfn that his departure was motivated by "personal reasons." However, analysts speculated that Galli had become frustrated trying to run Amazon in Bezos' shadow.

Some Amazon investors perceived Galli as a symbol of Amazon's drive towards profitability and Bezos as a symbol of growth at any cost. On Wednesday evening's conference call, Bezos assured investors that he is committed to balanced growth and getting the company in the black.

Adding insult to injury, Amazon's site was unavailable to Web users for a brief period Wednesday because of what the company said was an internal error. The problem was corrected a short time later.

|

|

|

|

|

|

|