|

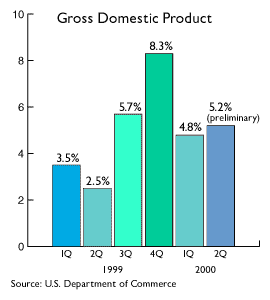

GDP shows surprise gain

|

|

July 28, 2000: 11:10 a.m. ET

Economy grew at 5.2% rate in 2Q, above forecasts and revised 1Q

|

NEW YORK (CNNfn) - The U.S. economy grew much faster than expected in the second quarter, bucking earlier indications of a slowing of the nation's economy, according to a government report Friday.

Gross domestic product grew at a 5.2 percent annual rate in the quarter, well above the 3.7 percent forecast of analysts surveyed by Briefing.com. The rate was even greater than the revised 4.8 percent growth rate in the first quarter.

The Commerce Department report raised concerns of another interest rate hike by the Federal Reserve at a meeting later this year. Previous economic reports suggesting a slowing of the economy had led some investors to believe that the Fed was done with its current series of rate hikes designed to cool the economy and control inflation. The Commerce Department report raised concerns of another interest rate hike by the Federal Reserve at a meeting later this year. Previous economic reports suggesting a slowing of the economy had led some investors to believe that the Fed was done with its current series of rate hikes designed to cool the economy and control inflation.

One hopeful note in Friday's report for those hoping to avoid future rate hikes was low inflation along with a drop in consumer spending.

The report said business spending and inventory investment grew along with government spending. Those factors spurred the broad measure of the nation's goods and services forward, overcoming a slowdown in consumer spending in the period.

The GDP price deflator, a key inflation indicator, rose at a 2.5 percent rate in the period, in line with estimates and below the revised 3.3 percent rate of increase in the first quarter. Excluding often volatile energy and food prices, the price of gross domestic purchases rose at a 1.8 percent annual rate in the quarter, down from a 2.8 percent annual rate of increase in the first quarter.

"Although the overall number on GDP was very strong, it does appear that consumer spending is slowing a bit," John Canavan of Stone and McCarthy told Reuters. That may help allay some fears of further Fed interest rate hikes.

But another report released Friday shows no waning in consumer confidence. The University of Michigan consumer confidence survey in July climbed to 108.3 from a June reading of 106.4, market sources told Reuters on Friday. The sponsored survey is not released publicly until later in the day.

"Fundamentally, the economy has not slowed as investors had hoped or the Fed requires," said Charles Lieberman, chief economist with First Institutional Securities. "It puts a tightening in August back on the table." "Fundamentally, the economy has not slowed as investors had hoped or the Fed requires," said Charles Lieberman, chief economist with First Institutional Securities. "It puts a tightening in August back on the table."

Others suggested the Fed would still avoid raising rates in August, but that rates were still heading higher.

"These numbers suggest the Fed is not done tightening for this cycle, if not in August, then later in the year," said David Jones, chief economist with Aubrey G. Lanston & Co.

But while the report raised interest rate concerns, some said it is also important to consider what it says about the underlying vigor of the U.S. economy.

"We essentially have a very strong economy," Asha Bangalore, an economist at Northern Trust Co., told the Associated Press. "Business investment is just roaring."

-- from staff and wire reports

|

|

|

|

|

|

|