|

Corvis IPO raises $1 billion

|

|

July 28, 2000: 6:54 p.m. ET

Networking company is worth $27 billion, but has generated no sales

By Staff Writer David Kleinbard

|

NEW YORK (CNNfn) - The optical networking equipment maker Corvis Corp. raised more than $1 billion in its long-awaited initial public offering, even though the company hasn't yet generated a dime of revenue.

Columbia, Md.-based Corvis sold 31.62 million shares at $36 each through lead underwriters CS First Boston and Robertson Stephens. In its first day of trading Friday, Corvis' stock soared 47-7/16 to 83-7/16, a 132 percent gain.

The company has 330.5 million shares outstanding, giving it a market cap of $27.6 billion right out of the gate.

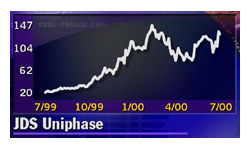

The success of the Corvis (CORV:Research, Estimates) offering shows how investors have an almost insatiable appetite for optical networking stocks. The stocks of other companies involved in the fast-growing area, such as JDS Uniphase, SDL Inc., and Corning, have soared over the past 12 months. At its current price of 116, JDS Uniphase (JDSU: Research, Estimates) is almost six times higher than its 52-week low of 19-5/16. The success of the Corvis (CORV:Research, Estimates) offering shows how investors have an almost insatiable appetite for optical networking stocks. The stocks of other companies involved in the fast-growing area, such as JDS Uniphase, SDL Inc., and Corning, have soared over the past 12 months. At its current price of 116, JDS Uniphase (JDSU: Research, Estimates) is almost six times higher than its 52-week low of 19-5/16.

Using photons to transmit data

Optical networking refers to the use of photons of light to transmit data over fiber-optic cables, instead of electrical signals traveling over copper wires. Optical signals can travel almost 2,500 miles without regeneration, compared with 40 miles for copper wire and coaxial cable systems. In addition, a modern fiber-optic cable can handle 1.6 million telephone conversations, versus about 120 conversations for a standard copper telephone wire.

Corvis' products "enable the creation of all-optical backbone networks that support transmission over long distances and eliminate the need for expensive and bandwidth-limiting electrical regeneration and switching equipment," the company said in a registration statement filed with the Securities and Exchange Commission. The company sells its equipment to telephone companies trying to upgrade their networks to handle the exploding volume of Internet traffic.

The company managed to obtain a $27.6 billion market cap even though it hasn't commercially shipped a single product. However, the company does have two customers - Broadwing Communications Services and Williams Communications - each of which has agreed to purchase $200 million of its products over a two-year period, subject to its successful completion of field trials. Corvis expects those trials to be completed in the second half of this year.

Corvis has racked up significant losses since its inception in June 1997. As of April 1, 2000, it had an accumulated deficit of $118 million, according to its SEC filing.

Existing competition

Giants such as Alcatel, Cisco Systems, Lucent Technologies, NEC, and Nortel Networks dominate the market for the type of network communications equipment Corvis sells. In addition, the young company could face competition from other large communications companies that are expected to enter the market.

Corvis says its competitive advantage comes from the fact that its equipment enables telephone companies to dramatically reduce their operating expenses. Its products do this by reducing the amount of equipment in "backbone" networks and trimming costs associated with maintaining equipment and spare parts inventory

Corvis was founded and is led by one of the best-known figures in optical networking - David Huber. Huber founded Ciena Corp. (CIEN: Research,Estimates) in 1992 and later served as its chief technology officer and chief scientist. Ciena was the first company to make volume commercial shipments of dense wave division multiplexing equipment. Dense wave division multiplexing allows the simultaneous transmission of several channels on a single fiber, thereby greatly increasing the transmission capacity of each line.

|

|

|

|

|

|

|