|

Dipping into the nest egg

|

|

July 31, 2000: 12:56 p.m. ET

Know when you can borrow from 401(k)s and IRAs without penalty

By Cheryl Meyer

|

NEW YORK (CNNfn) - Eleazar Tellez and his wife wanted to buy their first home, a modest house in San Antonio, Texas. They didn't have enough money in their savings account to cover the down payment, so they turned to their retirement funds instead, as their only hope of becoming homeowners.

"We have a little bit in savings, but everything else was tied up in the IRA," said Tellez, 31, a father of three and a member of the U.S. Air Force.

Meanwhile, Jocelyn Bolick, 42, a software engineer in Vermont, had watched her $100,000 401K-turned-IRA triple in value, and thoughts of retiring early flashed in her mind. She wondered if she could withdraw money annually from her retirement plan, starting now.

Their situations couldn't have been more different, but Tellez and Bolick have asked what hundreds of Americans are asking every year: Can they withdraw money early from their IRAs or 401(k) plans without penalty? Their situations couldn't have been more different, but Tellez and Bolick have asked what hundreds of Americans are asking every year: Can they withdraw money early from their IRAs or 401(k) plans without penalty?

The answers can be "yes" and "no," depending on various factors, but financial planners and money gurus offer virtually the same advice: If you can avoid it, don't tap into your retirement funds before 59-1/2, the age the U.S. government says is OK to begin withdrawals without incurring a 10 percent hit.

"We advise in a general sense that the last amount of money that you spend is money in a qualified plan or an IRA," said Tom Grzymala, president and chief financial officer of Alexandria Financial Associates Ltd., in Alexandria, Va. "Spend your taxable money first."

Still, financial crunches often force people to dip into their retirement plans early, despite advice from financial planners, tax accountants or brokers.

In some cases, people lock too much money into their IRAs, without saving enough liquid cash for a rainy day. In other cases, disaster - such as high medical expenses, a disability or a job layoff - can strike, causing people to dig deep into their pockets to pay unexpected bills.

Learn about 401(k)s and IRAs on CNNfn.com.

And in still other cases, like Bolick's, the once-booming stock market makes early retirement more than a pipe dream, and allows investors to withdraw from IRAs earlier than expected.

According to the Internal Revenue Service, you must wait until age 59-1/2 before you can withdraw from your IRAs or 401(k)s. After age 70-1/2, you typically must make minimum withdrawals each year from a traditional IRA or a 401(k), or incur steep penalties. (Roth IRAs don't require minimum withdrawals after age 70-1/2). These minimum withdrawals can be calculated in several ways, and can be reduced by naming your children as beneficiaries.

In general, if you withdraw from retirement plans before age 59-1/2, you will incur a 10 percent federal penalty on the investment, a state penalty, and, on traditional IRAs, applicable income taxes. If you own a Roth IRA, you won't pay taxes once you cash it in, nor will you pay on the earnings, providing you've been invested in the Roth IRA for five tax years and are over the age of 59-1/2.

Legislative loopholes

Fortunately for investors, the IRS created some exceptions, which allow people to withdraw money from their retirement plans without penalty.

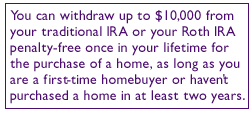

One of those loopholes applies to first-time homebuyers. The 1997 Taxpayer Relief Act allows you to withdraw up to $10,000 penalty free - once in your lifetime -- from your traditional or Roth IRA for a purchase of a new home, as long as you are a first-time homebuyer or haven't purchased a home in at least two years.

If you're married, you and your spouse could each withdraw $10,000 without penalty from individual IRAs toward a home, as long as the money is used for a down payment or building (not home repairs or mortgage payments). First-time buyers will still pay taxes on the money if they withdraw from a traditional IRA.

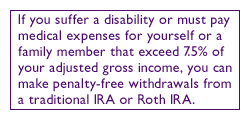

The IRS also grants penalty-free exceptions if you suffer a disability or must pay medical expenses for you or a family member that exceed 7.5 percent of your adjusted gross income. If you lose your job but must pay skyrocketing health-insurance premiums for you and your family, the IRS will also cut you a break. And, if you want to send Johnny or Jenny to college, feel free to tap into your IRAs without a penalty. If one year of college cost more than $20,000, you can withdraw that much. The IRS also grants penalty-free exceptions if you suffer a disability or must pay medical expenses for you or a family member that exceed 7.5 percent of your adjusted gross income. If you lose your job but must pay skyrocketing health-insurance premiums for you and your family, the IRS will also cut you a break. And, if you want to send Johnny or Jenny to college, feel free to tap into your IRAs without a penalty. If one year of college cost more than $20,000, you can withdraw that much.

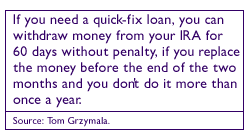

Need a quick-fix loan? You can also withdraw money from your IRA for a 60-day period without penalty, if the money is replaced prior to the end of the two-month span and you don't do this more than once a year, Grzymala said.

People like Bolick, who simply want to retrieve some of their retirement funds now, can opt for what's called the  "substantially equal periodic payment" exception, or SEPP, which is based on estimated life expectancy and typically allows you to withdraw annual "payments" if you agree to withdraw these amounts for a minimum of five years or until you reach age 59 1/2. "substantially equal periodic payment" exception, or SEPP, which is based on estimated life expectancy and typically allows you to withdraw annual "payments" if you agree to withdraw these amounts for a minimum of five years or until you reach age 59 1/2.

But be forewarned: Don't try to calculate SEPP payments on your own, because they're confusing and complicated. One mistake either now or down the road could mean paying a hefty penalty to the IRS.

Money experts advise working with certified financial planners or other financial wizards, or contacting the IRS (www.irs.gov) if you want to withdraw from your nest egg before 59 1/2. The rules also differ for each kind of retirement plan available.

For instance, if you retire during the year you reach age 55, you can withdraw money from your 401K without incurring a penalty (though you will incur taxes on that money). But if you're younger than 55, you cannot withdraw from the employer-sponsored plan without penalty, even if you've been terminated.

The IRS also lets you borrow money from your 401K for a down payment on a house, providing the plan has a loan provision and you agree to pay back the money in accordance with the 401K's rules, financial planners say. For specifics on your qualified plan, consult your company personnel office.

Confused? Join the club

If you're confused by these rules, take heart. At least 42 percent of consumers fret about their financial decisions and feel little control over their financial future, reports the Financial Planning Association.

Just recently, the U.S. House of Representatives approved a measure that could boost annual contributions for both IRAs and 401(k) pension plans. If passed by Congress, the bill will raise the $2,000 annual pre-tax IRA contribution to $5,000 by 2003, and increase the yearly salary contributions for 401(k)s to $15,000 by 2005. Currently, annual salary contributions to 401(k) plans max out at $10,500. Just recently, the U.S. House of Representatives approved a measure that could boost annual contributions for both IRAs and 401(k) pension plans. If passed by Congress, the bill will raise the $2,000 annual pre-tax IRA contribution to $5,000 by 2003, and increase the yearly salary contributions for 401(k)s to $15,000 by 2005. Currently, annual salary contributions to 401(k) plans max out at $10,500.

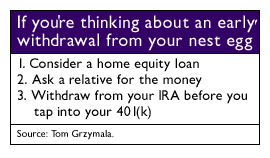

Grzymala, a certified financial planner, offers several pieces of advice to investors who struggle with financial decisions, particularly regarding early withdrawals.

First, if you already own a house and need some cash, file for a home equity loan. "If you don't own any home equity, ask Aunt Susie or Grandma Smith" for financial assistance, he said. If those options fail, withdraw from the IRA first, and the 401(k) plan last.

"Certainly don't take loans out of your 401(k)," Grzymala said. "Let your tax-deferred money grow as long as you can let it grow."

For Tellez and Bolick, questions still remain. Tellez and his wife recently withdrew $20,000 total for a house down payment, but only used about $16,000 of that money. The $4,000, according to financial experts, is subject to a 10 percent penalty unless Tellez uses that money to reduce the mortgage.

Bolick, meanwhile, is still contemplating what to do with her investment.

"Basically I've been forecasting the future," she said. "I guess I'd rather have the option of retiring [early] and working part-time, or doing some volunteer work."

-- Cheryl Meyer is a freelance writer who covers personal finance issues for CNNfn.com.

|

|

|

|

|

|

|