|

CEOs bite the dust

|

|

August 2, 2000: 9:06 a.m. ET

Tough time to be top dog, with 20% more CEOs leaving tail between legs

By Staff Writer Alex Frew McMillan

|

NEW YORK (CNNfn) - Life ain't easy at the top, or so the people at the top always say. But they have a point so far this year, a new study shows.

Turns out the top job in a company is an increasingly precarious perch. CEO departures stepped up 20 percent in the six months through July, compared with the six months before that, according to Challenger, Gray & Christmas Inc.

CEOs "are practically doomed to failure from day one," the report, issued Tuesday, states. "They are under more pressure than ever before to produce strong numbers every quarter. They are constantly being second-guessed and scrutinized by Wall Street and their own directors. It if were baseball, they would be expected to hit .400 day after day, month after month."

The pace has picked up this summer

Sympathy may be slim in a world where CEOs frequently make more than baseball players who hit .400 month after month. But spare a thought for the big guy.

In July alone, four CEOs quit per business day, according to Chicago-based Challenger Gray, which helps displaced workers find jobs. CEO departures rose 13 percent last month, over June. In all, 76 CEOs stepped down in July. In July alone, four CEOs quit per business day, according to Chicago-based Challenger Gray, which helps displaced workers find jobs. CEO departures rose 13 percent last month, over June. In all, 76 CEOs stepped down in July.

That makes it the fourth-most tumultuous month out of the last 12.

May saw even more departures, 90, meaning it was the second-most active month in the last year for CEOs to step down. June wasn't much better as 67 CEOs left.

Of course, the reasons for their departures are legion. Some left voluntarily, some resigned under pressure, some well, let's just say they "wanted to spend more time with their family."

But in all, 801 chief executives - including ex-Halliburton Co. supremo and vice presidential hopeful Dick Cheney - left the corner office over the last year.

Did they bring it on themselves?

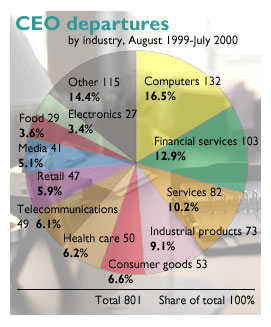

Computing and financial-services companies were the most roiled, accounting for a combined 29.3 percent of the CEO departures.

What gives? Can the chiefs really not stand the heat in the kitchen?

"Obviously it has to do with the puncture in the balloon in the tech world," said Dave Opton, executive director of Exec-U-Net, a Web site that caters to top-level executives looking for jobs.

"Last year, if I was a recruiter from a company, people were coming in and wanted to talk to me about equity and stock options," Opton said. "Last year, if I was a recruiter from a company, people were coming in and wanted to talk to me about equity and stock options," Opton said.

"Now they're saying, 'Could you explain to me what the salary is, and is it going to be here next year?' "

In fact, some experts say CEOs have created the high rate of turnover by jumping at all that hot dot.com cash. Now they're getting burned.

"In the last six months, we've seen the culmination of the irrational exuberance found in the dot.com industries that has rippled through all the other industries," said Richard Johnson, president and CEO of job site HotJobs.com.

Why climb the ladder when you can jump?

Time was, you had to work your way to the top, Johnson went on, and spend 15 years at General Electric before you got a shot at Jack Welch's job.

But CEOs started to see the likes of Amazon.com Chairman and CEO Jeff Bezos pulling in big bucks and got jealous, Johnson said. They realized it was easier to jump to a digital upstart than hang around waiting to inherit dead men's shoes.

Suddenly a position that paid $50 million in stock and options wasn't out of the question. It was there for the taking, Johnson said, even for someone who once would only have dreamed of making $15 million, and then after decades of graft.

For every old-line CEO who jumped ship, a replacement had to be found. Brick and mortar companies lost executives or had to raise their pay packages to hang onto them. So there was an executive scramble, Johnson believes.

To him, that explains the sudden burst in turnover.

"It's the final ripple of the dot.com boom," Johnson said. "It finally hit the boardroom and the CEO."

What jumps around must fall down

Then in April, Nasdaq and the dot.coms imploded. Now, CEOs are likely coming to their senses, Johnson says. And of course some are finding out the hard way that the dot.com Gold Rush is over. They're fired.

"You've got the pressures of people being pushed out of, or jumping out of, high-tech positions," Opton at Exec-U-Net said. "Then you've got the opportunity of brick and mortar companies that are looking to integrate into the dot.com world."

He thinks the tide has reversed, with dot.comers lured back or returning crestfallen to old-line companies. And there are other pressures. In financial services, the second-most disruptive field for CEOs, "you've still got a lot of consolidation going on," Opton said.

Summertime and the hiring is tough

January and February also saw a spate of CEOs leaving, according to the Challenger Gray study. They ranked No. 1 and No. 3 out of the last 12 months, with 95 and then 87 CEOs moving on.

But those are the traditional times for many people to change jobs, particularly in fields like investment banking - that's when those big bonuses are paid. It's also a natural time for people to make a new start. Also, many CEOs have contracts that end at the end of a fiscal year, often the calendar year.

The summer flurry of departures is much more unusual, according to Opton. He said Exec-U-Net has seen a pickup in the number of postings it receives, with more than 100 new top jobs coming up in June.

"It's unusual to see a lot of companies looking in the summer," he explained.

"It's harder to find people in the summertime because people are on vacation," Opton said. Even if a company can find the right candidate, the interview process takes longer in the summer. "People go away," he said.

The West is best, and big bucks easier to find

Exec-U-Net, which specializes in jobs paying over $100,000 a year, tracks demand for executives in various ways.

It's still strong, particularly on the West Coast and in the Southwest. Those parts of the country had more than twice the national average demand for top-flight employees, for the second quarter of 2000.

Demand is strongest, perhaps not surprisingly, for executives in high-tech fields. After that, the next-strongest industry is media and publishing. Demand was also above average in Exec-U-Net's "general business" category, all for the second quarter.

Demand is below average, though, in every other industry category, and particularly weak in the retail, manufacturing and natural resources fields.

Surprisingly, Exec-U-Net also indicates that the desperation is greatest for companies to fill very high-paying jobs.

Positions that pay more than $250,000 a year are the toughest to fill, the job site shows.

The jobs get easier to fill, progressively, as you move down the ladder, with the $200K-$250K range next easiest, and so on. Exec-U-Net only advertises jobs that pay more than $100,000 a year, but the $100K to $149K posts are where demand is the weakest.

-- Click here to send email to Alex Frew McMillan

|

|

|

|

|

|

|