|

Of Piazza, Intel and the Dow

|

|

August 2, 2000: 5:48 a.m. ET

Smith Barney's Freeman picks stocks; hopes for Subway Series

By Staff Writer Jennifer Karchmer

|

NEW YORK (CNNfn) - Like a true New Yorker, Rich Freeman is keeping his fingers crossed for a Subway Series in Major League Baseball this fall. A Brooklyn native who grew up playing stickball in the schoolyard, Freeman is an avid New York Mets fan, but it's not uncommon to see him checking New York Yankees' scores and stats on his computer in between executing trades.

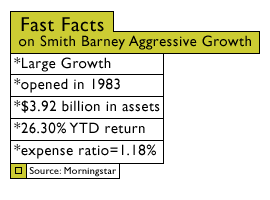

As manager of the $3.92 billion Smith Barney Aggressive Growth Fund, Freeman, 47, has had remarkable returns since the fund's inception in 1983.

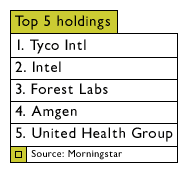

His most coveted stock pick, Intel (INTC: Research, Estimates), among his top five holdings, entered the portfolio when he bought it in 1985 for $1. Freeman doesn't hesitate to equate the success of that pick to Mets catcher Mike Piazza -- a prime contender for National League's Most Valuable Player this season.

"Piazza is like me picking Intel 15 years ago," Freeman said in an interview in his Manhattan office. "One of those comes along once in a lifetime. You're lucky if you own 'em."

Batting 1.000

With an avid baseball fan at the helm of the Smith Barney Aggressive Growth Fund (SHRAX), you could say the fund is batting impressively, not unlike Piazza, whose own average is close to .350.

The fund, which Freeman launched in 1983, has a 10-year annualized return of 21.78 percent, according to Morningstar. Year-to-date, the fund has returned 21.26 percent and in June, it was up 22.8 percent, ranking it for performance in the top two percent of similar large cap growth funds.

Much of the fund's success comes from Freeman's buy-and-hold approach, which many mutual fund managers embrace. However, Freeman takes the strategy to the limits. With a turnover rate of five-to-10 percent, the fund is atypical among other large cap growth funds, which average a turnover rate of 109 percent, according to Morningstar.

"A lot of aggressive growth managers tend to be momentum investors because stocks are going up they'll buy them," Freeman explained. "What I try to do is anticipate which stocks are about to go up. Because of that, I'd rather be early. I buy them when they're small, under-researched, and if it takes two or three years for Wall Street to realize it, as long as I feel ultimately vindicated, we'll stay with it."

Morningstar analyst Kelli Stebel, noted that once Freeman finds a stock he likes, he sticks with it.

"His turnover is very distinctive," Stebel said. "He's had Intel since the mid-80s, so you can imagine he seems to have a knack for picking winners."

Play ball!

Freeman himself admitted he does have a flair for eyeing winners, thanks to his stock market training during his teens.

On a hot day in the mid-1960s, Freeman would go home after playing stickball with his buddies to read the closing stock prices published in the New York Post his father would tote home.

"I used to tally up at the end of the day how the mutual funds did, going over all the positions," he said. "You've really got to be crazy to do that. But that probably got me interested in buying stocks on my own. I was always obsessed with the market. Luckily, I turned a hobby into a career."

Impressive results

You could liken the success of Freeman's aggressive growth fund to a baseball team: It's comprised of "individual names that collectively give it the performance," he said.

Some of those names include Intel, Tyco International (TYC), Forest Labs (FRX), Amgen (AMGN), and America Online (AOL). Forest Labs and Intel have posted year to date returns of up to 74 percent.

"He seems to be able to get his hands dirty with these companies and find out what's going on," Stebel said. "He's been picking winners for almost two decades."

But it wasn't always easy. When the fund was first started in 1983, Freeman was looking at small- and mid-cap companies, making bets on names which some thought didn't have a chance.

"At the time (Intel) was a controversial company, but we made a bet on the market," he said.

In the early days of the fund, Freeman bought Tyco, which at the time had a market capitalization of $228 million. Today it has soared closer to $70 billion. "That's probably a featured stock of the fund," Freeman said of Tyco, which has posted a year-to-date return of 38.05 percent.

Click here for details on the Smith Barney Aggressive Growth Mutual Fund

Boys of summer

So with a strong track record under his belt, how can Freeman continue to outperform as a fund manager? Pure love of the job, he said.

"Without sounding boastful, I literally want to have one of the top funds over the 10-year period. That's what motivates me," he said.

When he's not running the fund, he's watching Piazza and the other boys of summer hit home runs.

"When I come home, I talk to my family and watch sports. It's a total diversion from the day," he added.

"On a scale of one to 10, I'm a 10-Mets fan," he said. "I'm more like a nine- or eight- Yankees fan. When they play each other, there's no contest."

-- Staff Writer Jennifer Karchmer covers mutual funds for CNNfn.com. Click here to send her e-mail.

|

|

|

|

|

|

|