|

Europe hit by tech slump

|

|

August 3, 2000: 8:09 a.m. ET

Bourses dragged by profit growth fears, Nasdaq ills; banks also slump

|

LONDON (CNNfn) - Blistering losses for Europe's technology sector dragged Europe's leading markets down Thursday as investors grew cautious about profit growth prospects for software and hardware firms following the recent slump in their U.S. counterparts.

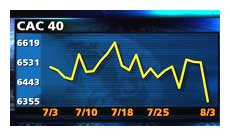

The CAC 40 index in Paris was the biggest loser, closing down 174.98 points, or 2.7 percent, to 6,354.93, as defense electronics systems maker Thomson-CSF (PHO) tumbled 9.6 percent.

London's benchmark FTSE 100 closed down 74.2 points, or 1.2 percent, to 6,303.2, with semiconductor designer ARM Holdings (ARM) down 12 percent. The SMI index in Zurich, less subject to swings in tech stocks, edged down 0.2 percent.

Frankfurt's electronically traded Xetra Dax lost 74.54 points, or more than 1 percent, to 7,037.91. Epcos (FEPC) led Dax losers, tumbling 11 percent, even though the electronics components company reported better-than-expected earnings per share for the third quarter and a 77-percent jump in sales compared with a year earlier.

The pan-European FTSE Eurotop 300, a broad index of the region's largest stocks, fell 1.2 percent, with its information technology hardware component down 6.5 percent, as mobile phone makers Nokia and Ericsson each fell more than 7 percent.

Helsinki's HEX general index fell 5.2 percent to a new low for the year, largely because of the drop for Nokia.

Wall Street also was beating a retreat as Europe's markets closed. The Dow Jones industrial average was down 0.2 percent and the technology- heavy Nasdaq composite, whose hefty losses over the last week have hit Europe's tech sector, was down 1.7 percent.

"There's still a bit of a tech wreck going on in the wake of the Nasdaq weakness," Gary Dugan, a European equity market strategist with J.P. Morgan, told CNNfn.com. "The other problem is that we haven't had good sector rotation and we've seen a bit of a sell-off in the banks. The results for the banks have not been too good - they are facing margin pressures."

Dugan said equity investors, at least for now, are less concerned about changes in Europe's interest rate picture. Earlier Thursday, both the Bank of England and the European Central Bank left interest rates unchanged, as most economists had expected.

The ECB's decision didn't help the euro, which is hovering near 10-week lows against the dollar. The currency continued its recent retreat, slipping to 90.47 U.S. cents from 91.35 late Wednesday in New York.

Broad downdraft for techs

Technology stocks across the continent slid. In London, it was mainly software and information technology service providers. CMG (CMG) shed 7 percent, Sage Group (SGE) lost 7.4 percent, Sema Group (SEM) dropped 6.6 percent, and Misys (MSY) fell 5.7 percent.

The top 10 FTSE losers in London were in the technology, telecommunications and media sectors.

Cable TV company Telewest Communications (TWT) shed 11 percent to a new 20-month low, and Internet service provider Freeserve (FRE) fell 5.8 percent.

In Paris, telecom equipment maker Alcatel (PCGE) fell 6.6 percent, chip maker STMicroelectronics (PSTM) dropped 6.9 percent, data network operator Equant (PEQU) fell 7.1 percent, and information technology consultant Cap Gemini (PCAP) slipped 4.9 percent.

And in Germany, Europe's biggest software company, SAP (SAP), shed 4.7 percent and chipmaker Infineon Technologies (FIFX) fell 4.8 percent.

Banks roll out the earnings

Leading the top banks reporting earnings Thursday was Deutsche Bank (FDBK), which shed 2.2 percent. Europe's biggest bank posted a 115-percent rise in earnings to  3.78 billion, beating analysts' forecasts, but said it may not be able to keep up its hefty growth pace in coming quarters. 3.78 billion, beating analysts' forecasts, but said it may not be able to keep up its hefty growth pace in coming quarters.

In Paris, bank Société Générale (PGLE) shed 9.6 percent following the release of its second-quarter earnings report, a day after the stock hit a record high. Rival BNP Paribas (BNP) fell 4.4 percent.

Financial stocks were mostly higher in London. Royal & Sun Alliance (RSA) rose 3.4 percent. The insurer said first-half operating income was little changed from a year earlier, but it is seeing good growth in its life and general insurance businesses.

Standard Chartered Bank (STAN) rose 4.5 percent, registering the biggest gain on the FTSE. Among other London risers were utilities, often seen as a safe-haven investment: National Power (NPR) climbed 3.8 percent and United Utilities (UU-) added 3.7 percent.

Other "old economy" stocks fared well. In Frankfurt, automaker BMW (BMW) rose 2.4 percent, rival Volkswagen (FVOW) rose 2.1 percent and retailer Metro (FMEO) rose 1.6 percent.

Among higher oil stocks, BP Amoco (BPA) rose 1.8 percent, Shell Transport and Trading (SHEL) added 1.3 percent after reporting a 95-percent jump in second-quarter earnings, and Total Fina Elf (PFP) gained 2.1 percent in France.

-- from staff and wire reports

|

|

|

|

|

|

|