|

Viacom reports 2Q profit

|

|

August 3, 2000: 4:14 p.m. ET

Loss for media conglomerate was expected; report is first including CBS

|

NEW YORK (CNNfn) - Media conglomerate Viacom Inc. reported an unexpected second-quarter profit Thursday in its first earnings report since its purchase of CBS lnc.

The company said that excluding merger-related charges it earned $9 million, or 1 cent a share, in the second quarter. Analysts surveyed by earnings tracker First Call had been looking for a 5-cent-a-share loss in the period. The company said that excluding merger-related charges it earned $9 million, or 1 cent a share, in the second quarter. Analysts surveyed by earnings tracker First Call had been looking for a 5-cent-a-share loss in the period.

Including merger-related charges, the company posted a net loss of $495.6 million, or 41 cents a diluted share, in the most recent period. The company reported net income of $59 million, or 8 cents a share, in the same quarter a year earlier.

Viacom also posted stronger-than-expected gains in EBITDA -- earnings before interest, taxes, depreciation and amortization -- with a double-digit percentage increase in most of its sectors on a pro forma basis, which takes into account the results of recently acquired units before the mergers.

Pro forma EBITDA reached $1.31 billion, above the $1.26 billion forecast and the $1.11 billion result from those units a year earlier. Television EBITDA rose 48 percent to $346.7 million, while EBITDA from the Infinity radio unit acquired as part of the CBS purchase increased 24 percent to $457.6 million.

Revenue rose to $4.9 billion in the quarter from $3.0 billion a year earlier.

Assets in film, television and cable propelled the results, the company said. Leading the strength was CBS's summer network phenomenon, "Survivor," films "Mission Impossible" and "Shaft," and Viacom's sturdy Nickelodeon children's cable network.

"This was just a blow-out quarter across the board," Christopher Dixon, analyst at PaineWebber, told CNNfn's Ahead of the Curve. He said the outlook for the company remains strong, especially with CBS's "Survivor" program starting to attract younger viewers to the network.

Overall, Dixon said the demand for advertising dollars remains strong across the industry.

"More and more people are spending money on marketing," he said. "Companies are going to need to increase their marketing budgets as we move into this increasing complex economy. That's great news for these media companies -- whether it's Viacom or what we'll see this afternoon with Disney (DIS: Research, Estimates)." (210K WAV) (210K AIFF)

Banc of America Securities analyst Stewart Halpern said the company's executive, in a conference call after the report was released, sounded upbeat about operations now that the CBS deal is completed.

"(Viacom) reiterated confidence in prospects to meet or exceed estimates for the back-half of the year, (and) offered a bullish view on the outlook for 2001, based on overall advertising growth of 6-7%, and the radio-outdoor-cable segments growing 8-10 percent," he said in a note to investors.

The company, which closed its $39.8 billion purchase of CBS on May 4, also owns a majority of video rental leader Blockbuster (BBI: Research, Estimates), as well as cable networks such as MTV and Nickelodeon, movie studio Paramount Pictures as well as its television unit, and publisher Simon & Schuster.

For the first six months of the year the company posted a net loss of $879.9 million, or 93 cents a share. That result includes the merger-related charge and a change in accounting practices in the first quarter. The company posted net income of $91.8 million, or 13 cents a share, a year earlier. Year-to-date revenue rose to $7.9 billion from $6.0 billion a year earlier.

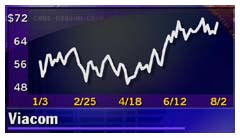

Shares of Viacom (VIA.B: Research, Estimates) gained 2-9/16 to 71-5/8 by late afternoon on Wednesday.

|

|

|

|

|

|

Viacom

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|