|

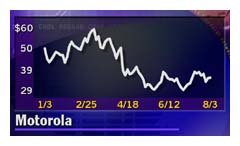

Handset makers decline

|

|

August 3, 2000: 7:12 p.m. ET

But Motorola asserts that its outlook for phone sales hasn't changed

|

NEW YORK (CNNfn) - The stocks of the leading makers of mobile phones and mobile phone components dipped Thursday after an analyst research report said that Motorola Inc., one of the industry's largest players, informed its suppliers that it would produce fewer handsets than it had previously forecast.

Motorola, responded, however that the analyst report wasn't accurate. The company said it didn't have any such conversation with its suppliers and that its forecast for sales of mobile phones this year remains unchanged.

According to a note issued by Lehman Brothers analyst Tim Luke, Motorola held a conference call in which it told its suppliers that it would produce about 85 million cell phones this year. That would be below an earlier goal of up to 100 million units, Luke's note said.

However, a Motorola spokesman said Thursday afternoon that no such conference call occurred and that the company hasn't changed its guidance regarding sales of mobile phones. The communications giant had a generally upbeat meeting with analysts on Tuesday, at which it forecast that its revenue for the full year would be $39.5 billion and its earnings per share would be $1.05

"There was no conference call last night, we have not changed our guidance to analysts, nor have we told our suppliers anything different than we have for the last 30 days or so," said Motorola spokesman Rusty Brashear. "At our analyst meeting, we projected that sales of handsets would grow 25-to-30 percent in the second half, on a dollar basis."

At the same analyst meeting earlier this week, Motorola said that the industry's worldwide sales of mobile phones are likely to be between 425 million and 450 million units in 2000. Motorola sold 50 million-to-55 million phone handsets last year, and said that its unit volume rose 50 percent in the first half of 2000 versus the first half of 1999.

Motorola's Brashear said that the company never officially forecast that it would sell 100 million handsets this year, although it may have accidentally created that expectation when it said in the fourth quarter of 1999 that it aimed to create a supply chain capable of producing up to 100 million handsets per year.

"Arguably, you could say that we set an expectation," Brashear said.

Motorola does have a conference call with its phone component suppliers scheduled for Thursday evening. However, the purpose of that call is to introduce the new head of the company's Personal Communications unit, Mike Zafirovski, the Motorola spokesman said.

Motorola (MOT: Research, Estimates) closed down 11/16 at 35-15/16. The stocks of Nokia (NOK: Research, Estimates) and Ericsson (ERICY: Research, Estimates), the two other major mobile phone makers, also were hit, with Nokia losing 1-1/4 to 40-3/4 and Ericsson dropping 1/16 to 18-1/16. Ericsson stock had been as low as 16-1/2 earlier in the day. Motorola (MOT: Research, Estimates) closed down 11/16 at 35-15/16. The stocks of Nokia (NOK: Research, Estimates) and Ericsson (ERICY: Research, Estimates), the two other major mobile phone makers, also were hit, with Nokia losing 1-1/4 to 40-3/4 and Ericsson dropping 1/16 to 18-1/16. Ericsson stock had been as low as 16-1/2 earlier in the day.

Analysts at Lehman Brothers and CS First Boston characterized Motorola's forecast of 85 million units as being consistent with the company's plan to improve its operating margin in mobile phones to at least 10 percent in the fourth quarter of this year, even if that means sacrificing unit growth or market share.

"For the past five months, the company has been working on the profitability of the phone business rather than just sheer market share," said CS First Boston analyst Marc Cabi. "We think Motorola can achieve those double-digit operating margins."

However, Lehman Brothers' Luke said in his research note that he expects "further pressure on the handset component group." Luke also said that he expects global industry-wide mobile phone sales to total 425 million units this year and that his $55 share price target for Motorola remains unchanged.

Makers of phone components hurt also

On July 21, Ericsson, the world's biggest supplier of equipment for cellular phone networks, announced that its phone handset unit would post a loss for the whole business year, saying sales of its highest-priced phones are dwindling as a share of the total.

Concerns about the growth rate of the mobile phone industry also have hurt the makers of phone components over the past two months. The stocks of AVX Corp. (AVX: Research, Estimates) and Vishay Intertechnology (VSH: Research, Estimates), for example, have lost half their value since May, while Kemet (KEM: Research, Estimates) has fallen to 25 from 40 over the same period.

Merrill Lynch analyst Jerry Labowitz said in a research note Thursday that Motorola's forecast of mobile phone unit volume shouldn't have any impact on his 2000 or 2001 earnings estimates for those companies.

"As investors react to concerns regarding cell phone production, the shares of the passive component makers we follow have been plummeting despite further momentum in the business, higher earnings expectations and record low valuations," Labowitz said in a research note.

"Kemet estimates that sales to handset makers account for 20 to 25 percent of their capacitor unit shipments, 7-to-8 percent of total revenues, and around 5 percent of profits," Labowitz wrote. "We think Kemet is the largest supplier of tantalum capacitors to Motorola and has more exposure to Motorola than AVX and Vishay, but is also well positioned at other leading wireless makers such as Nokia."

|

|

|

|

|

|

|