|

Unilever to split units

|

|

August 4, 2000: 9:12 a.m. ET

Anglo-Dutch consumer products maker posts 14% drop in 2Q profit

|

LONDON (CNNfn) - Unilever PLC, the Anglo-Dutch manufacturer of products ranging from Ragu pasta sauce to Dove soap, announced plans to split into two separate global units Friday in a move that many analysts speculate could foreshadow a breakup of the company.

The company plans to form two global divisions - one focused on food, the other on household products and personal care items -- to drive up sales and margins and focus on its top brands. The move increased speculation that Unilever, which makes hundreds of brand-name products, ultimately will split into two separately traded companies.

|

|

VIDEO

|

|

CNNfn's Finnoula Sweeney reports on Unilever's decision to split into two separate global units.

CNNfn's Finnoula Sweeney reports on Unilever's decision to split into two separate global units.

|

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

The company also posted a 14 percent drop in second-quarter earnings Friday, dragged down by one-time costs, but beat analysts' forecasts.

Unilever, which agreed to buy U.S.-based Bestfoods for $24.3 billion as well as SlimFast diet foods and Ben & Jerry's ice cream during the quarter, earned  928 million ($841.5 million) on a pre-tax basis during the period as sales rose 3 percent to 928 million ($841.5 million) on a pre-tax basis during the period as sales rose 3 percent to  10.9 billion. The results exceeded the forecasts of analysts, who had expected earnings of about £800 million euros. 10.9 billion. The results exceeded the forecasts of analysts, who had expected earnings of about £800 million euros.

"The second quarter saw an increase in momentum with improved underlying volume growth, a healthy contribution from acquisitions, and aggressive investment behind our brands," the company said in a statement.

At constant exchange rates, net earnings fell 16 percent to  562 million ($509.6 million), while underlying operating margins rose to 11.3 percent during the period from 10.6 percent in the 1999 second quarter. 562 million ($509.6 million), while underlying operating margins rose to 11.3 percent during the period from 10.6 percent in the 1999 second quarter.

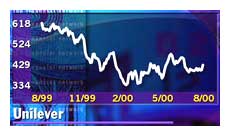

Unilever (ULVR) shares edged up about 1 percent Friday afternoon in London, adding 5.25 pence to 431.25.

The stock has lagged behind the FTSE All-Share index by 35 percent over the last year and rival UK food companies by 18 percent. The shares have slid from about 650 pence in July 1999 to a low of 324-1/2 pence in February.

The restructuring plan, part of the company's "Path to Growth" strategy, follows a six-month management review. Unilever denied the move paved the way for a de-merger.

"This is not a precursor to splitting Unilever, it is a realignment of the business bringing the strategic and operational functions closer," a company spokesman said.

But many analysts say a split would make sense, saying that Unilever's roughly 1,500 product offerings have become unwieldy under one roof.

Under the reorganization, finance director Patrick Cescau will succeed Alexander Kemner as global food chief in January 2001. Kemner is slated to retire next May.

Keki Dadiseth, who undertook the six-month management review, will become worldwide home and personal care chief in January.

Unilever said regulatory approvals for the Bestfoods acquisition are proceeding as planned and the deal is expected to close in the fourth quarter.

-- from staff and wire reports

|

|

|

|

|

|

Unilever

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|