|

Dow continues win streak

|

|

August 8, 2000: 4:58 p.m. ET

Investors buy consumer cyclicals to lift blue-chips; Nasdaq slumps

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - The Dow Jones industrial average rose for its seventh straight session Tuesday, soaring more than 100 points after a key economic report showed stronger-than-expected productivity, sparking a rally in the blue chip index.

Consumer cyclical stocks were the beneficiaries of the economic report. Home Depot, Eastman Kodak and Caterpillar were the leaders behind the Dow's rally as investors rotated money away from technology issues and into cyclical stocks.

Explaining the rotation into Dow consumer cyclicals, Scott Bleier, investment strategist with Prime Charter Ltd., told CNNfn's market coverage that investors are gaining confidence that inflation is under control and are placing value on "old economy" issues. Explaining the rotation into Dow consumer cyclicals, Scott Bleier, investment strategist with Prime Charter Ltd., told CNNfn's market coverage that investors are gaining confidence that inflation is under control and are placing value on "old economy" issues.

"The market is acting like we were just coming out of a recession," Bleier said. "It's about as tough and confusing on a day-to-day basis because of all this rotation. The market is looking past the (economic) slowdown, past the (presidential) election and out to the first quarter of 2001."

The Dow advanced 109.88, or more than 1 percent, to 10,976.89. The blue chip index has gained more than 450 points over the past seven sessions and is just 4.5 percent off from the start of the year.

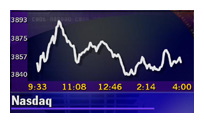

Meanwhile, the Nasdaq composite index erased three sessions of gains, falling modestly as investors remained nervous ahead of quarterly results from Cisco Systems. After the close, the computer networking company reported earnings that beat estimates by a penny. Meanwhile, the Nasdaq composite index erased three sessions of gains, falling modestly as investors remained nervous ahead of quarterly results from Cisco Systems. After the close, the computer networking company reported earnings that beat estimates by a penny.

The Nasdaq shed 14.43 points to 3,848.56 and is now 5.4 percent down from the start of the year. The S&P 500 gained 3.49 to 1,482.81.

Market breadth was mixed. On the New York Stock Exchange, advancers outpaced decliners 1,579 to 1,276 as more than 990 million shares changed hands. On the Nasdaq, losers nudged out winners 2,211 to 1,809 as volume reached more than 1.4 billion shares.

In the currency markets, the dollar rose against the euro but slipped versus the yen.

Economic data boosts Dow

Analysts said the day's economic data helped support the notion that the Federal Reserve may be near the end of its rate tightening cycle and sent investors bargain hunting for consumer cyclical stocks.

The U.S. Labor Department said worker productivity rose at a 5.3 percent pace in the second quarter, above the 4.5 percent gain expected by analysts surveyed by Briefing.com and well above the revised 1.9 percent gain posted in the first quarter. Unit labor costs decreased 0.1 percent in the quarter, countering an expected gain.

Attracting buyers to the Dow, Home Depot (HD: Research, Estimates) gained 2 to 57, Eastman Kodak (EK: Research, Estimates) jumped 2-3/8 to 60-1/2, Caterpillar (CAT: Research, Estimates) rose 1-11/16 to 38-3/8 and Microsoft (MSFT: Research, Estimates) advanced 4-1/8 to 74-1/8. Attracting buyers to the Dow, Home Depot (HD: Research, Estimates) gained 2 to 57, Eastman Kodak (EK: Research, Estimates) jumped 2-3/8 to 60-1/2, Caterpillar (CAT: Research, Estimates) rose 1-11/16 to 38-3/8 and Microsoft (MSFT: Research, Estimates) advanced 4-1/8 to 74-1/8.

The economic news was positive for investors, hungry for any bit of data that may support an end to interest rate hikes by the Federal Reserve. The Fed has raised interest rates six times in the past year and its monetary policy-making body will meet next on Aug. 22.

"The market gets increasingly convinced that the Fed is on hold for August and probably for the rest of the year," Peter Cardillo, director of research for Westfalia Investments, told CNNfn's market coverage. "That's why you're seeing interest in the cyclicals."

Techs muted ahead of quarterly reports

With earnings season winding down, analysts said investors are still awaiting quarterly results this week from Cisco, Dell Computer and Applied Materials. While Cisco reported better than expected profits Tuesday afternoon, analysts will be keenly watching for comments from the company about revenue outlook.

Donaldson Lufkin & Jenrette initiated coverage of Cisco with a "buy" rating, citing strong growth of 30 percent over 10 years for the tech heavyweight.

Cisco (CSCO: Research, Estimates) fell 3/4 to 65-1/2, Dell (DELL: Research, Estimates) lost 1 to 41-11/16, and Applied Materials (AMAT: Research, Estimates) shed 5/8 to 70-9/16.

Analysts said investors also will continue watching for developments in union negotiations with Verizon. Analysts said investors also will continue watching for developments in union negotiations with Verizon.

In its third day of a union strike, Verizon Communications (VZ: Research, Estimates) fell 5-5/8 to 42-1/2 after it reported a second-quarter profit that missed analysts' expectations. It also announced an $800 million all-cash purchase of high-speed Internet service provider NorthPoint Communications (NPNT: Research, Estimates). NorthPoint shares gained 3/4 to 14-1/4.

In other quarterly results and news, Dial Corp. (DL: Research, Estimates) lost 7/8 to 11-15/16 after its board reportedly forced out its top two executives and warned its quarterly earnings will miss expectations, according to the Wall Street Journal.

J.P. Morgan downgraded Dial to "market performer" from "long-term buy" based on the news.

|

|

|

|

|

|

|