|

Eli Lilly gets Prozac blues

|

|

August 9, 2000: 8:11 p.m. ET

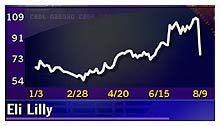

Stock plunges after court opens door to competition on its top drug, Prozac

|

NEW YORK (CNNfn) - A U.S. appeals court on Wednesday set a sooner-than-expected end to Eli Lilly and Co.'s reign as the sole marketer of Prozac, the popular antidepressant drug, a development that sent the pharmaceutical company's stock down by more than 30 percent.

Shares of Indianapolis-based Eli Lilly plunged 32-17/32 a share to 76, after the U.S. Circuit Court of Appeals for the Federal Circuit in Washington, D.C. reversed a decision from an Indiana lower court that had given the company's antidepressant drug Prozac patent protection through 2003.

The decision opens the door to Barr Laboratories (BRL: Research, Estimates) and other drug makers who manufacturer generic versions of Prozac, which at more than 34.5 million prescriptions is the most widely prescribed antidepressant of its kind. Under the ruling, Barr can put a generic version in pharmacies in August 2001. The decision opens the door to Barr Laboratories (BRL: Research, Estimates) and other drug makers who manufacturer generic versions of Prozac, which at more than 34.5 million prescriptions is the most widely prescribed antidepressant of its kind. Under the ruling, Barr can put a generic version in pharmacies in August 2001.

The news propelled shares of Barr Laboratories to a closing price of 77, up 31-1/4, or about 68 percent.

Competition seen hurting Lilly results in 2001, 2002

Increased competition for Prozac is seen bruising Eli Lilly's results for the next two years, if the ruling is not overturned in appellate court. Lilly's Prozac revenue in 1999 stood at $2.61 billion, more than one-quarter of its total sales of $10 billion.

The company expects to post single digit earnings-per-share growth in the calendar years 2001 and 2002, accelerating to double-digit sales and earnings growth in 2003.

"We expect to continue our strong earnings growth in the first half of 2001 leading up to the generic entry in August," Charles Golden, the company's chief financial officer, said in a statement. "Then, we'll likely see earnings declines in the second half of 2001 and the first half of 2002.

Earlier this year, the company predicted per-share earnings growth to be in the mid-teens over the next three years. Last year, Lilly earned $2.5 billion, or  $2.46 a share. $2.46 a share.

The company anticipates that strong underlying growth of current products and others to be launched in 2001 and 2002 will lead to a return to double-digit earnings growth in the second half of 2002.

In an interview on CNNfn's Moneyline, Eli Lilly Chief Executive Sidney Taurel said that despite the development, new drugs will provide the fuel to overcome any Prozac-related setbacks.

"(Looking forward) the strategy ... is to come up with new products," he said. "Currently we have eight products which are in phase three clinical trials and two more which will reach that stage by the end of the year."

"That means up to 10 products that will be launched between 2001 and 2004, which will help us weather the storm," Taurel added. "That means up to 10 products that will be launched between 2001 and 2004, which will help us weather the storm," Taurel added.

Pharmaceutical analyst Len Yaffe of Banc of America Securities said the early arrival of Prozac generics would trim about $1 billion in Lilly's Prozac sales for the year of August 2001 to August 2002. Still, he told CNNfn's Street Sweep that the company's roster of planned products is strong, and that in time, new products will fill the revenue gap.

"We think that their pipeline looks extremely robust and these recent drugs again are adding $800 to $900 million a year in revenues which is almost what they are going to lose to Prozac," he said.

Other drug stocks suffer

The news also infected the stocks of other pharmaceutical companies on Wednesday. Shares of Forest Laboratories (FRX: Research, Estimates), which makes a brand name antidepressant, fell 24-15/32, or 21.3 percent, to 90.

Shares of Sepracor also stumbled on the news, falling 18 percent to 106-1/8. Eli Lilly has a licensing agreement to develop and sell Sepracor's R-fluoxetine, a variation of Prozac that is undergoing clinical trials and is believed to have fewer side effects.

Analyst Yaffe labeled the slump a setback for drug company stocks, which had been outperforming major indices, and said his firm had been urging some clients to buy at the lower levels.

"The drug stocks have been phenomenal performers, since March," he said. "So I think it is appropriate to put it in its proper context in the fact that the drug stocks now maybe are taking a little bit of a breather." (283K WAV, 283K AIFF)

Signs of the potential erosion of Prozac sales amid a rise in competition are already evident in non-U.S. markets, the company revealed last month in its second-quarter earnings report. Eli Lilly said Prozac sales dipped 31 percent in non-U.S. markets in the period, including the United Kingdom, where its patent on Prozac has expired and competition has grown. Signs of the potential erosion of Prozac sales amid a rise in competition are already evident in non-U.S. markets, the company revealed last month in its second-quarter earnings report. Eli Lilly said Prozac sales dipped 31 percent in non-U.S. markets in the period, including the United Kingdom, where its patent on Prozac has expired and competition has grown.

The company recently attempted to expand Prozac's uses, and in July won government approval for Sarafem, a form of Prozac. Sarafem is the first prescription drug for women suffering from the temporary depression and severe physical symptoms of premenstrual syndrome.

-- from staff and wire reports

|

|

|

|

|

|

Eli Lilly

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|