|

Net auction deal in doubt?

|

|

August 10, 2000: 7:59 a.m. ET

European online auctioneer QXL studying new information about Ricardo

|

LONDON (CNNfn) - In a sign that its plan to acquire German rival Ricardo.de AG may be in jeopardy, U.K. online auctioneer QXL.com PLC said Thursday it is evaluating new information about the company that could have implications for the deal. Ricardo shares fell 13 percent on the news.

QXL.com (QXL), a European challenger to U.S. Internet auction powerhouse eBay �(EBAY: Research, Estimates), said it has received "certain information" from Ricardo and "is evaluating the implications of this information on the proposed transaction."

Ricardo was expected to provide a response to QXL's statement later Thursday, according to a Reuters report. QXL told CNNfn it would make a further announcement in about a week.

The companies announced May 16 that they would merge in a stock deal worth roughly The companies announced May 16 that they would merge in a stock deal worth roughly  1.1 billion ($994 million) at the time, but investors have punished QXL's already volatile stock out of concern over Ricardo's shaky finances. 1.1 billion ($994 million) at the time, but investors have punished QXL's already volatile stock out of concern over Ricardo's shaky finances.

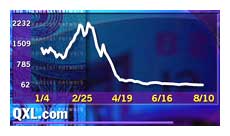

Ricardo stock slid  5.1 euros to 5.1 euros to  33.70 on Frankfurt's Neuer Markt Thursday. The company has lost about 85 percent of its value since setting an all-time high of 33.70 on Frankfurt's Neuer Markt Thursday. The company has lost about 85 percent of its value since setting an all-time high of  222 in February. 222 in February.

QXL stock jumped 2-1/4 pence, or more than 3.6 percent, to 64 pence in London on the news. The shares have lost about two-thirds of their value since the deal was announced. The company went public last year at 62 pence per share. QXL shares also trade on the Nasdaq market in the United States.

In an interview with CNNfn Thursday, QXL Chief Executive Officer Jim Rose touted his company as one of the few major competitors left in the online auctioneering business.�

"If you look at the competitive landscape from 8 months ago, there was eBay, Amazon, Yahoo and a ton of European players," he said. "The field has narrowed - there's really just QXL and eBay - QXL is in 12 countries, eBay's just in two."

QXL made the announcement as it reported that fiscal first-quarter earnings nearly halved compared with last year's results.

The company lost £15.5 million ($23.3 million) in the period ended June 30, compared with a loss of £28.1 million in the year-earlier first quarter. Registered users rose 88 percent to 1.3 million over the fourth quarter ended in March.

Gross auction value rose 81 percent to £18.4 million over the fourth quarter on a pro forma basis, including recent acquisitions. On a year-over-year basis, auction value soared 837 percent.

Excluding benefits from acquisitions, auction value rose 24 percent to £12.6 million over the fourth quarter and 545 percent above the first quarter of 1999.

QXL operates in 13 European countries. Ebay is the top auction site in Germany, and also has a site in Britain.

|

|

|

|

|

|

QXL

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|