|

Asian stocks drift higher

|

|

August 13, 2000: 11:59 p.m. ET

Tokyo edges up; Hong Kong, Taiwan, Australia improve marginally

|

NEW YORK (CNNfn) - Major indices in Asia opened higher Monday following overall acceptance of the Bank of Japan's interest rate hike and a positive market performance on Wall Street Friday.

Tokyo stocks edged higher at the beginning of the market session Monday, but firmed up by midday, as the BOJ's Friday interest rate hike fell within most market expectations

Stocks in Hong Kong drifted upward in early trading, but gains are expected to be lower ahead of the much-anticipated release of U.S. economic numbers Wednesday. Analysts said the market will also remain hawkish ahead of a slew of earnings announcements due out this week, especially for companies listed in the Growth Enterprise Market (GEM).

South Korea's bellwether KOSPI index was up 3.14 percent at 744.91. Hyundai Engineering & Construction rose by the daily limit of 15 percent to 3,335 won and Hyundai Motor was up 4.7 percent at 17,950.

Taiwan stocks opened slightly higher on Monday, but soon fell back on caution over President Chen Shui-bian's first overseas trip. The Weighted index opened 0.03 percent higher. But 12 minutes after trade began, the index was down 41.60 points, or 0.52 percent, at 7,933.05. Taiwan stocks opened slightly higher on Monday, but soon fell back on caution over President Chen Shui-bian's first overseas trip. The Weighted index opened 0.03 percent higher. But 12 minutes after trade began, the index was down 41.60 points, or 0.52 percent, at 7,933.05.

Singapore stocks were firm in early trade on Monday, buoyed by last Friday's strong finish of U.S. markets. Chartered Semiconductor led the way, boosting the index more than six points. The key Straits Times Index was 0.60 percent or 12.69 points higher at 2,113.69.

Japan's benchmark Nikkei stock average firmed on Monday, after last Friday's interest rate hike fell within most market expectations.

By midday trading in Tokyo, the benchmark Nikkei 225 was up 60.07 points or 0.37 percent at 16,177.57.

"The market was done with factoring in the end of zero rates by the time of the decision. Now the market is assessing the long-term impact of the rise, which may prompt structural reforms," said Yutaka Nakai, executive officer of investment strategy at Daiwa Asset Management.

The BOJ raised the key overnight call rate 25 basis points to 0.25 percent—it was the first such move in ten years.

Interest-rate sensitive banking shares were mixed with Industrial Bank of Japan Ltd off 0.41 percent at 728 yen and Fuji Bank Ltd up 0.54 percent at 739 yen.

Negative impact from a rate hike had mostly been priced in during the sector's downtrend over the past few months, especially after the selling which followed last month's bankruptcy of retailer Sogo Co Ltd, traders said.

However, concern that a series of rate rises is looming as the Japanese economy struggles to fully recover had put a cap on potential gains in the banking sector, analysts said.

"Such rate hikes would put pressure on bank earnings. So there could be a clearer difference in the share price performance of financially strong banks and others from now on," said Nozomu Kunishige, senior financial analyst at Lehman Brothers.

Bank of Tokyo Mitsubishi Ltd, considered one of the stronger lenders, rose 1.64 percent to 1,240 yen.

The capital-weighted TOPIX index of all shares listed on the Tokyo Stock Exchange's first section inched up 1.50 points or 0.10 percent to 1,492.39. The capital-weighted TOPIX index of all shares listed on the Tokyo Stock Exchange's first section inched up 1.50 points or 0.10 percent to 1,492.39.

Shares in debt-strapped general contractors were also mixed, with Sato Kogyo Co Ltd up 3.92 percent at 53 yen and Kumagai Gumi Co Ltd losing 2.27 percent to 43 yen.

Banyu Pharmaceutical Co Ltd, one of the session's most active stocks, fell 8.33 percent to 2,310 yen after the drug maker said on Friday it halted development of a drug to treat incontinence and lung blockage.

Vector Inc., which made its debut on Nasdaq Japan on Friday, ended the morning at 2.92 million yen, after having first traded at 2.52 million yen, up from its initial public offering price of 1.2 million yen. Vector operates a Web site for downloading computer software.

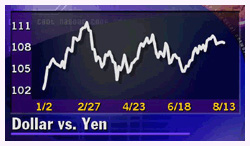

In the currency market, the U.S. dollar inched up against the yen in early Monday Asian trading after showing subdued reaction to the BOJ interest rate move.

The dollar stood at 108.68 yen, compared with 108.49 yen in late U.S. trading Friday.

Hang Seng stages weak open

The blue-chip Hang Seng Index was trading up 0.17 percent or 30.90 points early Monday at 17,245.32. Turnover totaled HK$941 million.

"The Hang Seng has opened up on U.S. gains but it is quite a lackluster opening. There is little news to push price higher," said Geoff Galbraith, deputy head of institutional sales at Dao Heng Securities.

Analysts said the market lacked upside momentum as declining Pacific Century CyberWorks shares, the most actively traded stock, weighed on the index.

"PCCW's share price has been under pressure as prices were expected to come down to near its share placement price of around HK$15.80. The market is also expecting an upcoming Cable & Wireless share placement," said Andrew To, director of research at Tai Fook Securities.

Dealers said the sale by PCCW Chairman Richard Li of 240 million shares, or one percent of the company, last Wednesday was putting downside pressure on the stock price. Shares of PCCW, which will complete its merger with Cable & Wireless on August 17, were trading down 3.13 percent at HK$15.50 in early morning trade.

Hutchison Whampoa, the conglomerate which confirmed on Monday that it has bought a 51 percent stake in Tiscali's Andala UMTS consortium was trading up 1.31 percent at HK$116.

The terms of the deal were undisclosed, but it gives Hutchison control of the consortium, which will get funding from the Hong Kong conglomerate to bid for one of five 3G (third generation) mobile phone licenses in Italy. The terms of the deal were undisclosed, but it gives Hutchison control of the consortium, which will get funding from the Hong Kong conglomerate to bid for one of five 3G (third generation) mobile phone licenses in Italy.

Australian shares drift higher, following Wall Street

Australian shares opened modestly higher on Monday, taking their lead from a strong performance on Wall Street on Friday.

The benchmark S&P/ASX 200 index rose 10.7 points or 0.3 percent to 3,319 in early trading. However, traders expect that interest will continue to focus on individual stocks, rather than wider trends, as the profit reporting season continues.

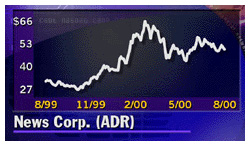

Media giant and owner of Fox television network News Corp. (NWS: Research, Estimates) stole the early limelight after trading in its shares was halted pending an announcement. The company is expected to reveal a deal to buy U.S. T.V. station group Chris-Craft for $5.3 billion. News Corp shares closed down 60 cents at A$21.30 here on Friday, while the company's ADRs fell 1.7 percent on Wall Street.

Australia's third largest telecommunications group AAPT Ltd advanced to A$6.12, but within half an hour of trade was up just four cents to A$6.00. The company had reported a full year net profit of A$36.24 million, up from A$29.6 million in the previous corresponding year. Australia's third largest telecommunications group AAPT Ltd advanced to A$6.12, but within half an hour of trade was up just four cents to A$6.00. The company had reported a full year net profit of A$36.24 million, up from A$29.6 million in the previous corresponding year.

News on a possible merger between the Australian Stock Exchange, and the New Zealand Stock Exchange also flared up Monday.

In early trade, the ASX was up 36 cents to A$11.50.

Advancing stocks outpaced declines by a ratio of five to two, while about 37 percent of stocks traded remained steady.

-From staff and wire reports

|

|

|

|

|

|

|