|

Venture funding explodes

|

|

August 14, 2000: 8:06 a.m. ET

Venture capitalists shrug off a jittery Wall Street; pour record billions into high tech

|

NEW YORK (CNNfn) - Wall Street still may have doubts about the future of Internet companies, but in an astounding vote of confidence in the sector, venture capitalists poured record amounts of money into high technology and Internet plays in the second quarter of 2000.

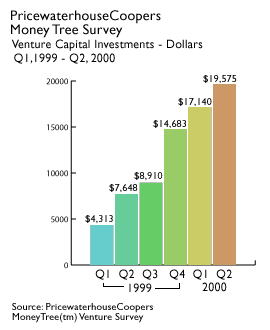

Venture capital investment soared to $19.6 billion in the second quarter of 2000, $2.5 billion more than the previous quarter. That figure shattered all previous quarterly financing records and exploded the fear that venture financing for high techs would disappear following recent shake-outs in the dot.com sector. Venture capital investment soared to $19.6 billion in the second quarter of 2000, $2.5 billion more than the previous quarter. That figure shattered all previous quarterly financing records and exploded the fear that venture financing for high techs would disappear following recent shake-outs in the dot.com sector.

The venture capital survey, released Monday by PricewaterhouseCoopers, revealed that more venture capital money has been pumped into start-ups in the first two quarters of 2000 than in all of 1999.

"The results are truly incredible," said Tracy Lefteroff, managing partner of PricewaterhouseCoopers' venture capital practice. "I thought the results would be good, but I wasn't sure they'd be this good."

Internet still hot, e-commerce is not

Back in April, at a time when the Nasdaq composite shed more than 1,100 points in one week, venture capitalists said they would continue to pour money into high tech startups, chasing the dream of funding the next Sun Microsystems (SUNW: Research, Estimates) or Yahoo! (YHOO: Research, Estimates). Clearly, they meant what they said.�

The bulk of the venture money invested in the second quarter, $18.7 billion, filled the coffers of high technology startups. And while funding for Internet-related businesses rose slightly, to $11.7 billion from $10.6 billion in the previous quarter, venture capitalists retreated from the sector that had claimed the lion's share of venture pot in 1999: e-commerce.

Investors shunned business-to-business and business-to-consumer sites, both of which saw overall investment drop in the second quarter of 2000. Instead, venture capitalists pumped more dollars into Internet infrastructure and applications companies.

"What you are seeing is a shift away from e-commerce and back to the plumbing of the Internet," Lefteroff said. "The telecom sector and software are doing quite well as are DSL, broadband and fiber optics. Most of them are retooling to enter the fiber optic age."

Fewer deals, more dough

The total number of deals leveled off in the second quarter, to 1,414, up only 1 percent over the previous quarter, while the average size of the deals grew more than 13 percent to $12.1 million. Buried in those statistics is the fact that, while venture capitalists are flush with cash and optimistic about the future of high technology, they are getting more picky and not spreading their investments as broadly as they have in the past.

It's also likely that some companies put off public offerings after the market's� April nosedive, and instead took another round of venture capital funding.

"Larger and larger rounds is a trend we see continuing," Lefteroff said. "This quarter, some companies that may have been planning an IPO went back to the venture capital well instead. And, venture capital firms have plenty of money to keep those companies growing for the foreseeable future."

Silicon Valley still reigns

One aspect of venture capital funding remains constant quarter after quarter: the vast majority of VC cash funded burgeoning businesses in one tiny  cluster of towns in Northern California known as Silicon Valley. Companies headquartered in Silicon Valley scored more than a third, $6.9 billion, of the total venture funding doled out in the second quarter. cluster of towns in Northern California known as Silicon Valley. Companies headquartered in Silicon Valley scored more than a third, $6.9 billion, of the total venture funding doled out in the second quarter.

The remainder was spread across the nation, with New England coming in a respectable second with $2.6 billion. The greater Southeast, Midwest, Washington D.C., New York City ,and Texas regions logged more than $1 billion in venture capital during the second quarter.�

PricewaterhouseCoopers predicted, on the basis of the this latest survey, that although the money is moving in a different direction and the number of deals isn't growing rapidly, venture capital funding will remain strong for the rest of 2000.

"Barring catastrophic occurrences, we expect investing to continue in this range through the rest of the year," Lefteroff said. "I'd say if you have a good deal, there is probably not a better time to go out looking for money."�

|

|

|

|

|

|

PricewaterhouseCoopers

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|