|

Analysts interpret HP's 3Q

|

|

August 17, 2000: 2:16 p.m. ET

Analysts scrutinize computer maker's earnings; shares give back gains

|

NEW YORK (CNNfn) - At first glance, computer maker Hewlett-Packard appeared to have blown past the analysts' estimate when it reported its fiscal third-quarter earnings after the closing bell Wednesday.

The results, however, drew mixed reviews from analysts Thursday, some of whom criticized the way the company presented the numbers and expressed concern about slower growth in sales of UNIX servers, which are used primarily to run Web sites.

On the surface, HP's strong sales of electronic imaging and printing products helped the company post net income of 97 cents per share, beating Wall Street's expectations by 12 cents, as sales rose 15 percent to $11.8 billion from $10.3 billion.

The results represented the third consecutive quarter during which HP (HWP: Research, Estimates) beat Wall Street's expectations.

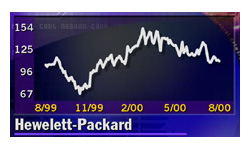

After soaring in after-hours trading Wednesday, HP's shares fell back tk-tk to tk in early afternoon trade Thursday. They finished at 111-7/16 on the New York Stock Exchange Wednesday.

Carly Fiorina, who took over as HP's president and chief executive in July 1999, said the latest quarterly results "demonstrate the tremendous progress we're making in all of our businesses around the world." Carly Fiorina, who took over as HP's president and chief executive in July 1999, said the latest quarterly results "demonstrate the tremendous progress we're making in all of our businesses around the world."

But some analysts weren't so sure of that.

"The operating numbers were not as good as advertised," said Bear Stearns analyst Andrew Neff in a research report issued Thursday. After adjusting for favorable currency impact, one-time equity gains, a lower-than-expected tax rate, and higher-than-expected interest and other income, the company earned closer to 87 cents per share during the quarter, Neff said.

Even so, Neff characterized the quarter as "strong across the board," especially in its printing and imaging business, and raised his fiscal year 2000 estimate to $3.62 per share from $3.50. He also pegged a price target for the stock to the $125-to-$130 range.

Banc of America Securities analyst Kurt King was less sanguine about the company's results. He downgraded his rating on the stock to "buy" from "strong buy," citing disappointing UNIX server growth and the credibility of the company's management.

He also said the upside was derived mainly from expense management and non-operating items.

In an interview on CNNfn's Market Call program Thursday, King noted that Fiorina, who during her tenure has consistently delivered earnings that have been either in line with or ahead of estimates, may have reached too far when setting expectations for individual pieces of the business, undercutting some of her credibility. [234K WAV or 234K AIFF] In an interview on CNNfn's Market Call program Thursday, King noted that Fiorina, who during her tenure has consistently delivered earnings that have been either in line with or ahead of estimates, may have reached too far when setting expectations for individual pieces of the business, undercutting some of her credibility. [234K WAV or 234K AIFF]

During the quarter, HP experienced strong growth in its consumer PC business, as consumer desktop sales rose 62 percent and notebook sales jumped 93 percent. Sales of commercial desktop PCs actually declined, however.

Meanwhile, sales of UNIX servers rose a tepid 13 percent, reflecting a high degree of competition in that market segment from the likes of Sun Microsystems and IBM.

Merrill Lynch's Steve Milunovich on Thursday added a dime to his fiscal 2000 earnings estimate for HP, which he now expects to come in at $4.10 per share.

"Or thesis has been that HP would have a solid second half, driven by strong results in the consumer market, which should move the stock back up to our price objective of $140," Milunovich wrote in a research note Thursday.

He added, however, that despite its efforts, "It is not clear when HP will become a leader in the Internet infrastructure market," Milunovich said. The company's Unix server growth rate continues to lag Sun's, and it does not yet offer as deep a set of Internet servers as IBM, he said. He added, however, that despite its efforts, "It is not clear when HP will become a leader in the Internet infrastructure market," Milunovich said. The company's Unix server growth rate continues to lag Sun's, and it does not yet offer as deep a set of Internet servers as IBM, he said.

DLJ analyst Kevin McCarthy increased his fourth-quarter and fiscal 2001 earnings-per-share estimate based on a lower tax rate and a lower number of shares outstanding. But he agreed that the third-quarter's results were "not as good as they appeared."

|

|

|

|

|

|

|