|

Icahn's latest buy: GM

|

|

August 18, 2000: 4:35 p.m. ET

Financier to stake in No. 1 automaker; satellite unit seen as key to move

By Staff Writer Chris Isidore

|

NEW YORK (CNNfn) - Financier Carl Icahn is taking aim at the world's largest automaker, notifying General Motors Corp. that he plans to acquire a stake in the blue chip company with a depressed share price, company officials announced Friday.

GM officials said Icahn notified them Wednesday of his intent to take a large stake in the world's largest automaker. The company said his intended stake could be as little as $15 million, or well less than 1 percent of shares outstanding, or as much as $5.6 billion, or 15 percent of the company.

GM has seen its stock plummet more than 30 percent since late April, when it set a 52-week high of 94-5/8.

GM Chairman Jack Smith defended his company's performance in a prepared statement and said GM continues to believe its stock is undervalued. The Detroit company recently announced a $1.4 billion share repurchase program in the hopes of reviving its stock. GM Chairman Jack Smith defended his company's performance in a prepared statement and said GM continues to believe its stock is undervalued. The Detroit company recently announced a $1.4 billion share repurchase program in the hopes of reviving its stock.

A GM spokeswoman said Icahn did not indicate what his intentions are for taking the stake. Icahn was not immediately available for comment.

Shares of GM, a component of the Dow Jones industrial average, gained 3, or 4.6 percent, to close at 68-7/16 Friday.

Record of changing management plans

One of the premier corporate raiders of the 1980s, Icahn has often taken stakes in company and prompted executives to a reorganization or restructuring. He recently has started to reassert his market influence, helping force the sale of Nabisco Group Holdings (NGH: Research, Estimates) earlier this year.

Auto analysts speculated Friday that Icahn is likely most interested in seeing GM (GM: Research, Estimates) sell its satellite communications unit, Hughes Electronics.

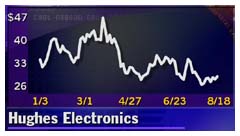

Hughes (GMH: Research, Estimates) shares act as a tracking stock. GM shareholders own all the assets of the company, but the division's results are attributed to the holders of the GM-H shares.

Because of sluggish performance in auto stocks overall and much higher multiples for high tech firms like Hughes, shares of the tracking stock have become almost the tail that wags the dog. Hughes' market capitalization is worth just under $27 billion, while GM's market cap is just under $37 billion.

In February, GM announced GM shareholders could exchange some of their common shares for Hughes shares that it held. It also placed more of the Hughes shares in various GM-controlled retirement accounts.

"At that time (of the stock swap), the company said it was stepping up the pace of its evaluation regarding what Hughes ownership structure would be optimal for the two companies," said GM's statement Friday. "At that time (of the stock swap), the company said it was stepping up the pace of its evaluation regarding what Hughes ownership structure would be optimal for the two companies," said GM's statement Friday.

"We continue to look at ways to further unleash value from our ownership of Hughes while preserving our strong credit ratings," said Smith in that statement.

While this dispersal of Hughes shares unlocked some of the unit's value for GM shareholders, it left the company a wholly-owned GM subsidiary and did little to quiet critics who were looking for a complete divestiture.

Smith, who was both chairman and chief executive at the time of the stock swap, defended GM's decision to hold on to Hughes at that time, saying it was important to the future of GM as cars start to have greater connections to the Internet and other communications.

"It is important to retain our strategic relationship with Hughes," he said at the time. "We continue to create new communications capabilities and functionality in our vehicles. Hughes has redefined itself as a premier provider of digital entertainment and business communications, which strengthens its ability to contribute to GM's strategy to grow its service-oriented businesses."

Shares of the Hughes tracking stock climbed 2, or 6.9 percent, to 30-7/8 Friday.

Analysts disagree on outcome of Icahn move

Analysts disagreed Friday whether a sale of Hughes is in the works at GM and whether Icahn could force the company to sell the unit.

"We can wait to see what happens, but perhaps he's bitten off more than he can chew," said David Healy, analyst at Burnham Securities. "They've used the value of Hughes effectively to benefit other shareholders. I don't think there's any consensus among analysts that GM is forgetting about shareholders and should be taken over by raiders."

But Gary Lapidus, auto analyst at Goldman Sachs, said he does think a Hughes sale is in the works at GM.

"It's hard to believe he wants to take this thing over," said Lapidus. "He's probably trying to capture the Hughes arbitrage. I suspect this is a bit more of a passive investment than you normally see from him. I think it would become less passive if GM didn't do the right thing [and sell Hughes], but I think they'll do the right thing."

Icahn would have to take a stake of 5 percent or greater in the company before he could convince management to make a move it didn't want to make on Hughes, said Nicholas Lobaccaro, analyst with Lehman Brothers.

"I don't know if they're chomping at the bit to unlock the value of Hughes any time soon," said Lobaccaro. "If look at the way the stock fell from 94 in April, you see that without Hughes being center of attention, the auto business gets almost no value on Wall Street."

GM is not the only company in which Icahn has announced plans to acquire a stake. In June, just after the Nabisco announced plans for the sale of that company, Icahn announced plans to buy up to 15 percent of troubled railroad holding company CSX Corp. (CSX: Research, Estimates) CSX responded by strengthening its anti-takeover defenses.

In July the announcement that he was looking to buy up to 15 percent of laser vision equipment maker Visx Inc. (VISX: Research, Estimates) sent those shares up, although it has since lost about half of that gain. He's also invested in auto parts maker Federal Mogul Corp. (FMO: Research, Estimates).

"It seems like he has stakes in a lot of companies," said Lobaccaro. "Sometimes he's very active. Sometimes he's passive. Federal Mogul is a company he's been putting money into, and it hasn't helped the stock price."

|

|

|

Hughes electronics revenue, earnings improve - July 17, 2000

GM limits Hughes stock swap - May 22, 2000

GM elects to keep Hughes - Feb. 1, 2000

Hughes shares rise on deal; spin-off speculation - Jan. 14, 2000

GM boss pushes cross sales - Jan. 12, 2000

Icahn target CSX still not back on track - June 28, 2000

Icahn's next target: CSX - June 27, 2000

Philip Morris to buy Nabisco, RJR gets holding company - June 25, 2000

|

|

|

|

|

|