|

IPO Focus: Biotech

|

|

August 20, 2000: 7:15 a.m. ET

Genome breakthrough sparks summer rally analysts hope continues into the fall

By Staff Writer Luisa Beltran

|

NEW YORK (CNNfn) - Perhaps no one sector tests the hopes and dreams of IPO investors more than biotechnology, where companies often offer no revenue and no existing products -- increasingly a formula for disaster in the market for new issues.

After turning out in droves early this year, when biotech issues rode the initial public offering market's torrid wave to prosperity, investors deserted the sector during the second quarter, causing some industry players to get cold feet and withdraw their offerings. That support is beginning to return, although some analysts question if the best deals might already be past.

So far this year, 49 biotech companies completed their IPOs on the Nasdaq, raising $4.7 billion. Globally, 71 biotech deals raised $5.9 billion, far outpacing the 21 deals in 1999 that raised $915 million, according to data from BioCentury Publications Inc., a Belmont, Calif.-based information services company targeting the biotech and pharmaceutical industry.

The Labor Day hiatus hits the new issues market this week and only three IPOs are expected, all holdovers from last week. But the biotech sector is eagerly awaiting the return of the IPO market, hoping the mid-summer rally, coupled with new advances in human genomics, will continue to spur new gains into the fall season. The Labor Day hiatus hits the new issues market this week and only three IPOs are expected, all holdovers from last week. But the biotech sector is eagerly awaiting the return of the IPO market, hoping the mid-summer rally, coupled with new advances in human genomics, will continue to spur new gains into the fall season.

"Genomics is what people are focusing on because of the recent advances," said David McMillan, director of capital markets and syndicate manager at Lazard Freres & Co. "There is enormous opportunity here."

Genome brings investors

The success of the genome project helped spur the recent success of the sector, insiders said. On June 26, Celera Genomics (CRA: Research, Estimates) and the government-backed Human Genome Project completed the first draft sequence of the human genome. The genome is the total DNA content of an organism.

"The completion of the genome project was the branding event for the sector," said Keith Crandell, managing director of Chicago-based ARCH Venture Partners, a venture capital group that invests in biotechs.

The project caused a turning point for institutional and retail investors, Crandell said. The project's success changed the way investors look at biotechs, especially genome-related deals, because it promised changes in the way drugs are developed. The project will help drug companies tailor drugs to fit an individual's genetic makeup.

"Genomics will bring about a broad change in the way medicine is practiced," Crandell said.

With such promising research, actual products are still years away. But this hasn't stopped investors from bidding up biotech IPOs this year.

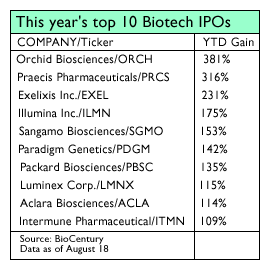

Overall, biotech deals have averaged a 46 percent gain this year, said CommScan, a New York-based investment banking research firm.

However, the market wasn't always this kind to the industry. Biotechs were dormant for much of the last decade, after the sector crashed in the mid-1990s. It took until December 1999 for the industry to rebound, and that rebound carried over into a rally during the first quarter of this year.

But the sector lost momentum in second quarter along with technology stocks as IPO investors got jittery. But a bounce again this summer has investors eyeing the sector once again.

Speculative stocks tend to run hotter and then fall off more when the IPO market dries up, said Joe Hammer, head of capital markets at Adams, Harkness & Hill, of biotech's roller-coaster ride.

"When the IPO market tapers off, the more speculative types of issues tend to take a bigger beating than those more "mature" IPOs with revenue and earnings," Hammer said.

Orchid blooms

The year's hottest biotech deal came in May when Orchid BioSciences Inc. (ORCH: Research, Estimates) raised $48 million after selling 6 million shares at $8 each via underwriters led by Credit Suisse First Boston. Orchid closed its first day up 2 at 10 but has blossomed since. Through Friday, Orchid has more than quadrupled its offer price, gaining 381 percent to close at 38-1/2.

Princeton, N.J.-based Orchid is another genomics deal. The company develops technologies related to single nucleotide polymorphisms, single base variations in genetic code. Because they are so common, SNPs can affect an individual's susceptibility to disease and their response to drugs.

Orchid's success has coincided with a return of hot biotech IPOs. The IPO market experienced a glut of deals during July and August with nearly 20 biotech deals opening for trade this summer. Many blossomed into success stories.

The current rally began in July, with Decode Genetics Inc. gaining 41 percent after pricing 9.6 million shares at $18 each, the top of the range, through underwriters led by Morgan Stanley Dean Witter. On Friday, Decode rose 2-7/16 to close at 27.

The four-year-old company is studying the population of Iceland to discover the function of genes and their relation to diseases. Reykjavik, Iceland-based Decode Genetics Inc. (DCGN: Research, Estimates) is attempting to identify specific genes that cause or indicate disease, and so far has identified 12 specific candidate genes but has not validated any disease genes.

Since Decode, however, the sector has up and down. On August 11, four biotechnology-related deals opened for trade but only one -- Lion Biosciences Inc. — produced a strong gain of 25 percent. Lion (LEON: Research, Estimates) is a biological information technology company that provides genomics and life science information to help speed drug discovery and life science research. On Friday, Lion rose 8-5/8 to 64.

Then, on August 15, the sector rebounded again with Dyax Inc., which climbed 72 percent in its first day. Dyax (DYAX: Research, Estimates) has developed a method called phage display that uses bacteria to identify compounds it says can be used to treat and diagnose diseases. On Friday, Dyax slipped 13/16 to close at 25-13/16.

August is traditionally slow for new issues, causing the sector to dip, said Lazard's McMillan.

"A lot of people are on holiday and they will start looking at new issues after Labor Day," he said.

But many analysts are hesitant to pin any hopes on the sector.

"The biotech sector is just not proven," said Ben Holmes, president of ipoPros.com. "It gets started and then it fades."

The glut of biotech deals this year may have caused investor interest to wane, said John McCamant, editor of Medical Technology Stock Letter, an investment newsletter that focuses on biotech stocks.

"There is just only so much appetite for new issues here," he said. "They all seem to sound alike now. Investors need time to differentiate these stories."

Success in September?

Biotech offers the promise of huge gains, but the wait-time before a company actually produces a product can be years, analysts said.

However, this is not expected to stop the flow of deals in September. Many analysts expect the biotech rush to continue as 19 companies are waiting to launch their deals during the second half of 2000.

"We've got a lot of companies queuing up for September," said Eric Roberts, managing director and co-head of global healthcare at Lehman Brothers. "People are excited about the activity in first quarter and they're trying to get their deals done."

"There certainly is enough cash sitting on the sidelines to make a viable IPO market," added Lazard's McMillan.

However, Roberts expects investors to become more discerning once the fourth quarter arrives. Most of the high-quality biotechs have either already gone public or will go public in September. So, investors looking to get in on a top biotech deal may have missed their chance.

"There are fewer quality private companies that haven't gone public yet," Roberts said. "As we get into fourth quarter, the number of well-developed private companies will be few and far between."

|

|

|

|

|

|

Orchid

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|