|

Bonds hold steady post-Fed

|

|

August 22, 2000: 3:29 p.m. ET

Fed decision to keep rates steady offers no surprises; dollar mixed vs. euro, yen

By Staff Writer Jill Bebar

|

NEW YORK (CNNfn) - Treasurys bonds ended little changed Tuesday after the Federal Reserve left short-term interest rates unchanged, in line with expectations.

In the currency markets, the dollar rose against the euro but slid against the yen.

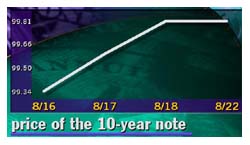

Shortly after 3 p.m. ET, the benchmark 10-year Treasury note rose 2/32 of  a point in price to 99-26/32. The yield, which moves in the opposite direction to price, fell to 5.77 percent from 5.78 percent Monday. a point in price to 99-26/32. The yield, which moves in the opposite direction to price, fell to 5.77 percent from 5.78 percent Monday.

The 30-year bond gained 2/32 to 107-24/32, its yield retreating to 5.71 percent.

The Federal Open Market Committee, the central bank's policy-making arm, kept the federal funds rate or overnight bank-lending rate, steady at 6.5 percent.

In a statement accompanying the action, the Fed revealed a tightening "bias" toward raising rates down the road, noting it remained concerned about the risks of inflation. Because the outcome was widely anticipated, there was little reaction.

"You got exactly what was expected, almost to a tee," said Mike Mauer, debt  strategist at A.G. Edwards. "There's nothing to react to." strategist at A.G. Edwards. "There's nothing to react to."

The Fed has hiked rates six times since June 1999. But after a number of economic reports signaling a slowing in the economy, it also kept rates steady at its last meeting in June.

A drop in oil prices provided support. In late New York trading, light U.S. crude futures for October delivery fell 75 cents to $31.23 a barrel. Recent concerns about rising energy prices have undermined Treasury prices as high prices raise the risk of inflation.

With the Fed out of the way, market participants look ahead to Wednesday's auction of $10 billion in two-year notes.

Dollar mixed

Reaction to the Fed decision among currency traders was also muted. The dollar traded at two-week highs against the euro, with the single currency falling below the 90-cent level.

The euro remained vulnerable on the heels of the weaker-than-expected German Ifo index of business sentiment. The index fell to 99.1 in July,  compared with consensus expectations of a 100.4 reading. compared with consensus expectations of a 100.4 reading.

Analysts said the Ifo index, along with other recent data out of the euro zone, diminished the prospect that the European Central Bank will raise rates at its policy meeting Aug. 31.

Meanwhile, a rally among Japanese stocks helped the yen. Tokyo's benchmark Nikkei index gained 2.6 percent.

Shortly after 3 p.m. ET, the euro traded at 89.71 cents, down from 90.21 cents Monday, a 0.6 percent gain in the dollar's value. The dollar was at 108.28 yen compared with 108.62 yen Monday.

|

|

|

|

|

|

|