|

Three sure-fire portfolios

|

|

August 22, 2000: 10:06 a.m. ET

Winning plans for conservative, moderate and aggressive investors

By Staff Writer Martine Costello

|

NEW YORK (CNNfn) - There are three types of people on Wall Street -- the ones who can't sleep at night when the market goes down, the ones who can't sleep at night if they miss a hot IPO, and the ones who fall somewhere in between.

Chicken-hearted, mild-mannered, or risk-taker. Three distinct investing personalities at opposite ends of the stock market when it comes to retirement savings.

In a world with more than 11,000 mutual funds, there are too many choices, too many possible combinations. Lion-hearted investors might not know which emerging markets fund to choose. Risk-averse investors might not know a good bond fund. And what exactly defines moderate?

So CNNfn.com asked three well-known financial pros to design a portfolio of mutual funds for an investor with a 10-year horizon. So CNNfn.com asked three well-known financial pros to design a portfolio of mutual funds for an investor with a 10-year horizon.

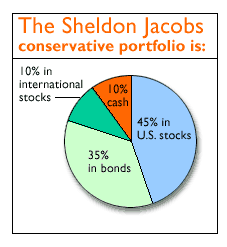

Sheldon Jacobs, editor of the investing newsletter No-Load Investor, said his conservative plan is a good option for people who think the market can't possibly keep going up forever.

Click here for CNNfn.com's special report, The Road to Riches.

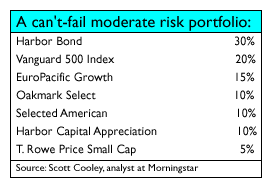

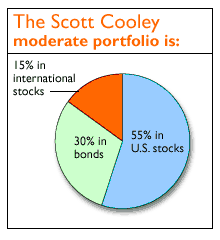

Meanwhile, Scott Cooley, an analyst at fund-tracker Morningstar, said his moderate plan is cost effective and easy to stick with in volatile times.

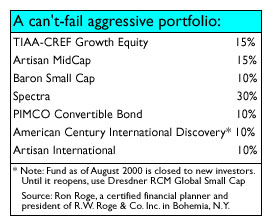

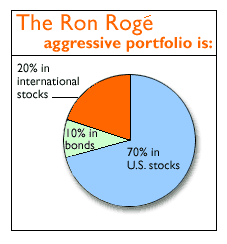

And Ron Roge, a certified financial planner and president of R.W. Roge & Co. in Bohemia, N.Y., said his aggressive portfolio will give you more bang for your dollars with a 35 percent weighting in technology.

Cash, bonds and peace of mind

Jacobs said he likes to use a total stock market index fund as a core holding. He also included 10 percent in cash, but said some investors might want to eliminate the cash allocation since the portfolio is for 10 years.

"It's a conservative portfolio with a low correlation to the market," Jacobs said. "It isn't affected by market fluctuations. It's good for older people who can't afford to take risk, and it's good for people of any age who just can't take risk." "It's a conservative portfolio with a low correlation to the market," Jacobs said. "It isn't affected by market fluctuations. It's good for older people who can't afford to take risk, and it's good for people of any age who just can't take risk."

Jacob thinks smart investors should come in from the ledge when it comes to their portfolios because the stock market can't possibly keep going up 20 percent a year. Price-earnings ratios -- that's the stock price divided by the earnings-per-share -- are still staggering, he said. The P/E of the S&P 500 is about 29, while the historical average for the overall market benchmark is 15, he said.

"One thing that's in the future is the technology revolution," Jacobs said. "But I can't think of any one thing that will drive the market higher."

Jacobs said he gave a speech advocating a conservative approach at a recent investing conference in California. The crowd wasn't exactly eating it up, he said.

"Everybody thinks things are fine," he said. "There are people who are living off their capital gains as if they're going to get them every year." "Everybody thinks things are fine," he said. "There are people who are living off their capital gains as if they're going to get them every year."

He chose Gabelli Blue Chip Value and Longleaf Partners to give the portfolio a value slant. Price Tax-Efficient Balanced is a blend fund of stocks and bonds, while the Heartland fund is in a neglected part of the market -- municipal bonds.

The Vanguard Inflation-Protected Securities Fund invests in bonds that rise in value based on the Consumer Price Index, while the real estate fund is also an overlooked sector. Still, the portfolio has a 19 percent technology tilt.

"If you're in your 20s, then you can be pretty aggressive," Jacobs said. "But if you're in the stage of life where you don't have many earning years left, there's a lot to commend in this portfolio."

A list of funds that's easier to stomach

Morningstar's Cooley said a lot of investors think they are more aggressive than they actually are. But when a part of the market tumbles, they jump ship and sell their holdings at a loss.

Even Cooley found himself in this situation. He had a small allocation in Templeton Developing Markets Fund in late 1997 when the sector took a dive. He was tempted to sell, but he knew he'd be getting out at the bottom. The fund eventually rebounded and earned 51 percent in 1999.

"A lot of people think they're aggressive, but when an asset class goes out of favor they don't have the stomach for it," Cooley said. "A lot of people think they're aggressive, but when an asset class goes out of favor they don't have the stomach for it," Cooley said.

People may not be able to imagine an extended downturn, but investors before the crash of 1987 probably couldn't imagine the Dow plunging 508 points on a grim Monday, he said.

"This is a portfolio people could live with if they needed to take some money out ahead of time," Cooley said. "They're not going to lose their shirts."

His portfolio has a 30 percent weighting in bonds, which he thinks will provide competitive returns in the next five to 10 years with less volatility. He likes Harbor Bond Fund, headed by star bond fund manager Bill Gross.

"Bill Gross is regarded as the best bond fund manager in the business," Cooley said.

Gross, manager of PIMCO Total Return Bond Fund, is a subadviser at Harbor. The Harbor fund has a much cheaper expense ratio of just 0.65 percent, Cooley said.

Like Jacobs, Cooley has a value slant to his lineup. Oakmark Select is managed by Bill Nygren, who finds great investments before the rest of the market catches on. Like Jacobs, Cooley has a value slant to his lineup. Oakmark Select is managed by Bill Nygren, who finds great investments before the rest of the market catches on.

"Bill is about the smartest manager I talk with," Cooley said. "He's a guy looking for a misunderstood area."

For example, Nygren was buying Amgen long before biotechs took off, and he was also early into cable and media stocks.

Selected American Fund is headed by Chris Davis, a value manager who is willing to look at sectors such as technology, Cooley said. For example, a few years ago, Davis was buying IBM while other value managers were investing in Philip Morris. Since then, IBM has been the winner.

But to counteract the value funds, Cooley chose Harbor Capital Fund, a growth fund managed by veteran Spiros Segalas. While growth stocks could suffer in a downturn, Segalas has a good long-term record. The fund also has a low expense ratio at 0.68 percent.

"He's beaten the index year after year," Cooley said. "It's the kind of fund that will do well if you have 10 years."

While the portfolio might be too aggressive for somebody in their 80s, Cooley said it could fit for someone in their 40s, 50s or 60s.

More bang for your bucks

Roge, on the other hand, steered clear of value in favor of growth funds that were strong enough to avoid a correction during the market downturn this spring.

"We're only looking for risk-adjusted returns," Roge said.

Still, if you invest $100,000 in the portfolio you have to be prepared that it could drop by $30,000 next week, he said. Still, if you invest $100,000 in the portfolio you have to be prepared that it could drop by $30,000 next week, he said.

The portfolio centers on a 30 percent weighting in Spectra Fund, managed by veteran growth manager David Alger.

Spectra is the top-performing growth fund of the 1990s, with 10-year annualized returns of 29.21 percent, according to Morningstar.

"If you look at the history of the fund, they have never had a down calendar year," Roge said of Spectra.

An aggressive investor also needs international exposure, Roge said. In 1999, for example, international funds beat the S&P 500. One of his choices, Artisan International, has a coveted five-star rating and earned 81.3 percent in 1999, according to Morningstar.

"We live in a global economy, and you don't want to limit yourself to companies here in the United States," Roge said. "We live in a global economy, and you don't want to limit yourself to companies here in the United States," Roge said.

He likes the TIAA-CREF fund because their managers are veteran institutional investors. TIAA-CREF is the largest private pension manager in the country.

"They have a great track record, and it's a great way to tap into their expertise," Roge said.

The portfolio does have a 10 percent bond weighting, but PIMCO Convertible Bond is actually half stocks and half bonds. The fund is a conservative way to play technology, since many tech companies with good growth prospects issue convertible bonds.

Roge thinks the portfolio would be a good fit for an aggressive investor of any age. But an older investor would need to make sure he has enough assets to take on such risk.

"We have people in their 70s and 80s who are aggressive," he said. "They have $4 million or $5 million in assets and they want to see their portfolios grow. They want to pass it on to their children and grandchildren."

-- Click here to send e-mail to Martine Costello

|

|

|

|

|

|

|