|

VA Linux beats the Street

|

|

August 23, 2000: 5:29 p.m. ET

Posts loss of 10 cents per share as sales rise more than 500 percent

|

NEW YORK (CNNfn) - VA Linux Systems Inc., which provides computer products and services based on the Linux operating system, posted a fiscal fourth-quarter operating loss that was a nickel narrower than analysts had expected, as sales soared more than 500 percent from the same quarter last year.

For the quarter ended July 28, the Sunnyvale, Calif.-based company said its net loss was $4.08 million, or 10 cents per share. Analysts polled by earnings tracker First Call had expected VA Linux to lose 15 cents per share during the quarter.

Revenue for the quarter was $50.7 million. That's up 547 percent from $7.8 million during last year's fiscal fourth quarter and up 46 percent sequentially.

For all of fiscal 2000, VA Linux reported a net loss of $23.1 million, or 68 cents per share, compared with a loss of $12.2 million, or 85 cents per share, in fiscal 1999.

The company's revenue in fiscal 2000 rose 579 percent to $120.3 million from $17.7 million in fiscal 1999.

"We have continued to demonstrate, quarter after quarter, strong revenue growth and improved financial results," Larry M. Augustin, the company's president and chief executive, said in a statement.

"We improved our gross margins to 22 percent and reduced our net loss, excluding non-cash charges, to 8.1 percent of revenue," Augustin added. "Our differentiation as a full-solution provider of Linux and open-source products became more visible this month with the launch of our build-to-order software selector and our launch of the open-source development network." "We improved our gross margins to 22 percent and reduced our net loss, excluding non-cash charges, to 8.1 percent of revenue," Augustin added. "Our differentiation as a full-solution provider of Linux and open-source products became more visible this month with the launch of our build-to-order software selector and our launch of the open-source development network."

VA Linux is one of a rapidly growing group of companies that specializes in software and solutions based on the Linux operating system. Linux is an "open-source" operating system, which means that it is in the public domain and open to modifications by independent developers.

Its competitors include Caldera Systems (CALD: Research, Estimates) and Red Hat (RHAT: Research, Estimates).

Linux has been seen by many as an emerging rival to Microsoft's ubiquitous Windows operating system and has been gaining strength in the server market, especially among dot.coms.

Although it is offered for free, most corporate users opt to pay for the operating system and its attendant support. VA Linux sells hardware, software and provides professional services for Linux systems as well.

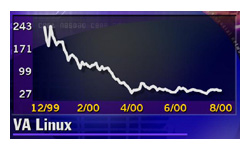

VA Linux (LNUX: Research, Estimates) shares rose 1-1/8 to 37-1/8 in Nasdaq trading ahead of the earnings report.

Although investors were enthusiastic when VA Linux made its record-breaking debut last December, the market appetite for the stock has since waned. At Wednesday's close, shares stood about 84 percent below their high of 239-1/4.

|

|

|

|

|

|

|