DETROIT (CNNfn) - Rick Wagoner, GM's new chief executive officer, is not exactly what you would call a risk-taker.

He rarely drives over the speed limit. He's not the kind of guy to make snap decisions. And when you ask him which GM vehicle he likes the most, he pauses for a moment and then he actually picks two - the Chevrolet Corvette and the Chevy Suburban - not because they're terrific driving machines, mind you, but because they're good examples of GM branding.

Ordinarily this is not the kind of guy you would want to lead a product renaissance at the world's largest automaker.

Related story: GM CFO Losh to retire.

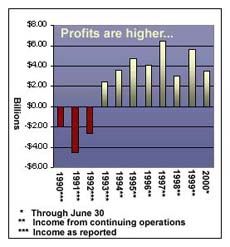

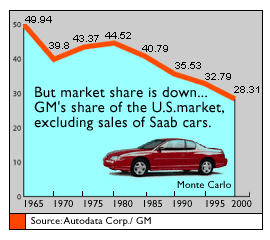

But these are far from ordinary times at GM. Despite a fleet of new vehicles over the last few years, GM's U.S. market share stands at just over 28 percent today, down from almost 50 percent in 1965. Profits are up, but not as much as at arch-rival Ford Motor Co. And when it comes to turning heads on a street corner, the latest wheels from GM today barely get a second look from consumers. But these are far from ordinary times at GM. Despite a fleet of new vehicles over the last few years, GM's U.S. market share stands at just over 28 percent today, down from almost 50 percent in 1965. Profits are up, but not as much as at arch-rival Ford Motor Co. And when it comes to turning heads on a street corner, the latest wheels from GM today barely get a second look from consumers.

The mouse is mightier than clay

So when GM's board of directors gathered earlier this year to decide who would succeed Jack Smith as chief executive officer, there really wasn't much doubt who would get the job. An outsider could take years to figure out how GM works, and with competition only intensifying time was short.

On the other hand, Wagoner, 47, already had demonstrated that he could tackle a number of difficult assignments, first in Latin America and then back at GM's headquarters in Detroit as chief financial officer and purchasing manager during the company's brush with bankruptcy in the early 1990s.

And while his background is primarily in finance, rather than engineering or design, Wagoner had a plan for getting GM back on track - and he was going to rely heavily on the Internet to do it. Among the objectives:

- Reduce vehicle development time to 24 months or less by using computer-aided design rather than clay models. Previously, cars could take more than 48 months from design to production.

- Develop innovative new products, such as GM's OnStar vehicle information service, that can provide GM with additional revenue long after the car is sold.

- Construct a build-to-order delivery system that allows buyers to custom order a vehicle and pick it up 10 days later at a local dealer, eliminating the need for excess inventory.

Industry experts say Wagoner's plan is far from a sure thing. After all, this is the same company that spent billions of dollars on robots in the 1980s - only to watch in frustration as the paint shop machines painted each other rather than the cars coming down the assembly line. But if the automaker finally can hot-wire its far-flung empire into one streamlined organization, the savings could be enormous.

"Whoever is ahead in this area can get a big advantage versus the other guys," Wagoner said in an interview with CNNfn.com. "Just being big isn't enough. We really want to pick up the pace in everything we do in the company."

To make sure GM doesn't lose focus, Wagoner keeps a list of his long-term goals on a giant sketchpad in his office high above the Detroit River. Among them, boost GM's global market share to 28 percent from 24 percent now, deliver annual revenue growth of 6 percent to 8 percent, and earn a nickel on every dollar in sales.

Every nickel helps

That last item may seem small, but when you consider that GM had $177 billion in consolidated sales last year alone, those nickels really start to add up.

Saul Rubin, an automotive analyst at UBS Warburg Securities, gives GM high marks for jumping on the Internet bandwagon sooner than most of its competitors. However, he's skeptical GM will be able to save as much money as Wagoner and his team of managers thinks.

"The question is not can they do it, but can they do better than their competitors," Rubin said. "It certainly won't be an easy road."

Indeed, both Ford and DaimlerChrysler are racing to do the same things on the Web that GM is doing. And Japan's big automakers are not that far behind. So, if GM is going to recapture some of its lost market share, it's going to have to do it where the rubber meets the road - specifically in the form of innovative new products that woo customers back into the showroom.

Wagoner admits GM has a lot of work to do on the product and marketing side of the business. But he's confident GM's new generation of vehicles will help the automaker reconnect with customers, particularly as the automotive market fragments into smaller segments.

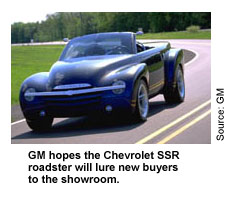

As an example, Wagoner points to the Chevrolet SSR - a cross between a pickup truck and a roadster that is expected to hit the streets in early 2002 - less than two years from the time GM's design team started working on the vehicle. Just a few years ago, a project like the SSR could have languished in GM's design studios for years before a decision was made. As an example, Wagoner points to the Chevrolet SSR - a cross between a pickup truck and a roadster that is expected to hit the streets in early 2002 - less than two years from the time GM's design team started working on the vehicle. Just a few years ago, a project like the SSR could have languished in GM's design studios for years before a decision was made.

GM also has high hopes for the Chevrolet Avalanche, which combines the popularity of a sport/utility vehicle with the functionality of a pickup truck. Also on the horizon is a Saturn sport/utility vehicle, due next year, and a Saturn minivan the following year.

Wagoner likens these products to chips in a high-stakes poker game in which the winner is the company that can grab as many customers as possible. Wagoner likens these products to chips in a high-stakes poker game in which the winner is the company that can grab as many customers as possible.

By delving into new segments, Wagoner hopes some of these bets will pay off, allowing the company to sell the new vehicles without costly incentives.

"The pricing and the competitiveness is so tough in the core business that you need these new bets to get the new customer base, to grow your share and to get better returns," he said.

Still, the rest of the auto industry is certainly not standing still. DaimlerChrysler's new generation minivans already are on the road, and even though GM's current minivans have been freshened this year to add the popular disappearing rear seat, a Saturn minivan is still two years away. Moreover, Ford's popular Explorer is due for a model-changeover next year, just as the all-new Chevy TrailBlazer, GMC Envoy and Olds Bravada debut.

How would you like that car?

On the consumer front, GM is moving quickly toward a build-to-order system that will allow customers to custom order a car on the GMBuyPower Web site, arrange the financing and insurance through GM's GMAC subsidiary, and pick up the car at a local dealership 10 days later. GM is testing the system in a few markets now. If all goes well, the automaker hopes that in a few years, more than half of the vehicles it sells will be built to order, up from around 20 percent today.

One trip to the showroom underscores just how important the build-to-order strategy can be. Currently, some models can sit on a dealer's lot for months on end before they find a buyer - and then only after the automaker has sweetened the pot by knocking a couple hundred dollars off the sticker price.

By reducing the length of time it takes a car to get from the factory to the driveway, GM (GM: Research, Estimates) not only can free up billions of dollars in capital, but it also can be more responsive to changing customer tastes.

"Generally, cars were not built to sit on dealer lots," Wagoner said. "It encourages the wrong kind of behavior in the whole system."

A worldwide auto parts bazaar

On the supply side, GM is joining with Ford and DaimlerChrysler to form a giant business-to-business exchange called Covisint that could save all three automakers billions of dollars in parts costs by opening up the supplier business to an online auction.

University of Michigan auto expert David Cole describes GM's drive into cyberspace as a "real game changer."

"It's sort of a critical ingredient," Cole said. "It's like when you mix eight or 10 chemicals and nothing happens. Then you drop this in and all of a sudden, boom, you get an explosion."

If so, then the new GM may look very different than the old GM. Given the fact that the company currently trades at only 7 times earnings, versus 25 times for the S&P 500 index, that could make some people wonder if corporate raider Carl Icahn, who recently announced plans to acquire up to 15 percent of GM, knows something the rest of Wall Street doesn't.

-- Click here to send email to Jerry Dubrowski.

|