|

Fixed-rate mortgage shines

|

|

August 25, 2000: 10:10 a.m. ET

Recent data shows fix-rate mortgage is home buyer's best bet now

By Greg McBride

|

NEW YORK (Bankrate) - An interesting convergence is taking place between fixed-rate mortgages and adjustable-rate mortgages -- one that has significance for consumers looking to buy a home in the coming months.

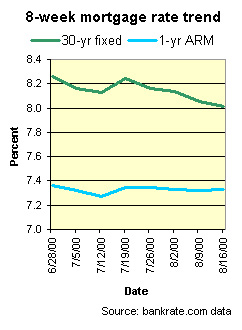

Over the past eight weeks, 30-year fixed-rate mortgages have fallen 25-basis points, while the 1-year adjustable rate mortgage (ARM) is largely unchanged. A basis point is one one-hundredth of a percent.

It's easy to see the reason the rates are moving differently: They're moved by different underlying forces.

The benchmark for fixed mortgages, the 10-year Treasury, has seen yields decline 24 basis points over the preceding eight weeks. But the benchmarks for ARMs are mixed -- the 1-year Treasury is virtually unchanged over the past eight weeks but other Cost of Funds measures used by some lenders continue to show increases each month. The benchmark for fixed mortgages, the 10-year Treasury, has seen yields decline 24 basis points over the preceding eight weeks. But the benchmarks for ARMs are mixed -- the 1-year Treasury is virtually unchanged over the past eight weeks but other Cost of Funds measures used by some lenders continue to show increases each month.

Thus, the spread between fixed and adjustable rates continues to narrow. In bankrate.com's Aug. 16 national survey, the average for 30-year fixed rate mortgages fell to 8.01 percent, while the 1-year ARM rose slightly and stood at 7.33 percent.

As fixed mortgage rates continue to fall, borrowers have the best opportunity yet this year to lock in. Adjustable-rate mortgages do not currently provide a rate low enough relative to fixed mortgages that would compensate for the risk of higher rates in the future.

Unless the borrower is reasonably certain of only being in the home a few years, a fixed-rate mortgage is a safer bet.

For the borrower looking to trade up to a larger home a few years from now, hybrid ARMs (such as the 3/1, 5/1, 7/1 ARM) are still a fine choice. Just be sure to get a mortgage that is fixed for the period of time you expect to be in the home.

- by Bankrate.com for CNNfn.com

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|