|

Paris leads Europe charge

|

|

August 25, 2000: 1:23 p.m. ET

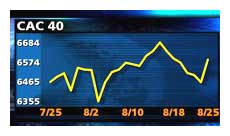

Defense, telecom gains drive CAC higher as techs lift Frankfurt, London indexes

|

LONDON (CNNfn) - Europe's markets ended on a high note Friday with Paris leading the way, jumping more than 2 percent behind a rebound for telecom sector stocks and newfound investor attention on the defense sector. Technology stocks lifted the benchmark indexes in London and Frankfurt.

In Paris, the CAC 40 index closed up 133.18 points, or 2.1 percent, to 6,595.11, with aircraft manufacturer EADS (PEAD), whose shares recently went public, soared about 11 percent after a brokerage raised its recommendation on aerospace-related shares.  A 3.9-percent gain for index heavyweight France Telecom (PFTE) was responsible for about 30 points of the CAC gain. A 3.9-percent gain for index heavyweight France Telecom (PFTE) was responsible for about 30 points of the CAC gain.

London's bellwether FTSE 100 index ended up 6.7 points, or 0.1 percent, to 6,563.7, with Logica (LOG), a software consultant, rising 5.6 percent.

Frankfurt's Xetra Dax rose 76.91, or 1.06 percent, to 7,307.17, as index heavyweight Siemens (FSAP) jumped 3.1 percent and electronic component maker Epcos (FEPC), a Siemens subsidiary, up 5.7 percent.

For the week, the key indexes were little changed: the FTSE 100 was up 0.3 percent, while the CAC 40, despite the gain Friday, was up less than 0.1 percent since a week ago Friday.

Among other major markets Friday, Zurich's SMI index closed down 0.5 percent, Italy's MIB30 added 1 percent and the AEX index in Amsterdam dropped 0.7 percent.

The pan-European FTSE Eurotop 300, a broad index of the region's largest stocks, climbed 0.3 percent, with its computer service sub-index rising more than 2.5 percent and its electronics components sub-index rising 2.1 percent.

Trading on Wall Street was mixed as the bourses closed. The Nasdaq composite index was down 0.1 percent, after rising for the ninth time in the past 10 sessions Thursday, while the Dow Jones industrial average rose 0.1 percent.

In the currency market, the euro was little changed at 90.24 U.S. cents.

"There's no sign of recovery for the euro," Neil Parker, an economist at Royal Bank of Scotland, said. "There's not much the European Central Bank can do with strong oil prices and a weak euro adding inflationary pressure. It has prepared the market for a rate rise next Thursday -- we expect 25 basis points."

A tech revival

In London, telecom and technology stocks rose, with the benchmark index's biggest component Vodafone AirTouch (VOD) up 2.3 percent, but on a slide was Cable & Wireless (CW-) fell 2.7 percent.

Media shares fell in London. Carlton Communications (CCM) and cable company Telewest Communications (TWT) dropped 3.6 percent each.

In Europe's software and computer services sector, Sema Group (SEM) and CMG (CMG) each rose 3.6 percent in London while France's Cap Gemini (PCAP), a computer consulting firm, climbed 3.5 percent in Paris. Europe's biggest software house SAP (SAP) rallied 3.2 percent in Frankfurt.

Aero engine maker Rolls-Royce (RR-) rose 3.2 percent, regaining a sliver of its heavy 22-percent loss Thursday after warning its earnings next year would be flat.

Mining and metals company Billiton [LSE:BLT ] fell 3.3 percent after Canadian copper miner Rio Algom (ROM: Research, Estimates) accepted its C$1.7 billion ($1.1 billion) buyout offer.

Aerospace flies high in Paris

In Paris, defense and media firm Lagardère (LMMB), which owns 15 percent of EADS, rose 5.8 percent. Credit Suisse First Boston analyst Pierre Chao increased his rating on aerospace suppliers to "overweight" from "market weight", citing a boom in orders of commercial airplanes.

However, Britain's BAE Systems (BA-), which owns 20 percent of Airbus Industrie, fell 2.1 percent in London.

In the telecom sector, data network operator Equant (PEQU) climbed 2.8 percent and telecom equipment company Alcatel (PCGE) rose 4.4 percent.

In Germany, mobile phone operator Debitel (FDBL) rose 7.6 percent after analysts told Reuters rival Mobilcom's Chief Executive Gerhard Schmid discussed the possibility of buying Debitel at an analysts' presentation in Frankfurt. Mobilcom (AMOB) rose 0.1 percent.

Swisscom, which own 74 percent of Debitel, rose 0.4 percent in Zurich. The Swiss telecommunications company announced it would reorganize itself into a series of independent operating units by 2001, giving its mobile-phone division its own corporate structure.

Deutsche Telekom (FDTE) rose 2.4 percent in Frankfurt.

In Italy, telecom stocks extended Thursday's recovery from recent losses sparked by fears about third-generation mobile phone licenses prices. The Italian government is expected to raise as much as $28 billion from the sale of five permits, in an auction that's set to end in November.

Telecom Italia rose 4.6 percent while Internet partner Seat added 2.2 percent, extending Thursday's 6 percent gain after it cleared the final obstacle in its merger with Telecom Italia's Tin.it unit.

-- from staff and wire reports

|

|

|

|

|

|

|