NEW YORK (CNNfn) - As Wall Street looks ahead to another slow and unpredictable week, one thing remains clear: the stock market is having a very hot summer.

Sure, the major market indexes are flat for the year, but measuring from Memorial Day to last Friday, one week ahead of Labor Day, the Nasdaq composite index is up 26 percent. Other major indexes are also higher.

In the days ahead - all packed with a thick calendar of economic indicators -- analysts are cautiously optimistic that more evidence of cooling growth will continue supporting stocks amid the widely-held belief that the Federal Reserve won't raise interest rates any time soon.

"Do not expect much stock market activity in the unofficial last week of summer unless new data cause investors to alter their relatively optimistic outlook for economic growth, inflation and interest rates for the balance of the year," Bank of America said in a not to clients Friday. "Do not expect much stock market activity in the unofficial last week of summer unless new data cause investors to alter their relatively optimistic outlook for economic growth, inflation and interest rates for the balance of the year," Bank of America said in a not to clients Friday.

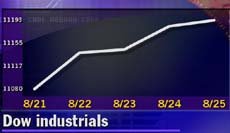

Last week was light but positive, with all major indexes gaining for the fourth straight week. The Nasdaq closed at 4,042.68, up 2.8 percent on the week. The Dow Jones industrial average finished at 11,192.63, up 1.3 percent over the last five sessions and the S&P 500 ended at 1,506.46, 1 percent higher on the week.

More than a dozen economic reports hit the market in the days ahead. But

August's payroll numbers due Friday should get most of the attention.

In the Labor Department report, the nation's unemployment rate is expected to hold steady at 4 percent, according to analysts surveyed by Briefing.com. The number of payrolls are expected to fall by 10,000 in August, a further sign that higher interest rates are slowing the economy's growth. In the Labor Department report, the nation's unemployment rate is expected to hold steady at 4 percent, according to analysts surveyed by Briefing.com. The number of payrolls are expected to fall by 10,000 in August, a further sign that higher interest rates are slowing the economy's growth.

The Federal Reserve, the nation's central bank, has raised borrowing costs six times since June, 1999. However, during the last two meetings, the central bank has decided to keep rates unchanged.

In the jobs report's final key component, average hourly earnings, a measure of wage inflation, are expected to rise a tame 0.3 percent.

Later Friday, the National Association of Purchasing Manager's index of manufacturing is due. The gauge is expected to rise to 52.5 in August from 51.8 the previous month, but will still be below year-ago levels.

July's personal income and spending figures come Monday. Personal income is forecast to have gained 0.3 percent following a 0.4 percent jump in June. Consumer confidence for August is due Tuesday. The gauge is seen slipping to 141.5 from 141.7 in July. July factory orders on Thursday, meanwhile, are forecast to have slipped 3 percent after a 4.5 percent gain in June.

Kathleen Stephansen, analyst at Donaldson, Lufkin & Jenrette, said the figures, taken in their entirety, should support the notion that the economy is cooling.

"The numbers will continue the trend of moderation but not further weakening of the trend," Stephansen said.

"You don't have many reports between here and October that will change the profile of the economy," she said. "The Fed is on hold until the November 15 meeting."

The Federal Reserve on Tuesday left interest rates unchanged for the second straight meeting. While stocks reacted favorably to that decision, trading volume has been light.

"You can see that investors really want to buy this market," said Charles Payne, head analyst at Wall Street Strategies. "But one of the things we have going against us is we are going into September and October, which are traditionally bad months for the market."

Decimals are coming

In one development that will be closely watched, the New York Stock Exchange on Monday will start quoting seven stocks in decimals. The exchange, along with the Nasdaq stock market, expects to convert entirely to decimals next year. Investor advocates applaud the move, saying it could bring better prices. But some traders fret that the narrowing of the spread between a stock's bid and ask price will mean lower commissions, driving some out of business.

The first stocks to be decimalized are Anadarko Petroleum Corp. (APC: Research, Estimates), FedEx Corp. (FDX: Research, Estimates), Forest City Enterprises Inc. Class A shares (FCE.A: Research, Estimates), Forest City Enterprises Inc. Class B shares (FCE.B: Research, Estimates), Gateway Inc. (GTW: Research, Estimates), Hughes Supply Inc. (HUG: Research, Estimates) and MSC.Software Corp. (MNS: Research, Estimates).

Profit reports tickle to near-halt

Earnings are sparse in the days ahead. Among the companies reporting, Neiman-Marcus (NMG: Research, Estimates), the high-end retailer, Thursday is expected to earn 17 cents per share in its fourth quarter, up from 6 cents in the year-ago period. Also Thursday, Jeweler Zale Corp. (ZLC: Research, Estimates) is forecast to post a profit of 29 cents a share from 23 cents a year ago. Earlier this month the largest U.S. specialty jewelry retailer announced plans to buy Piercing Pagoda Inc., a seller of low-priced earrings, for about $192 million in cash.

Few earnings reports also mean no high-profile negative reports. This, coupled with the belief the Fed is done raising borrowing cost for a while, is positive for the markets, said Barry Hyman, chief market strategist with Ehrenkrantz King Nussbaum. "Without having any economic numbers to hurt the market or earnings to hurt the market, the market should continue higher."

|