|

Foster's buys Beringer

|

|

August 28, 2000: 8:24 p.m. ET

Australian brewer and wine maker snags Beringer for $1.2 billion in cash

|

NEW YORK (CNNfn) - Beringer Wine Estates, one of the oldest wineries in California's Napa Valley, agreed Monday to be bought by Australian brewer and wine maker Foster's Brewing Group Ltd. for roughly $1.2 billion in cash.

Under the terms of a definitive agreement -- which the two companies reported after the close of trading Monday -- Foster's said it will purchase all of Beringer's outstanding shares for $55.75 per share in cash.

Additionally, Foster's said it will assume all of Beringer's outstanding debt, roughly $320.4 million, bringing the total value of the transaction to about $1.5 billion.

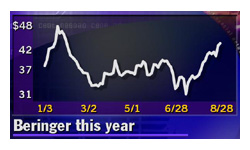

Beringer (BERW: Research, Estimates) shares ended Monday's session up $1.56 at $45.06. At that level, Foster's offer reflects a 23 percent premium. The transaction has been approved by the boards of directors of both companies.

Foster's is a leading premium global beverage company, which sells many of Australia's most famous beers, including Foster's Lager and Victoria Bitter. Its international wine business, Mildara Blass, is the leading premium wine producer in Australia. Foster's is a leading premium global beverage company, which sells many of Australia's most famous beers, including Foster's Lager and Victoria Bitter. Its international wine business, Mildara Blass, is the leading premium wine producer in Australia.

Beringer is a market leader in the California premium wine industry, comprising six wineries and more than 10,200 acres of vineyard land. The company also markets a portfolio of premium brands from Italy, France and Chile.

Ted Kunkel, Foster's president and chief executive, characterized the deal as "a defining event" for the company.

"We searched the world for a suitable wine acquisition and Beringer ... was the absolute stand out," Kunkel said in a statement. "It is a first-class company, which has a strong track record due to the quality of its assets and management's expertise in brand building and marketing."

Under the terms of the agreement, Beringer will become a wholly owned subsidiary of Foster's. Its senior management and organizational structure will remain unchanged, with business as usual, the companies said.

Beringer is majority owned by the Texas Pacific Group, a private investment partnership with capital of approximately $7 billion.

|

|

|

|

|

|

|