|

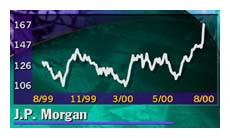

J.P. Morgan soars again

|

|

August 31, 2000: 5:44 p.m. ET

Investment bank's stock jumps for second straight day on merger rumors

|

NEW YORK (CNNfn) - J.P. Morgan shares continued their meteoric climb Thursday as investors targeted the New York investment bank as the sector's most likely acquisition candidate now that Donaldson, Lufkin & Jenrette has found a suitor.

J.P. Morgan's (JPM: Research, Estimates) stock soared $15.12, or 10 percent, to $167 Thursday, setting a new 52-week high by more than $12. Since the close of trading Monday, before rumor of DLJ's merger hit the Street, investors have increased the value of J.P. Morgan shares by nearly 14 percent.

A J.P. Morgan spokesperson declined to comment on the stock's activity, saying "we are declining to comment on news of a takeover or purchase."

But the speculation has been fueled in part by a series of analyst reports the last two days that have named the company as the most attractive takeover target remaining in a fast consolidating industry. Credit Suisse First Boston's $11.5 billion purchase of DLJ (DLJ: Research, Estimates) Wednesday followed UBS' $12 billion acquisition of PaineWebber in July.

The most frequently mentioned suitor for J.P. Morgan in Wall Street circles Thursday was Chase Manhattan Corp. (CMB: Research, Estimates). The most frequently mentioned suitor for J.P. Morgan in Wall Street circles Thursday was Chase Manhattan Corp. (CMB: Research, Estimates).

Chase has aggressively pursued investment banking partners in the past, most notably last year's failed courtship of Merrill Lynch (MER: Research, Estimates), the No. 1 U.S. brokerage ranked by total revenues.

While it ranks among the country's largest commercial banks, Chase has struggled to build a leading investment banking platform on a global scale. Nearly half of J.P. Morgan's sales are generated outside the United States and the company boasts a strong platform in Europe.

"The deal that would make the most sense for [Chase] is a combination with J.P. Morgan," said Ronald Mandle, an analyst with Stanford Bernstein, in a report issued Thursday. "Such a deal would substantially boost the capital markets presence of the combined company in equities, high yield, M&A and emerging markets."

Mandle notes the combined company would have assets under management of $675 billion, ranking it second in the United States after State Street. He also said Chase could pay up to roughly $178 per share for J.P. Morgan without hurting its earnings stream.

"Chase management continues to show its disciplined approach to capital management by the deals it has not done," he said. "The three primary factors the company looks at in a potential transaction are the property, the price and ease of fitting the companies together.

"J.P. Morgan potentially meets these criteria very well."

Merrill Lynch analyst Judah Kraushaar agreed that J.P. Morgan remains the industry's most attractive takeover target and in a research note Wednesday projected a franchise value for the company of up to $250 per share.

Using the same three-times book value that PaineWebber and DLJ were both able to garner, J.P. Morgan's acquisition value would be more in the $183 per share range, although Kraushaar argued the company's asset management franchise "argues for a higher worth."

Still, Chase at least has been down this road before. The New York bank was widely rumored to have approached nearly every large investment bank on Wall Street, including J.P. Morgan, two winters ago -- even offering to cede control of the company in a merger -- only to be rebuffed.

But with companies such as Goldman Sachs & Co. (GS: Research, Estimates), Morgan Stanley, UBS (UBS: Research, Estimates) and now Credit Suisse set up to compete on a global scale, analysts believe all parties are probably reevaluating their positions.

|

|

|

|

|

|

|