|

Europe tracks Wall St. up

|

|

August 31, 2000: 1:24 p.m. ET

FTSE at 5-month high as techs, media stocks soar; Suez, TotalFina hit Paris

|

LONDON (CNNfn) - Europe's leading markets closed mostly higher Thursday, cheered by an expected quarter-point interest rate hike by the European Central Bank and solid early gains on Wall Street that sparked the latest rally for Europe's technology, media and telecom stocks.

The gains came after the monetary policy committee of the European Central Bank raised interest rates by 0.25 of a percentage point to 4.5 percent, in line with economists' forecasts, citing a recently weak euro and high oil prices.

London's benchmark FTSE 100 index rose 57.6 points, or 0.9 percent, to 6,672.7, its highest close since late March. Telecom, media and technology stocks accounted for the top 10 gainers, led by Colt Telecom (CLT) up soared 18.3 percent.

Frankfurt's Xetra Dax was up 48.02 points, or 0.6 percent to 7,230.45 in late afternoon trading, led by a 5.9-percent gain for electronics components maker Epcos (FEPC).

But the CAC 40 in Paris closed down 9.2 points, or 0.1 percent, to 6,625.42. Suez-Lyonnaise des Eaux (PLY) fell 4.5 percent to lead decliners, after a report said the water and electricity utility was close to an expected merger with Germany's E.ON (FEOA). E.ON fell 3.3 percent.

Among other European bourses, the MIB 30 index in Milan climbed 1.3 percent, led by a 5.1-percent gain for Internet portal and publisher Seat Pagine Gialle. The AEX index in Amsterdam rose 0.6 percent and the SMI in Zurich was little changed.

The pan-European FTSE Eurotop 300, a broad index of the region's largest stocks, rose 0.7 percent to 1,669.95, with its computer services component rising 3.3 percent and its information technology hardware sub-index up 3.6 percent.

U.S. stocks were moving strongly higher as the bourses closed. The Dow Jones industrial average was up 165 points, or 1.5 percent, to 11,268.01 while the Nasdaq composite index jumped 71.29 points, or 1.7 percent, to 4,175.10.

In the currency market, the euro slumped against the dollar despite the interest rate hike by the ECB. The euro briefly fell to a new record low against the dollar at 88.40 U.S. cents, surpassing the 88.45 hit in May. However, the currency rebounded slightly and it was recently quoted at 88.77 U.S. cents. The currency is now down about 24 percent from its launch in January last year at about $1.17.

"The decision was no big surprise. What they have tried to do is achieve a balance between addressing creeping inflation and not jeopardizing economic recovery," Jeremy Hawkins, an economist at the Bank of America, said.

"Net-net, it won't have much effect as money rates have already adjusted to the rise, but it will lead speculators to anticipate the next rise."

Telecoms, media, techs back in vogue

London saw a feeding frenzy on "new economy" stocks. Chip designer ARM Holdings (ARM) rocketed 10.1 percent, fiber-optic component maker Bookham Technology (BHM) added 7.1 percent and Internet service provider Freeserve (FRE) rose almost 13 percent as it sprang back from heavy selling earlier in the week.

Among media shares in London, shares of cable company Telewest Communications (TWT) soared 15.1 percent and among publishers, Pearson (PSON) rose 6.4 percent and United News & Media (UNWS) jumped 5.7 percent.

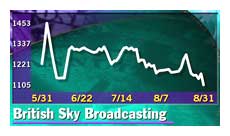

But while other media shares rallied in London, British Sky Broadcasting (BSY) fell 4 percent. Germany's KirchPayTV said it sold its 3.1 percent stake in the U.K. pay-TV service provider to Credit Suisse First Boston and Goldman Sachs. But while other media shares rallied in London, British Sky Broadcasting (BSY) fell 4 percent. Germany's KirchPayTV said it sold its 3.1 percent stake in the U.K. pay-TV service provider to Credit Suisse First Boston and Goldman Sachs.

Outside of the FTSE 100, shares of financial software maker QSP Group (QSP) plunged 22 percent after citing a "dull" first quarter and warning its results for the year through the end of 2000 would come in below market expectations.

The high tide in techs, telecom and media stocks also swept through Paris and Frankfurt. French broadcaster TF1 (PTFI) rose 4.2 percent. Daily business newspaper Les Echos said the channel had acquired the rights to the popular U.S. television program "Survivor."

Network operator Equant (PEQU) rose 3 percent, missiles and media firm Lagardere (PMMB) added 2.9 percent and computer consultant Cap Gemini (PCAP) added 2.6 percent.

In Frankfurt, Europe's top software company SAP (FSAP) tacked on 4.8 percent - contributing 31 points to the Dax gain - while the technology heavyweight Siemens (FSIE) climbed 2.9 percent, adding another 23 points to the index.

T-Online International (ATOI) blasted up 6.7 percent after Europe's largest Internet service provider reported first-half revenue nearly doubled to  353 million ($315.5 million). 353 million ($315.5 million).

Outside the high-flying new economy sector, in Paris, retailer Carrefour (PCA) jumped 6.1 percent after the company posted a 10.7 percent rise in first-half net profit excluding one-time items, and reaffirmed its target for 20 percent growth over the full year.

Franco-German life sciences group Aventis (PAVE) gained 3.1 percent after it posted a 61 percent jump in first-half net profit. Analysts polled by Reuters had bet on profit growth of between 31 and 59 percent.

French oil powerhouse TotalFina Elf (PFP) dropped 3.7 percent after speculation mounted that the French government might tax the corporate profits of French oil firms to fund a cut in the fuel tax. That came after French fishermen ended a three-day blockade of French ports on the English Channel in protest of high fuel prices.

TotalFina Elf also declined comment Thursday on a decision by the Belgian government not to renew a supply contract due to the company's presence in Myanmar, whose government has been criticized for being a dictatorship.

Among French financial stocks, insurer AGF (PAGF) fell 2.8 percent, rival Axa (PCS) dipped 2.6 percent, bank BNP Paribas (PBNP) dropped 0.7 percent and Crédit Lyonnais (PCL) slipped 1.3 percent.

Germany's Munich Re (FMUBV) dropped 1.7 percent while fellow insurer Allianz (FALV) dipped 0.9 percent. A rise in interest rates can crimp profits at financial firms due to the delay in passing on higher borrowing costs to customers.

-- from staff and wire reports

|

|

|

|

|

|

|