SAN FRANCISCO (www.redherring.com) - Baltimore Technologies, an Ireland-based Internet security firm, was quick to deny rumors that U.S computer giant Microsoft was considering a takeover bid.

But like many rumors, this one on Tuesday revealed certain truths. In this case, the gossip shed light on the hustle to establish a standard in the online security industry, one of the fastest growth areas of Internet security for Net transactions is becoming more important.

Recent studies have shown that concerns about online security are undermining the trust between companies and trading partners, as well as between online retailers and consumers. Moreover, laws recently passed in both the United States and Europe that render electronic signatures in online contracts legally enforceable increase the demand.

"The marketplace is forcing a solution," said Peter Sealey, professor at the Haas School of Business at the University of California, Berkeley. "What companies that deal in online security are discovering is that they need a robust solution. Some niche players may survive. But the industry needs a standard. The winner who establishes that standard will control half the market."

Consolidation coming

To that end, many of the hundred or so players are consolidating in an attempt to expand their portfolios of online security options. Small players are merging with each other, while bigger companies are swallowing their inferiors. Even software and system management vendors are entering the online security market by buying niche companies in order to bring online security in-house.

Currently, there are dozens of specialist Internet security companies, including Baltimore Technologies and Entrust. Big tech players like Cisco Systems, Novell, Nortel Networks, IBM, and Hewlett-Packard also offer security products and services as part of an overall package. To add to that, companies such as Logica and Andersen Consulting offer security services such as consulting and systems integration. Currently, there are dozens of specialist Internet security companies, including Baltimore Technologies and Entrust. Big tech players like Cisco Systems, Novell, Nortel Networks, IBM, and Hewlett-Packard also offer security products and services as part of an overall package. To add to that, companies such as Logica and Andersen Consulting offer security services such as consulting and systems integration.

"There is a broad universe of online security companies, and a lot of them are complementary and make good acquisition partners," said David Hilal, analyst at Friedman, Billings, Ramsey. As an example, Mr. Hilal cited the recent acquisition of Axent Technologies, a provider of e-security solutions, by competitor Symantec. Since little overlap exists between the two companies, their merger widens the reach of each. "Symantec is more consumer oriented and is one of the leaders in antiviral technology, whereas Axent is more enterprise focused," Mr. Hilal said. According to him, the winner in this industry will be the company that offers the most solutions. Since a hacker's ability to attack companies is increasing as quickly as technology is advancing, "vendors that offer the broadest solution will win," Mr. Hilal said. "Companies can't just target one problem."

Other analysts believe that niche companies can achieve a standard by leveraging their core products across various platforms.

Verisign dominates the market

Choosing the broad-based solution strategy, Verisign is by far the current leader in online security. The company has a $37 billion market capitalization, which far exceeds the market capitalization of competitors Baltimore Technologies, with $4.3 billion, and Entrust, with $1.6 billion.

Verisign has a far more diversified product line than these smaller companies. Its strategy is to provide a broad online-commerce solution, including not only security, but also payment and Web site solutions. Recent acquisitions of Signio, an Internet payment platform, and Network Solutions, a provider of domain-name infrastructure and registration services, pushed Verisign into a wider market. Verisign has a far more diversified product line than these smaller companies. Its strategy is to provide a broad online-commerce solution, including not only security, but also payment and Web site solutions. Recent acquisitions of Signio, an Internet payment platform, and Network Solutions, a provider of domain-name infrastructure and registration services, pushed Verisign into a wider market.

The company's core business, however, is authentication services, which include digital certificate and managed public-key infrastructure (PKI) services. Such services encrypt data that can be sent through cyberspace, while also providing the receiver with a key to unlock it.

In its second-quarter filings with the Securities and Exchange Commission, Verisign reported sales of 64,000 digital certificates, or a 137 percent increase from the same period last year, and 200 new customers, including BP Amoco and Reuters.

Verisign also has increased its reach internationally, by recently adding five affiliates: Telefonica in Spain, Bigon in Poland, Comsign in Israel, Cybersign in Malaysia, and IT Trust in Egypt. Aggressively entering the burgeoning broadband and wireless markets, Verisign recently introduced new technologies that will allow its customers to access private information and execute secure transactions from virtually any Internet-enabled device.

"Verisign has chosen an outsource model," said Mark Fernandes, an analyst at Merrill Lynch. "They have a large data center and pulled in different services. Because of this business model, the company can add a lot of functionality."

Smaller fish try not to get swallowed

In order to keep their customers from going to competitors who offer a broader range of online security services, Baltimore Technologies and Entrust have made acquisitions recently to broaden their portfolios, while maintaining a strong focus on their core product, PKI. They are mimicking Verisign, but on a smaller scale.

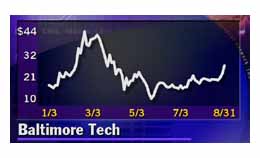

Baltimore Technologies strengthened its United States and international presence through its acquisitions of GTE Cyber Trust Solutions, a PKI provider, and Japanese online security provider NSJ Corporation. Baltimore Technologies also has partnerships with Andersen Consulting, Compaq, Hewlett-Packard, Sony, EDS, and Unisys. The company reported revenue of $24.6 million in the second quarter, a 72 percent increase from the first quarter and a 221 percent gain from the second quarter of 1999.

Although Baltimore Technologies is expected to lose money this year and in 2001, its revenues are growing much faster than those of its major competitor, Entrust, which has struggled since warning in July that second-quarter earnings would be much lower than expected. Entrust reported flat revenue growth in the second quarter as compared to the first quarter, and a 48 percent increase in revenue from the first quarter of 1999.

The main difference between Baltimore Technologies' current success and Entrust's recent woes is execution. Both companies are expanding in the international and wireless arenas. But Baltimore Technologies is a smaller company than Entrust in terms of sales in PKI. The former only sells security systems when a company is ready for a full deployment of an application, whereas Entrust gains customers through pilots, counting on a certain number of those clients to migrate to larger implementations. This quarter, however, Entrust didn't see enough of those migrations. The main difference between Baltimore Technologies' current success and Entrust's recent woes is execution. Both companies are expanding in the international and wireless arenas. But Baltimore Technologies is a smaller company than Entrust in terms of sales in PKI. The former only sells security systems when a company is ready for a full deployment of an application, whereas Entrust gains customers through pilots, counting on a certain number of those clients to migrate to larger implementations. This quarter, however, Entrust didn't see enough of those migrations.

"Even if Baltimore's growth slows down, they won't be affected as acutely as Entrust," said Howard Smith, analyst at First Analysis. "When you go off a smaller base, it's easier to hit the number."

A number of class action suits also dog Entrust. One alleges that Entrust's representations on second-quarter earnings artificially inflated the price of its stock, which in turn enabled the company to complete its acquisition of enCommerce, a Web security software company that provides authentication for selective access control to intranet/extranet Web-enabled resources.

"Entrust is one of the companies today that has a very specialized solution and has yet to broaden its portfolio," said Mr. Hilal. "It's ripe for acquisition."

But most analysts return to Verisign when recommending a solid long-term investment opportunity, even though much of the optimism is already factored in the stock price.

"Verisign is the highest quality company," said Mr. Howard. "But today's valuation reflects a lot of positive sentiment and not the risks inherent in technology over the next few years."

That may be true. But the beauty of having such a richly valued stock is that companies can easily use the shares to buy other companies. So look for Verisign to keep making purchases in order to solidify its leadership position in what is still a fragmented market.

Discuss tech news and trends in the Tech Trends Spotlight discussion forum, or check out forums, video, and events at the home page.

|