|

WorldCom buys Intermedia

|

|

September 5, 2000: 4:35 p.m. ET

Telecom provider buys local carrier and its stake in Web hosting firm Digex

|

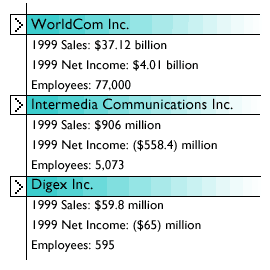

NEW YORK (CNNfn) - Following its commitment to pursue new growth along the digital band, WorldCom Inc. struck a deal Tuesday to acquire fast-growing communications company Intermedia Communications Inc. for nearly $3 billion in stock, significantly expanding its Web hosting capabilities.

Critical to the agreement from Worldcom's perspective was obtaining Intermedia's controlling stake in Web services firm Digex Inc., a leading corporate provider of Web and application hosting services to mid- and large-sized companies.

The acquisition will give Worldcom a 55 percent equity stake in Digex (DIGX: Research, Estimates) and a 94 percent voting interest. WorldCom (WCOM: Research, Estimates) will also assume more than $3 billion in Intermedia debt.

"With this merger, WorldCom accelerates by 12-to-18 months our ability to provide world-class managed Web and application hosting services -- one of the highest growth markets in the industry," said WorldCom President and CEO Bernard J. Ebbers.

The merger values Tampa, Fla.-based Intermedia (ICIX: Research, Estimates) at $39 per share, a 70 percent premium to the stock's closing price on Friday. WorldCom's bid topped a $22-per-share offer by rival Global Crossing Ltd. (GBLX: Research, Estimates), a Bermuda-based provider of fiber-optic networks.

Control of Digex enables WorldCom to expand its Web hosting services, giving it a much stronger presence in high-end managed hosting for businesses, as part of the company's "generation d" plan to expand its traditional telephone services to include the Internet.

Mel Marten, telecom analyst with Edward Jones said WorldCom is shifting away from consumers and more towards business service. (426K WAV or 426K AIFF)

In a conference call with reporters, Ebbers said that at present WorldCom basically only rents space for Web hosting through UUNet, which operates the telecom company's current Internet backbone capabilities. The acquisition of Digex gives the company the ability to step into managed hosting, he said. In a conference call with reporters, Ebbers said that at present WorldCom basically only rents space for Web hosting through UUNet, which operates the telecom company's current Internet backbone capabilities. The acquisition of Digex gives the company the ability to step into managed hosting, he said.

The scope of WorldCom's UUNet capability will give Digex the opportunity to get into large content management, from which it had previously shied away, he said.

Intermedia up, but Digex stumbles

Shares of Intermedia jumped 38 percent on the news, rising $8.59 to $31.47, but shares of Digex dropped nearly 20 percent, falling $16.62 to $67.88. Shares of WorldCom fell $3.19 to $33.75.

Analysts said Digex shares were hurt by indications that Worldcom was not planning to bid on the remaining Digex shares it would not already own through the Intermedia acquisition.

Digex, which has been on the block since July, could have commanded a large premium if WorldCom had gone in for the entire company, analysts said. The company carries a market capitalization of nearly $5.4 billion.

"I think there may have been expectations that WorldCom would buy all of Digex rather than just Intermedia's stake," said Michael Turits, analyst with Prudential Securities. "People buying on that expectation may be disappointed."

"There isn't any reason for them to go out and buy the rest (of Digex), especially because Digex isn't profitable yet," Edward Jones' Marten said. "So WorldCom can consolidate the stock that it does own and still really control that business."

Ebbers said buying Intermedia rather than carving out Digex enabled WorldCom to pay a lower multiple.

Turits said Prudential's price target for Digex is $112. He added one reason for WorldCom to keep the Digex stock public is to use the shares as currency for future transactions.

But Morgan Stanley cut its rating on Digex to "outperform" from "strong buy" without additional comment.

WorldCom challenges for Web hosting leadership

WorldCom will exchange shares worth $39 a piece for each outstanding share of Intermedia. The exact exchange ratio will be determined before closing, but will not exceed 1.1872 if WorldCom's average share price falls below $32.85 or drop under 0.8904 if the average share price rises above $43.80. Also, if the exchange rate is greater than 1.0685, WorldCom may decide to pay the difference in cash rather than additional stock.

The deal is Worldcom's first since its proposed merger with Kansas City, Mo.-based Sprint Corp. (FON: Research, Estimates) was dissolved due to antitrust concerns.

Bear Stearns, which acted as an advisor to Intermedia on the merger, said in an analysts' report the deal is "strategically sound" and with Digex, WorldCom "arguably becomes the leader in Web hosting."

WorldCom Chief Financial Officer Scott Sullivan said the transaction would dilute 2001 cash earnings per share by a percentage in the mid-single digits, or, in the worst case, lower teen digits.

Sullivan estimated 2001 earnings to be about $2.65 per share.

But Bear Stearns expected dilution of between 13 and 15 percent, and estimated lowering its earnings expectations to between $2.30 and $2.40.

Intermedia provides voice and data services to more than 90,000 business and government customers across the United States, and is listed as one of the nation's top independent competitive local exchange carriers. Intermedia offers local and long-distance service and offers Internet and data services through its 54 percent stake in Digex.

Merrill Lynch said in an analyst report the transactions represent the "best possible exit strategy for Intermedia, with UUNet's backbone providing significant cost synergies.

Beltsville, Md.-based Digex hosts Web sites and other Web-based applications for more than 550 customers, including large retailers such as J. Crew, automotive manufacturer Nissan and others. It operates two data centers in the United States and one in the United Kingdom.

|

|

|

|

|

|

WorldCom

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|