|

TotalFina profit soars 165%

|

|

September 6, 2000: 9:05 a.m. ET

French oil company cites strong dollar, crude prices for explosive gain

|

LONDON (CNNfn) - TotalFina Elf SA demonstrated Wednesday how stratospheric oil prices are inflating producers' profits, reporting first-half earnings before special items more than doubled as the leading French oil company matched analysts' forecasts.

Earnings excluding one-time items for the first six months of 2000 jumped 165 percent to  3.4 billion ($3 billion), or 4.83 European cents per share, from a pro forma figure of 3.4 billion ($3 billion), or 4.83 European cents per share, from a pro forma figure of  1.3 billion, or 1.83 cents a share, a year ago, assuming TotalFina had already completed its merger with Elf Aquitaine. 1.3 billion, or 1.83 cents a share, a year ago, assuming TotalFina had already completed its merger with Elf Aquitaine.

Analysts had expected the company profit of between  3.0 billion and 3.0 billion and  3.7 billion, a Reuters survey showed. 3.7 billion, a Reuters survey showed.

Sales jumped 162 percent from pro forma levels last year to  52.4 billion, and operating income nearly tripled to 52.4 billion, and operating income nearly tripled to  6.81 billion. 6.81 billion.

TotalFina Elf said that "changes to the economic environment" - such as a 13.5-percent increase of the U.S. dollar compared to the euro and the more than doubling of the average price of Brent crude oil prices -- accounted for a positive effect on operating earnings of  3.9 billion on the first half of 2000. 3.9 billion on the first half of 2000.

First-half operating income in the company's upstream business - oil exploration and production - soared 261 percent to $4.67 billion, more than that division's income in all of 1999. Those activities are especially subject to gains in oil prices.

In the downstream segment, which carries out oil refining and marketing, income rose 136 percent to  1.21 billion, thanks to the company's improvements in refining profit margins. 1.21 billion, thanks to the company's improvements in refining profit margins.

The price of Brent crude continued to rise Tuesday, topping $33 a barrel after hitting a new 10-year high.

Reports have said that the French government, which has faced crippling protests from truckers who are disgruntled by the rising oil prices, might call on TotalFina Elf to help defray the higher costs for French consumers.

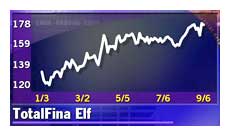

Shares of TotalFina Elf (PFP) shed 1 percent to  175.7 in Paris shortly after the earnings announcement. 175.7 in Paris shortly after the earnings announcement.

The results were "adequate", wrote Peter Hitchens, an analyst with Williams de Broe, in a research note published on Wednesday. He has a "buy" rating and a  117.50 price target on TotalFina Elf stock. He pointed out that this could be seen as disappointing, "given that most of the other integrated oil companies have come out at the top of, or above, the market range." 117.50 price target on TotalFina Elf stock. He pointed out that this could be seen as disappointing, "given that most of the other integrated oil companies have come out at the top of, or above, the market range."

Among rivals that have recently reported, Britain's BP Amoco topped analysts' targets with a 164-percent increase in its second-quarter profit, while Anglo-Dutch company Royal Dutch/Shell Group reported a 95 percent jump in second-quarter earnings last week.

|

|

|

|

|

|

TotalFina Elf

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|