|

FedEx in talks to go postal

|

|

September 7, 2000: 3:38 p.m. ET

Express package leader in talks with Postal Service about delivery alliance

By Staff Writer Chris Isidore

|

NEW YORK (CNNfn) - FedEx Corp. and the U.S. Postal Service are in negotiations about a strategic alliance that could include FedEx carrying priority and express mail and the Postal Service handling some of FedEx's lower-cost ground deliveries.

Officials with the Memphis, Tenn.-based express carrier had little comment on the talks, saying simply they were in discussions about "a broad range of strategy initiatives."

But in a telephone press conference, Postmaster General William Henderson said he's optimistic that the broad outlines of an agreement could be reached by the time the USPS board of governors meets Oct. 2 and 3. He said regular talks between postal service and FedEx officials have been taking place on a regular basis in both Memphis and Washington since he and Fred Smith, FedEx's founder and chairman, had initial discussions a few months ago. But in a telephone press conference, Postmaster General William Henderson said he's optimistic that the broad outlines of an agreement could be reached by the time the USPS board of governors meets Oct. 2 and 3. He said regular talks between postal service and FedEx officials have been taking place on a regular basis in both Memphis and Washington since he and Fred Smith, FedEx's founder and chairman, had initial discussions a few months ago.

"We decided it was in our best interests to go ahead and talk about broad parameters," Henderson said. "The devil is in the details. But we think FedEx is an excellent company, and they could provide some excellent help for us."

Henderson said the post office would not be involved delivering any of FedEx's core overnight or two-day packages, which include delivery guarantees. Instead it is looking at a possibly getting involved in the company's growing efforts at home delivery of deferred packages that take up to five days to arrive. FedEx only reaches about half of the nation's home with that product today, and doesn't anticipate reaching nationwide coverage until 2002.

FedEx is slated to invest $42 million in expansion of this home delivery product during the current fiscal year, and another $11.3 million during the fiscal year ending in May, 2002.

Such packages are of growing importance with consumer purchases on the Internet, as many of those customers want low-cost delivery of those goods, but want to be able to track the progress of the product. UPS handles a majority of those packages currently, according to market surveys.

Among the other items being discussed would be allowing FedEx to deliver to post office boxes for the first time, as well as having FedEx pick-up and delivery boxes at postal facilities. Among the other items being discussed would be allowing FedEx to deliver to post office boxes for the first time, as well as having FedEx pick-up and delivery boxes at postal facilities.

Henderson said he's confident that any agreement would be legal under existing postal law, but acknowledged there would probably be fierce opposition from competitors such as United Parcel Service (UPS: Research, Estimates).

Tad Segal, spokesman for UPS's Washington office, confirmed his company's opposition to any possible deal. He questioned whether an agreement would ever receive necessary approval.

"This is far from a done deal. Congress is going to look at this. The General Accounting office is going to look at this," he said, adding that he believes federal antitrust officials would also get involved in examining any deal. "At the moment this appears more like pie in sky than rubber meets the road."

Analysts spoke excitedly about the potential of such a deal, though, especially as it shows a change in FedEx thinking. The company has always insisted on owning its own planes and other infrastructure as a way of guaranteeing its promised service levels, but some analysts believe it needs to be more willing to change that model.

"FedEx is looking for ways to reinvent itself," said Ed Wolfe, analyst with Bear Stearns. "This gives me some hope."

Still Wolfe and other analysts say the opposition to such a deal would be so formable, that they question whether such a deal will ever come to past. And the deal is not without risks for FedEx, some said.

"You're not going to get same delivery standard, and I doubt there would be confirmation of delivery," said Paul Schlesinger, analyst with Donaldson Lufkin and Jenrette. "A lot of the features of the service they'd have to give up, and there's serious risk of compromising the brand. Still, this could wind up being a good deal for them. Is it the stake in the heart for UPS? No, I don't �think so." "You're not going to get same delivery standard, and I doubt there would be confirmation of delivery," said Paul Schlesinger, analyst with Donaldson Lufkin and Jenrette. "A lot of the features of the service they'd have to give up, and there's serious risk of compromising the brand. Still, this could wind up being a good deal for them. Is it the stake in the heart for UPS? No, I don't �think so."

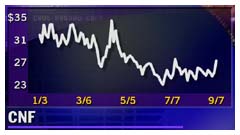

Even if FedEx only agreed to handle USPS's express and priority mail rather than turn over any of its packages, such a deal would pose some risks. Analysts point out the problems faced by CNF Inc. (CNF: Research, Estimates), which entered into a $1.8 billion contract in April 1997 to process priority mail at 10 East Coast hubs for the postal service through 2002 on an outsource basis.

The costs spiraled since the service started in 1998 and the company now estimates that it would need an additional $173 million just to break even on the contract, and it sued the postal service in April over the pact.

Henderson and company officials confirmed they are in negotiations for the company to try to terminate the contract.

"It (termination of the contract) is one of the things being discussed," said Nancy Colvert, spokeswoman for CNF. "The finances just don't seem to be working for them, and we can't continue to lose money at this rate."

Wolfe said he believes from his discussions that an end to the contract is near, although neither postal nor company officials would confirm that. Wolfe said he believes the CNF stock should rise if such a settlement is reached.

Shares of FedEx fell 62 cents to $39.65 in trading Thursday, while UPS shares fell $1.25 to $54.56. CNF shares rose $1.06 to $27.19.

-- Click here to send e-mail to Chris Isidore

|

|

|

|

|

|

|