|

College kid insurance 101

|

|

September 7, 2000: 6:05 a.m. ET

Property, health and auto coverage are the main subjects for parents to study

By Staff Writer Alex Frew McMillan

|

NEW YORK (CNNfn) - College kids today, honestly. It's not like it was back in the old days. With their new-fangled MP3 players, digital cameras and that darn BMW Z3, they're packing more than books as they head back to campus.

"The economy is good, and people are bringing more expensive toys, if you will," said Jeanne Salvatore, vice president of consumer affairs for the Insurance Information Institute, a trade group.

Laptops are required at many universities. Most college kids have more electronics than their counterparts five years ago. All those goodies mean there's more to look after. Which might mean there's more to insure.

In fact, 24 percent of college freshman have a laptop, 20 percent have a cell phone and 10 percent have a portable device like a Palm Pilot or a CD player, according to a release from the trade group Independent Insurance Agents of America. Throw in a nice set of Calloway clubs, and you're talking real money. In fact, 24 percent of college freshman have a laptop, 20 percent have a cell phone and 10 percent have a portable device like a Palm Pilot or a CD player, according to a release from the trade group Independent Insurance Agents of America. Throw in a nice set of Calloway clubs, and you're talking real money.

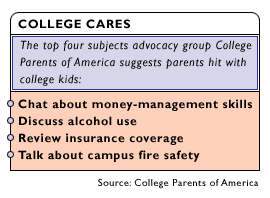

College Parents of America, an advocacy group that represents 200,000 families, recommends reviewing a college-bound kid's insurance. It is one of four main issues the group says parents should target. College-bound kids have other thoughts on their minds, and the policies are in the parents' control.

"This is one of many items that we ask parents to focus upon when they're sending the student back to school," said Richard Flaherty, the group's president. "Take a look at your insurance and make sure you're covered."

College kids often covered at first

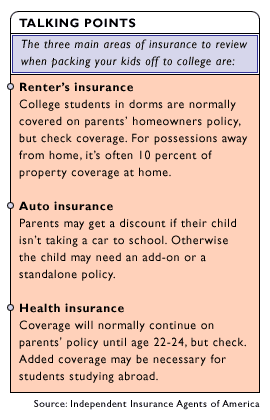

When freshman head to college, their possessions are nearly always covered by their parent's homeowners policy if they're living on campus, insurance experts say. If the parents don't own a home, the student will likely be covered by any renter's policies, too.

But check the coverage. "Some policies [cover] your possessions anywhere in the world," Salvatore said. But it is very common that a homeowner's or renter's policy gives you 10 percent of the coverage you have for possessions away from home - in a dorm, for instance.

In other words, if a homeowner has $50,000 in personal-property coverage at home, the child would be covered for up to $5,000 in property loss in a dorm. So a $2,000 loss would be covered, minus the deductible. But very expensive possessions might require a "floater" or add-on policy.

Caps for certain kinds of goods

Homeowner's and renter's policies often have limits on certain categories of goods. The amount claimable for jewelry and furs is often capped at $2,000 or less, for instance. Computer and electronic goods tend to be capped, too, at $5,000 or $10,000, Salvatore said.

Though that seems like a lot, "it doesn't sound like a weird scenario, quite frankly, for a family to own four computers," Salvatore said. Two computers at home and two with the kids at school can add up, and then there's the cost of software and so on.

So extra coverage may be in order there. "Things like jewelry, it might be quite honestly easier to leave that at home," Salvatore said. "Or put it in a safe-deposit box."

Living off-campus brings other issues

When a college student moves out of the dorms, he or she is considered to have his or her own residence. A standard renter's policy will cost between $150  and $300 a year, according to Salvatore. and $300 a year, according to Salvatore.

There's a chance the student may still be covered on the parents' homeowner's policy if they claim him or her as a dependent on their taxes, said Sharon Strama, an insurance agent with The Gibson Agency. But she recommends parents get a separate renter's policy anyway, for clarity's sake.

"It costs me more to write one than it's worth," she says. "But it's a buffer between you, and you getting sued." Besides property, the renter's policy will cover liability for damage from parties and pets or to the pizza man.

Such dramas - while popular in panicked parents' minds -- are few and far between. Strama said that she doesn't see very many claims on student renter's policies, and that they're mostly for theft when they come.

Medical insurance is next for a check up

Theft or damage aren't the only insurance issues when the "rats" switch rugs for frat parties.

College Parents of America reports that one in three adults between 18 and 24 has no health-insurance coverage. Nearly one in six college kids has no health insurance, per a 1997 study from College Parents of America and the independent insurance agents' group.

But most full-time students are covered by their parents' health insurance, assuming their parents have coverage. Student-health facilities often offer free treatment, particularly for minor ailments, too.

There are three main circumstances that mean a student is not eligible on his or her parents' plan.

Students are normally not covered if they switch to part-time status. The number of hours necessary to qualify as a full-time student will be defined in the policy. Taking time off to travel or work typically means "students" lose them their coverage, too.

Other disqualifying reasons

Even for full-time students, there is a cutoff age where kids no longer qualify on their parents' policy. That's typically 23. Again, check the policy.

And students may not be covered by their parents' policy if they study abroad. But if they are studying in Western Europe or another country with good health care, they may be covered by that system, particularly if it is a national health system, Bob Hunter, director of insurance for the Consumer Federation of America, pointed out.

Repatriation policies are available but often not worth it, even in undeveloped nations, Hunter said. Local contacts may know good health-care sources. If worst comes to worst, a sick student could visit an emergency room and fly back to the United States, Hunter said. Then they would be covered by their parent's policy.

"They love to sell you insurance you don't need - you don't need a lot of insurance for college," Hunter said. But he agreed it's worth checking the status of your policies.

So health insurance is probably worth a review. "Unfortunately, there's no norm with health insurance because it's changed so dramatically," Salvatore said. She recommends that parents check with their employer's benefits staff or whatever company sold them their health policy.

Cars come next

The last main area to consider when sending your kid off to college is auto insurance. This can in fact amount to good news for parents. If they are sending a son or daughter to college without a car, they may well qualify for a reduced rate on their own auto insurance.

If their child was driving their car, many companies give an "away at school" credit, Strama said. Or the company may reduce the higher rate for a "youthful operator" to the rate for a regular adult, given the reduced time the young person will be driving the car.

Insurance companies often give "good student" discounts worth 10 percent or 15 percent off a premium, too. Normal practice is to present a report card showing the student has an A or B average. Strama pointed out that insurers tend to require this proof only once a year, so students and parents alike should pick the best semester.

But many parents do send their kids to college with cars, some of them expensive or powerful, perhaps as high-school graduation presents.

A separate policy for the student can easily run $1,000 to $2,000 a year, depending on the car, the kid's record and where the student is going to college. High crime and accident areas will jack up the rate.

Linking a renter's policy and an auto policy can qualify the student for a discount. But many parents leave their college kid on their policy.

"It's usually better, when they're taking the car to leave it in the parent's name," Strama said. And there's another option.

"My daughter is just going to be up the creek," Strama said. "She's going to have to take a bike everywhere."

|

|

|

|

|

|

|