|

Educate your IRA

|

|

September 8, 2000: 8:00 a.m. ET

An education IRA is one option to help you save for college

By Staff Writer Jennifer Karchmer

|

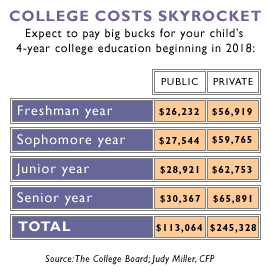

NEW YORK (CNNfn) - Saving for your kids' college education today is no laughing matter. With college costs going through the roof, you could expect to pay almost a quarter million dollars for four years at a private school for your newborn's future education.

So taking advantage of an education IRA may be one way to start saving now. Despite its name, it's actually not a retirement account and it does have some limitations. But coupled with other savings plans, you can start now to build a nest egg for higher education costs without dipping into your own IRA or 401(k) plan.

"Very few parents do save for college in their child's early years," said certified financial planner (CFP) Judy Miller. "When I counsel young parents, I make it clear that they have emergency reserves to protect them for unexpected events and so they don't have to use these education funds as a first line of support."

Start saving now

You just arrived home from the hospital with your newborn in your arms, and amid the baby bottles and diapers, you sigh, thinking about the daunting task of sending the little one to college in 18 years.

Looking at the latest data from the College Board, you can expect to pay more than $113,000 for a four-year public school degree. Even more astounding is the bill for private college in 2018 -- about $245,000!

So Congress created education IRAs in 1997 to provide a tax break to families trying to save for their children's college education. As your eyes bulge and you get queasy thinking about those astronomical costs, planners say opening an education IRA is one avenue to get you in the habit of saving.

Your contributions aren't tax deductible, but the earnings are tax-exempt, as are the withdrawals when the money is used for qualified expenses for college such as tuition and fees, room and board, books and other supplies.

Should I open an education IRA?

Of course, like other IRAs, there are rules governing who is eligible to open one. Single taxpayers with an adjusted gross income of up to $95,000 annually and married couples filing jointly with an adjusted gross income of up to $150,000 annually can invest in an education IRA and contribute the maximum amount of $500 per year, per child under 18.

So let's say you're starting to build that education nest egg for your kids but you would like to keep your retirement savings chugging along. Can you do both?

Visit CNNfn's Career page to read "Working your Degree," a new column that highlights job opportunities for a different college major each week. Click here for last week's column.

You can, in fact, contribute to an education IRA in addition to your $2,000 contribution to a traditional IRA or Roth IRA. Your investment earnings in the education IRA will grow tax deferred, and funds can be withdrawn tax-free to meet those expenses specifically for college.

So let's say you're preparing for college for Timmy, Jimmy, and Sarah. You may open more than one education IRA, depending on how many children you have. And under each plan you can contribute the maximum allowed amount of $500.

So if you have three children and plan to max out each education IRA you've opened, you could contribute a total of $1,500 a year.

And certainly Aunt Marge, Grandpa Joe and even your neighbor can make contributions on behalf of the child, but again, the total contributions per education IRA cannot exceed $500 a year.

Do keep in mind that the education IRA generally must be distributed or rolled over to another eligible family member by the time the beneficiary reaches age 30. Otherwise, you'll pay income taxes in addition to being slammed with a 10 percent penalty.

Also, opening an education IRA may affect your eligibility for state tuition programs, education tax credits and scholarships.

Other savings avenues

Surely, it's a great idea to start socking away the dollars for your baby's education now, even before his first steps, but many financial planners say you'll need more than just an education IRA to pay the bill because of its limitations.

John Demming, a spokesman with Vanguard Group, said the $500 contribution limit is a drawback to the plan.

"Because of the limits, they're not likely to cover a significant portion of expenses for your child's higher education," he said, "so treat it as one option."

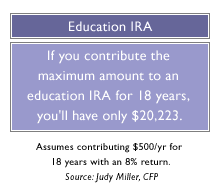

In fact, if you made yearly contributions of $500 for 18 years to an education IRA you would have only $20,223, not even enough to pay for one year of college at a public school, according to Miller.

Instead, she suggests parents open a growth-stock mutual fund account with a well-known fund company and begin contributing as much as possible. Earmark that account for educational purposes only, then you're not limited by contribution caps.

Miller suggests the Vanguard Growth Index Fund (VIGRX) or the Vanguard 500 Index Fund (VFINX), which both closely benchmark the S&P 500 Index, which historically has returned more than 10 percent.

Of course, you don't pay taxes on the mutual fund until you take money out, but you will pay capital gains on how much your money grows through the years.

If you're bummed out because an education IRA isn't going to get you very far, planners suggest you take a look at 529 savings plans, which allow you a little more flexibility in saving for college. Your contributions grow tax-deferred for tuition and other qualified college expenses at colleges and universities anywhere in the country.

A number of states have set up these programs, and regardless of where you live and where your child goes to school, you can choose whichever state's plan you like.

You can donate up to $10,000 a year and your spouse another $10,000 - much higher than the education IRA contribution limits.

More details on 529 plans

While you may be thinking $500 a year does not seem like very much to contribute each year to your child's future, some lawmakers are thinking the same thing.

There's a movement in Washington, D.C., to increase the contribution limit to $2,000 year. Lawmakers are also considering proposals to raise the savings limit for traditional and Roth IRAs to $5,000 from $2,000, the level established in 1981.

--Staff Writer Jennifer Karchmer covers news about 401ks and IRAs for CNNfn.com. Click here to send her e-mail.

|

|

|

|

|

|

|