|

OPEC to raise output

|

|

September 10, 2000: 12:50 p.m. ET

Oil cartel agrees to 800,000-barrel daily increase to ease prices

|

LONDON (CNNfn) - OPEC oil nations agreed Sunday to lift production by 800,000 barrels a day, in an effort to cool the recent price crunch that officials have warned could hurl the world economy into recession.

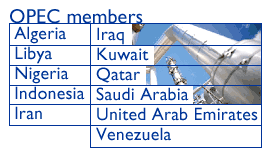

The Organization of Petroleum Exporting Countries said it will raise output by 3.1 percent to 26.2 million barrels a day for 10 members, excluding sanctions-bound Iraq. The pact, hammered out at a semi-annual meeting of the oil cartel in Vienna, goes into effect Oct. 1 and will continue until OPEC meets again Nov. 12 to assess market conditions.

Oil ministers said the increase, which was slightly higher than industry watchers anticipated, aims to meet demands among importing countries for the cartel to push crude down to its preferred range of $22 to $28 per barrel.

"We think this is enough but we want consumer nations to work to reduce taxes," said Qatari Oil Minister Abdullah al-Attiyah.

But others said the extra crude is a stop-gap measure that's insufficient to meet world demand.

"OPEC must extract more," said German Transport Minister Reinhard Klimmt.

The United States, the world's top oil importer, called the agreement "a step in the right direction." But a White House spokesman added: "Whether this will be effective and will be enough to stabilize the market remains to be seen."

Leo Drolass, an industry analyst at the London-based Center for Global Energy Studies, said the output increase is just "a tiny amount" and would not stem the recent spike in oil prices.

"This is much ado about nothing -- it's not going to have much of an impact," he said. "I'm afraid it's going to be more of the same for American consumers."

OPEC under pressure

Brent crude oil prices hit new 10-year highs last week, settling at $34.55 a barrel in London trading Thursday, sparking international pressure on OPEC to loosen its grip on the taps.

Truckers and fishermen in the United Kingdom, France and Italy have been railing against their governments for the high taxes that they levy on gasoline, which have compounded the oil-price pinch. Truckers and fishermen in the United Kingdom, France and Italy have been railing against their governments for the high taxes that they levy on gasoline, which have compounded the oil-price pinch.

President Clinton, as well as finance ministers in Europe and Asia, has expressed concern the surging prices could crimp world economic growth. Higher oil prices run the risk of sparking worldwide recession by increasing the cost of doing business.

Industry watchers had been expecting the cartel, which claims to be responsible for about 40 percent of the world's total oil production, to lift output by at least 500,000 barrels per day. Earlier this year, OPEC pledged to hike output by at least that amount if prices remained above their planned targets for 20 straight trading days.

Brent crude oil prices have settled above $28 per barrel every trading day since Aug. 3, and as of Thursday, the average OPEC price was $33.84 per barrel. In anticipation of an OPEC accord, Brent crude for October delivery fell $1.77 to settle at $32.75 per barrel on Friday.

The front-month contract for New York crude oil also plunged Friday, down $1.76 to settle at $33.63 per barrel.

Iran, Libya and other so-called price hawks in OPEC have resisted past efforts to raise the group's production target, which currently is 25.4 million barrels a day.

-- from staff and wire reports

|

|

|

|

|

|

OPEC

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|