|

Siebel to buy Janna

|

|

September 11, 2000: 8:31 p.m. ET

Software firm acquiring Toronto's Janna Systems in $975 million stock swap

|

NEW YORK (CNNfn) - Customer service and marketing software company Siebel Systems Inc. agreed Monday to acquire Canadian software maker Janna Systems Inc. in a $975 million stock swap.

Toronto-based Janna makes customer service software for the financial services industry, including software that enables banks and brokerage firms to offer their customers personalized "self-service" over the Web. Lehman Brothers, for example, uses Janna software to manage customer relationships across its institutional sales and research operations.

Siebel said it plans to integrate Janna's products into Siebel's existing financial services software applications, beginning with Siebel Financial Services 2001, which is slated for release in summer 2001. Siebel's current financial services customers include: Bank of America, Charles Schwab, Chase Manhattan Corp., Deutsche Bank, Fidelity Investments, Fleet Boston Financial Corp., and Prudential.

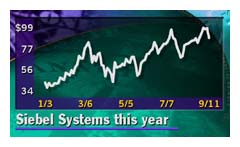

Under the terms of the agreement, each outstanding share of Janna's common stock, which trades on the Toronto Exchange, would be exchanged for 0.497 shares of Siebel stock, resulting in the issuance of up to 11 million additional shares of Siebel (SEBL: Research, Estimates) stock. Those 11 million shares are worth about $975 million, based on Siebel's closing price of $88.38 Monday. Under the terms of the agreement, each outstanding share of Janna's common stock, which trades on the Toronto Exchange, would be exchanged for 0.497 shares of Siebel stock, resulting in the issuance of up to 11 million additional shares of Siebel (SEBL: Research, Estimates) stock. Those 11 million shares are worth about $975 million, based on Siebel's closing price of $88.38 Monday.

The transaction values Janna at $43.92 per share (C$64.56), a 32 percent premium over its closing price of C$49 Monday. Janna has rocketed from a low of C$5.25 per share this year to a 52-week high of C$56.

San Mateo, Calif.-based Siebel is paying a steep price for the much smaller Janna, which reported revenue of C$19.2 million (US$12.96 million) for all of 1999 and C$19 million for the six months ended June 30, 2000. Janna's net income for the first six months of this year, including goodwill charges, was C$349,000, or 1.7 Canadian cents per share.

"We see the financial services opportunity as absolutely enormous, with 25 percent-to-30 percent of Siebel's revenue coming from financial services today," David Schmaier, Siebel's senior vice president for products, said in an interview with CNNfn.com. "There is a huge change going on where financial institutions are going from being product focused to being customer focused. Banks and brokerages want one view of the customer and to be able to cross-sell all their products to that customer."

While Siebel has been strong in software for retail banking and brokerage and insurance, Jenna is better known for its presence in the institutional banking and brokerage segment.

"Jenna has 300 people with considerable industry expertise, so we think the premium is justified," Schmaier said of the price Siebel is paying.

The transaction is expected to be accounted for as a pooling of interests, and to qualify as a tax-free reorganization. The acquisition -- subject to the approval of Janna Systems Inc.'s stockholders and certain government agencies -- is expected to close in the fourth quarter 2000.

|

|

|

|

|

|

|