|

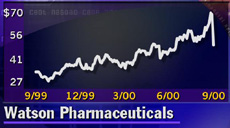

Watson falls after warning

|

|

September 13, 2000: 1:08 p.m. ET

Drug maker slides 22% after disclosing merger drives down 3Q results

|

NEW YORK (CNNfn) - Shares of specialty drug maker Watson Pharmaceuticals slid more than 22 percent Wednesday after the company disclosed third-quarter results would be hit hard by its acquisition of Schein Pharmaceutical Inc.

Shares of Corona, Calif.-based Watson (WPI: Research, Estimates) fell $14.31 to $49.81 in afternoon trading.

Watson said late Tuesday that third-quarter earnings are expected to fall to 3 cents to 5 cents per share, excluding one-time items, a major tumble from the First Call consensus estimate of 48 cents per share for the period. The company earned 38 cents per share in the year-earlier quarter.

Fourth-quarter estimates and full-year 2001 results also were revised downward, although not as dramatically.

Watson closed its cash-and-stock buyout of Schein in August, after the money-losing company put itself on the block amid an array of problems. Schein, based in Florham Park, N.J., has struggled with job cuts and regulatory probes of quality-control standards at its plants.

Watson said lower sales of Schein products, plus higher-than- expected goodwill and operating expenses associated with the acquisition are taking their toll on results. Watson said lower sales of Schein products, plus higher-than- expected goodwill and operating expenses associated with the acquisition are taking their toll on results.

"We remain confident in the long-term benefits the Schein acquisition will bring to Watson and its stockholders," Watson Chairman and CEO Allen Chao said. "However, in the short term, we did not fully appreciate the high inventory levels of Schein products ... currently with customers."

The company said it expects to bring Schein expenses into line by the end of the year and realize about $50 million in cost savings from the merger next year.

Watson said price pressures from generic drugs in the dermatology treatment market also cut into third-quarter results. The company makes the branded medication Monodox, an oral antibiotic for acne.

Third-quarter results are slated for release Nov. 7.

For the fourth quarter, earnings estimates were lowered to 39 cents to 41 cents per share, compared with the First Call target of 54 cents per share. For full-year 2001, earnings now are expected to total $2.38 to $2.42 per share, compared with the consensus estimate of $2.47.

|

|

|

|

|

|

Watson Pharmaceuticals

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|