|

Unravel Roth mysteries

|

|

September 13, 2000: 11:53 a.m. ET

Are you eligible for a Roth IRA? Follow the rules for defining your earnings

By Ed Slott

|

NEW YORK (CNNfn) - When I talk about Roth IRA eligibility, I always use the term "income" as if it is easy for people to understand. �But I've learned from your e-mails that figuring out income eligibility isn't that simple.

To convert your traditional IRA to a Roth IRA, your "income" cannot exceed $100,000. But this "income" number is not on your tax return or anywhere that you can look up. So how do you know what it is? You have to figure it out using your tax return.

The next question I usually get is, is usually "How can I use my 2000 tax return to find that information now if my tax return even at the earliest will not be done until sometime in 2001?" The next question I usually get is, is usually "How can I use my 2000 tax return to find that information now if my tax return even at the earliest will not be done until sometime in 2001?"

You'll have to estimate your income. You may want to use last year's tax return as a guide and plug in this year's projected amounts. Since it's already coming up on the last quarter of the year, you should have a good idea of what your 2000 income will be.

The actual income you use to find out if you qualify to either convert to a Roth IRA or contribute to a Roth IRA (the $2,000 per year contribution) is known technically as MAGI (Modified Adjusted Gross Income). Leave it to the IRS to make this stuff up, but it's not their fault. Congress came up with this calculation and expects the IRS to turn it into English for us.

Visit Ed Slott's irahelp.com

You must find your MAGI to know if you qualify for a Roth IRA or Roth conversion. To find MAGI begin with your projected Adjusted Gross Income (AGI). AGI is a number that you can find on your tax return. On the 1999 tax return (last year's) it's the number on the bottom of Form 1040, Page 1, line 33. In fact, on line 33, the form states: "This is your Adjusted Gross Income." So it's kind of hard to miss.

Your AGI is your income from all sources before you claim your itemized deductions and your deductions for yourself, your spouse and other dependents (your personal exemptions). Only a few select deductions are allowed to reduce your AGI. The most common of these are your IRA, SEP, SIMPLE, Keogh deductions, student loan interest deduction, alimony you paid, self-employed health insurance deduction, moving expenses, and one-half of self employment tax. These items reduce your AGI.

Read Ed Slott's recent columns on the three most important decisions you'll make with your IRA: Choosing a beneficiary, picking a life expectancy and picking a distribution method.

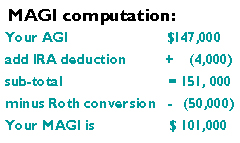

Back to your MAGI calculation. Begin with your AGI.

From AGI you must add back the following items: your traditional IRA deduction, your student loan interest deduction, any international earned income exclusion, any international housing exclusion or deduction, the exclusion for qualified bond interest, the exclusion for employer-paid adoption expenses.

For most of you, only the first item (the IRA deduction) will apply. This means then, that you cannot reduce your MAGI by an IRA deduction. If you're wondering about the student loan interest deduction, it will have no effect on MAGI because for those of you who are close to the Roth $100,000 conversion limit, you have too much income to qualify for the student loan interest deduction anyway. Once your income exceeds $75,000 (married-joint) you lose the student loan interest deduction ($55,000 for single individuals).

So now you have begun your quest for MAGI with your AGI and will add back your IRA deduction (if you had one). Then, from your sub-total, you deduct any Roth conversion income. This does not mean that your Roth conversion income is not taxable. It is. It means that it does not count as income to be eligible for a Roth conversion or contribution.

Example: let's see if you've got it.

Your AGI is $147,000, and that's after your Roth conversion income of $50,000 and a traditional IRA deduction of $4,000 ($2,000 for you and $2,000 for your spouse). Can you convert the $50,000? Answer: no, because your MAGI has exceeded $100,000.

Since your MAGI has exceeded $100,000 you cannot convert. Although your IRA deduction reduces your AGI, it does not reduce your MAGI for Roth IRA eligibility. Since your MAGI has exceeded $100,000 you cannot convert. Although your IRA deduction reduces your AGI, it does not reduce your MAGI for Roth IRA eligibility.

To see if you can contribute up to $2,000 ($4,000 married-joint) to a Roth IRA, you calculate MAGI the same way, except that your MAGI cannot exceed a phase-out range of� $150,000 - $160,000 (married-joint) and $95,000 - $110,000 (single or head of household).

So now you know what "income" is for Roth IRA eligibility. It's MAGI. Make sure to refer to this column when you need to make this key calculation.

|

|

|

|

|

|

|