|

The paper they're printed on

|

|

September 14, 2000: 6:01 a.m. ET

Defunct stocks can hold impressive value, and lucky backers find lost equity

By Staff Writer Alex Frew McMillan

|

NEW YORK (CNNfn) - When John Herzog was a young stockbroker hungry for customers, he conjured up a neat salesman's ploy. He was walking by an antique shop when a stock certificate caught his eye.

"It looked interesting to me," Herzog remembered. "I thought I'd take it home and frame it, and if you came to my office you'd think it was interesting also. And I would steer the conversation toward investing." He'd have you hooked.

Herzog, now chairman emeritus of the Wall Street firm that bears his  name, Herzog Heine Geduld, paid $5 for the elegant piece of paper. The New York and Harlem Rail Road Co. certificate was elaborately designed, with pictures of a puffing steam train, two figures in period dress, and a sleeping dog. name, Herzog Heine Geduld, paid $5 for the elegant piece of paper. The New York and Harlem Rail Road Co. certificate was elaborately designed, with pictures of a puffing steam train, two figures in period dress, and a sleeping dog.

When he got the certificate home, he noticed that it bore the ink signature of William Vanderbilt. The railroad magnate signed it as president of the company.

"I thought, 'Wow, I'm holding something that he had held and signed.' I liked that link with history," he recalled. It was he who was hooked instead.

A piece of paper worth $134,400

That was 40 years ago. Over his Wall Street career, Herzog became an avid collector of stock and bond certificates. His interests led him to found the Museum of American Financial History in New York.

He's not alone, meaning those certificates you found in granny's attic or Uncle Johnny's safe-deposit box might be worth the paper they're printed on. The securities may be defunct, or the certificate cancelled, but the artifact can still hold value.

Herzog figures his first certificate, which he gave to the museum, is worth about $500. That's not great when you consider he stored it for four decades. But a 9,900 percent gain isn't bad for something he wanted to buy anyway. Herzog figures his first certificate, which he gave to the museum, is worth about $500. That's not great when you consider he stored it for four decades. But a 9,900 percent gain isn't bad for something he wanted to buy anyway.

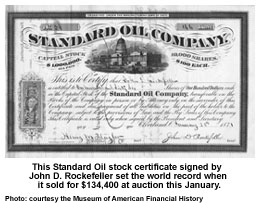

Last January, a Standard Oil Co. piece signed by John D. Rockefeller set the world record for a certificate at auction when it sold to a private collector for $134,400.

Finding hidden value

Sometimes the stock isn't defunct. Companies such as New York-based R.M. Smythe and Tucson, Ariz.-based Stock Search International will research securities for a fee to find out if there's any value in the underlying security.

They will also appraise the certificate from a collector's point of view. Scott J. Winslow Associates in Bedford, N.H., is another prominent stock-certificate dealer that appraises certificates, though it doesn't research securities.

Stock Search International charges $85 to investigate a company. It then keeps 30 percent of any value it manages to recover.

"Two out of every 10 securities that we research issued by what we call 'obscure companies' have survived," Pierre Bonneau, president, said. It researches 3,500 certificates a year. He said three-quarters of the family-run company's $750,000 in revenues come from research and recovery.

Companies that lose their investors

Companies go to great lengths to track investors and have to keep the outstanding equity on their books. But the investor and the "investee" sometimes lose each other.

Name changes are the No. 1 reason, Bonneau said, followed by mergers. Bankruptcies sometimes leave money behind for investors, too, a point many don't appreciate. Name changes are the No. 1 reason, Bonneau said, followed by mergers. Bankruptcies sometimes leave money behind for investors, too, a point many don't appreciate.

Antique dealers, who may sell a stock certificate now and then, and stockbrokers, who may not bother with the certificate of an obscure entity, aren't as thorough as a stock-research company like Smythe or Stock Search International, according to experts in the field.

Stock Search International once recovered $185,000 for an investor in the North European Oil Corp., Bonneau claimed. The penny-stock company owned land in northern Germany but went out of business prior to World War II.

Then the directors revived it in 1957. The company found oil on some of the land. Bonneau's client, who originally spent $125 on 5,000 shares, found they were very valuable. Bonneau said one million shares are still missing but outstanding in the company.

Such stuff as dreams are made of

Such stories are the stuff of legend, like finding a copy of the Declaration of Independence behind a yard-sale painting. Most long-lost certificates have already been cancelled, the stock called in.

"Occasionally people may find their shares are worth something and turn it in for the current value, maybe worth a few hundred dollars," said Richard Gregg, president of the U.S. chapter of the Bond & Share Society. But he said most certificates are worthless from an investment point of view.

Researching a certificate isn't entirely wasted, though. The research company provides the history of the security to customers. "At least they can frame it on the wall and have a story to tell at the same time," Gregg said.

And certificates, including cancelled ones, can be valuable, or just plain nice to look at. Stock research companies will also appraise the collector's value.

Anyone for scripophily?

The hobby of collecting stock certificates, scripophily (or the love - philos -- of scrip, a document of ownership) first caught on in the 1970s in Europe, where there is a tradition of ornate stock certificates.

By the mid-1980s, several part-time dealers were meeting regularly in New York. Collectors' interest often stemmed from collecting similar items like paper money or coins. By the mid-1980s, several part-time dealers were meeting regularly in New York. Collectors' interest often stemmed from collecting similar items like paper money or coins.

Other collectors were drawn by their background in finance or a particular industry. Collecting famous signatures is also popular.

In the United States, strong demand exists for Revolutionary-era bonds and also stock certificates from the great industrial boom at the start of the 20th Century.

Herzog isn't sure how much one certificate he bought is worth. Alexander Hamilton issued it to George Washington, making it one of the first U.S. Treasury bonds in history. Washington, who was showing his trust in the new nation by turning his Virginia debt over to the United States, signed the back.

Herzog paid $1,600 for it in the mid-1980s. He has since given it to the museum, which also says the document is the first to use the $ sign. Collectors have speculated it might fetch $750,000, Herzog said.

Early industrials and famous John Hancocks

Collectors prize stock certificates signed by famous magnates like Vanderbilt, Rockefeller or Andrew Carnegie, and robber barons like Jay Gould. Early certificates from famous companies like Coca-Cola, Pepsi and Ford Motor are also popular.

There are other collectible oddities, like certificates signed by U.S. presidents. Stephen Goldsmith, executive vice president of R.M. Smythe, points out that presidents used to be allowed to maintain ownership of companies while in office.

So there's demand for certificates of the 29th president, Warren G. Harding, who owned Harding Publishing. Millard Fillmore, the 13th president, signed railroad bonds as comptroller of the state of New York, too.

Modern certificates can fetch reasonable prices. The Wringling Brothers certificates from the 1960s fetch $500 to $600, according to Goldsmith. "They're very graphic and colorful. It's basically a piece of circus art," he said.

Playboy's certificates from the 1970s are notorious for their depiction of a centerfold with "some minor modifications," Goldsmith said. "She's got very long hair." They fetch between $275 and $350, depending on condition.

A few thousand avid collectors

Most certificates are much cheaper. "What's nice about them is, you can find certificates for a few dollars," Goldsmith said. "You can collect within a budget."

The most popular industries are railroads, aviation, automobiles, oil, mining, banking and insurance. Sports memorabilia are always popular collectors items - the Honus Wagner baseball card fetched $1.3 million on eBay. A 1957 Baltimore Baseball Club stock certificate fetched $800. The most popular industries are railroads, aviation, automobiles, oil, mining, banking and insurance. Sports memorabilia are always popular collectors items - the Honus Wagner baseball card fetched $1.3 million on eBay. A 1957 Baltimore Baseball Club stock certificate fetched $800.

But collectors say there will undoubtedly be strong interest in the pioneers of the computer industry, say, particularly if certificates are hand-signed by a luminary. Whether certificates are merely interesting and worth a few dollars or very valuable depends on how rare they are.

Scripophily hasn't taken the world by storm. "This is not a hobby that has mass appeal," Goldsmith said. Instead, it has seen "slow and steady growth."

Gregg estimates there are 20,000 stock-certificate collectors worldwide, a quarter of them in the United States. Most dabble and only own a certificate or two, buying sporadically.

"It's a wild guess, because we have no statistics to pin it down," he admitted. His collector's society has 1,000 members worldwide, and 100 of the members that list themselves as dealers. He figures 30 to 40 dealers are professional, with the rest looking for a dealer's discount.

Internet spreading the hobby

The Internet is making it easier for collectors to trade, though. Sites like Scripophily.com are springing up. Stock Search International says it will offer the first certificate-only Internet auction when its scripophilyauction.com site goes live, slated for later this year.

There are plenty of old stock certificates on eBay. But Scott Winslow, the New Hampshire dealer, cautioned that they tend to be flea-market quality.

"It's really caveat emptor," Winslow, who has sold certificates via eBay, warned. He believes most real-world dealers are pretty reputable, however, because the field is still so narrow.

Like any collectible or investing in art, the main requirement is to like what you buy. If you're looking to invest, you're almost certainly better off picking real "live" stocks.

"It's a labor of love," Gregg said. "Anybody buying any collectible in the hope that it's going to be worth 10 times as much 10 years down the road, you're kidding yourself.

"You buy something you like and that is of interest. And if it is worth more down the road, wonderful," he concluded.

-- Click here to send e-mail to Alex Frew McMillan

|

|

|

|

|

|

|