|

Savings tips to retire rich

|

|

September 14, 2000: 7:43 a.m. ET

From Gen-X to Senior Citizen, here's a primer on how you should save

By Cheryl Meyer

|

NEW YORK (CNNfn) - Jeremy Wray was a kid fresh out of high school when he wheeled his way toward fame and fortune.

The street skateboarding teenager, with some persistence, attracted the attention of skateboard companies. Soon, he had his own skateboard lines, from which he received royalties. He designed shoes for Adio Footwear, such as the Jeremy Wray V.2. And he made videos of his skateboarding stunts, which are sold in board shops worldwide.

The money poured in, and Wray, now a 25-year-old professional skateboarder, turned a passion into a full-time, lucrative career. Today, he said, he earns between $80,000 and $100,000 annually from royalties, sponsorships, videos and other deals. The money poured in, and Wray, now a 25-year-old professional skateboarder, turned a passion into a full-time, lucrative career. Today, he said, he earns between $80,000 and $100,000 annually from royalties, sponsorships, videos and other deals.

What's he doing with all that money? According to Wray, he's saving it.

He's buying a house soon. He's thinking about IRAs, tax-deferred savings plans and money-market accounts. And he's consulting a financial planner.

Higher salaries, more saving potential

Wray may have an atypical career, but his situation isn't so unusual. Professionals of all ages are earning more now than ever, thanks in part to today's thriving economy.

With America's burgeoning wealth, the rules for saving haven't changed, but financial planners are more adamant than ever that people map out a plan for their hard-earned dollars - and for their future.

Click here to read CNNfn.com's special report, The Road to Riches, to help you on your path to retiring wealthy.

"The biggest mistake is putting it off," said Steven Kaye, a certified financial planner and president of the American Economic Planning Group Inc. in Watchung, N.J., about saving money. "If people can get in the mode of saving 10 to 15 percent of their income when they're young, they'll be financially well off later on in life."

Young, rich and focused on today

Many Gen-Xers draw paychecks that took their fathers 20 years to earn, yet some young workers don't have a clue what to do with the money, except spend it.

Wray said none of his peers is doing any saving at all.

"They're living month-to-month, and spending everything they have," Wray said. "They're living month-to-month, and spending everything they have," Wray said.

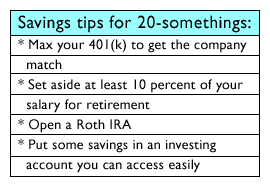

Most financial planners say that people in their 20s should begin saving as much as possible while they're young.

The biggest reason is to take advantage of compound interest, where the interest you earn on your savings starts earning interest. Compound interest is so powerful that someone who saves $2,000 a year from age 20 to 30 will still save more by retirement than someone who saves the same amount from age 30 to 60.

"Anything they can squeeze out is so much the better for the future, even if it's only $30 a month," said Tom Gryzmala, president and chief financial officer of Alexandria Financial Associates Ltd. in Alexandria, Va.

Some planners advise people in their 20s to set aside at least 10 percent of their salary for retirement, and virtually all agree that young workers should first match their 401(k) contributions with the maximum amount added by their employer. In other words, if their employer matches 3 percent of their salary, they should also try to contribute 3 percent.

Next, many planners advise twentysomething workers to take out Roth IRAs. Investors won't pay taxes on Roth IRAs once they cash them in, nor will they pay on the earnings, providing they've been invested in the IRA for five tax years and are over the age of 59 1/2. Next, many planners advise twentysomething workers to take out Roth IRAs. Investors won't pay taxes on Roth IRAs once they cash them in, nor will they pay on the earnings, providing they've been invested in the IRA for five tax years and are over the age of 59 1/2.

Still, young professionals shouldn't lock all their money into retirement accounts. By the late 20s, they may be married. They may want to buy a home. And they may be thinking about having children. So some money, according to planners, needs to be set aside for life changes.

Kenneth Caplin, a certified financial planner and principal of Caplin Associates in Orange, Calif., advises young investors to save some money in a money market or other savings account that's easy to access for such short-term expenses.

Gryzmala suggests people in their 20s put at least half of their savings toward a home purchase.

Juggling retirement saving with other expenses

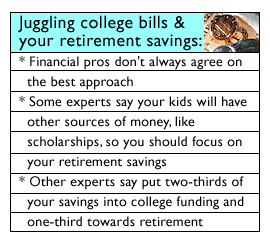

For many people, saving becomes even more confusing in their 30s and 40s, when many factors come into play.

Should they save more for their retirement - or their kids' college educations, for example?

Mark and Laurie Saloman, both in their early 30s, own a single-family home in Basking Ridge, N.J., and have two young children. Mark works as a lawyer. Laurie works from home as a freelance writer.

Both admit they are good at saving money, and they have done well financially because of their frugal ways. But they're not saving anything for their kids' education, except for generous gifts they've received from friends and relatives. Both admit they are good at saving money, and they have done well financially because of their frugal ways. But they're not saving anything for their kids' education, except for generous gifts they've received from friends and relatives.

"We'd rather save for our own retirement at this point," Laurie Saloman said. "If the kids don't have enough for college, they can take out loans, but nobody will fund our retirement for us."

Caplin agrees with their reasoning. "If you are being realistic, it's easier for them to fund [their] retirement and worry about scholarships and grants for the children" down the road, he said.

Others planners give conflicting advice. Once a married couple with kids buys a home, they should put two-thirds of their monthly savings into their children's education, and one-third into retirement, Gryzmala said. In their 40s, when the kids may be heading off to college, the couple can take out a home-equity loan on their house to help fund the college education if necessary.

Without question, education planning can't be ignored. The cost of sending Andrew or Ashley to college has increased about 10 percent annually for the last 10 years, said Kaye. He suggests people with newborns open a "gift to minors" account, where parents pay essentially no taxes on the first $1,400 in the child's name.

Put your savings in high gear

Once in their late 40s or 50s, most people should focus solely on saving for their retirement, and even beefing up monthly contributions to their various retirement accounts.

Elliot Kramer, 49, an estate planning and tax attorney in Roseland, N.J., said he's now beginning to think long-term.

"[And] I'm beginning to learn, that even as you educate your children, you have things such as weddings for them, and they want to buy homes. And while I've stopped saving for their education, I still believe I have contingent liabilities," he said.

Kramer said he currently saves about 20 percent of his income. About 50 percent of his savings goes toward retirement and 30 percent goes for miscellaneous expenses and individual savings accounts. (The other 20 percent goes to charity, he said). Kramer said he currently saves about 20 percent of his income. About 50 percent of his savings goes toward retirement and 30 percent goes for miscellaneous expenses and individual savings accounts. (The other 20 percent goes to charity, he said).

Planners admit that no hard-and-fast rule works for everyone, no matter what their age. People face different situations: Some can afford to save money for their kids' education, their four-bedroom home and their retirement; others can barely make the mortgage payment; and still others just need to manage their money better.

Money for unexpected emergencies

Still, some common-sense rules apply to everyone, such as saving enough for a rainy day.

"All along you should always have between three to six months of monthly living expenses in an emergency cash fund," Gryzmala said. "Life has many, many detours, many bumps in the road. If you don't' have a plan, you may not be able to recover."

In other words, if your elderly parents need care, if you encounter medical problems, if your child is born with a disability - or even if you inherit money - you need to be prepared.

Such emergencies may not be on the mind of young Jeremy Wray, but Wray believes he's heading down a financially sound path. His financial planner, Kenneth Caplin, has helped Wray prioritize his skateboard earnings.

"He's mapped out a simple plan, nothing too tricky," Wray said of Caplin. "He put the money in the right places."

-- Cheryl Meyer is a freelance writer who covers personal finance issues for CNNfn.com.

|

|

|

|

|

|

|