|

Main Street hunts for help

|

|

September 15, 2000: 11:20 a.m. ET

Record number of firms report jobs hard to fill; inflation concern is low

By Staff Writer Steve Bills

|

NEW YORK (CNNfn) - The labor squeeze has been beneficial to Steve Salem. His Sioux City agency, Rudy Salem Staffing Services, has opened four new offices in the last 12 months to help Iowa employers hire help.

This is not to say life is easy. "We're sitting here with just about zero unemployment," Salem said, noting that the jobless rate in Iowa, at 2.4 percent, is well under the nation's near-record-low 4.1 percent level.

Still, recent signs of cooling are having at least some slight effect. "It's not as difficult to find candidates" to fill jobs, he said. "But it's more difficult than ever to find good candidates."

It's the same situation all over. Nationwide in August, a record 35 percent of small firms reported hard-to-fill job openings, according to a survey released Friday by the National Federation of Independent Business Education Foundation. The number had held for the last four months at 33 or 34 percent, till now the highest level in the 25-plus years of the monthly survey.

Despite the problems in filling vacancies, companies are pushing ahead with plans to add staff, the survey found, with 20 percent of respondents planning to hire new workers, just shy of the record 22 percent set last December.

But 49 percent of the firms actively recruiting new workers reported "few" or "no" qualified applicants for their vacancies.

Pervasive problem finding people

"We can't add people because we can't find people," said David Hurley, head of Landmark Engineering and Surveying Corp. of Tampa, Fla. "Everybody has the same problem."

Hurley is concerned about the apparent complacency of workers in their attitudes toward their jobs. "Ten years ago, we had people who knew they could be out of work a year, two years, three years," he said. "Today I have people who think nothing of calling in and saying, 'I have to take the day off to take care of my car.' Hurley is concerned about the apparent complacency of workers in their attitudes toward their jobs. "Ten years ago, we had people who knew they could be out of work a year, two years, three years," he said. "Today I have people who think nothing of calling in and saying, 'I have to take the day off to take care of my car.'

"You have to take care of your job."

Salem tells a similar story. One bright spot of his agency's expansion has been the addition of a day-labor service -- offering short-term placement of unskilled or semi-skilled workers for jobs in light manufacturing and the like. The "All in a Day" venture helps employers with their immediate staffing needs, but the supply of workers is erratic, he said.

"They'll work when they want to work, but other days they won't show up," especially around the first of the month when government benefits checks come in, Salem said. "It blows my mind."

To some extent, small businesses are taking advantage of technology to confront the labor squeeze. "I have a CAD operator I've never seen," Hurley said, referring to a Nashville contractor who uses computer-aided design software to produce engineering drawings that he transmits to the firm over the Internet.

And Hurley continues the conventional job search as well. Earlier this week, he was awaiting the arrival of a new hire to join the 48-member firm. "We're not giving up," he said. "You find them eventually. It's just difficult."

Overall, optimism improves

Overall, the NFIB's "index of small business optimism" climbed 8/10ths of a percentage point in August, to 101.9, following a 3.2-point gain in July.

And looking ahead, a net 3 percent of all firms expect the economy to improve over the next three months -- an 8-point climb in August. For most of the year, owners have been expecting the economy to weaken.

In one key indicator, the number of firms raising prices, the percentage has dropped sharply to 10 percent of companies, down from 19 percent in June. While the number is still higher than it was a year ago, "the direction has got to look good to the Fed," said William C. Dunkelberg, chief economist at the NFIB.

Capital spending plans are down, raising the risk that Main Street companies will lose the ability to fight off inflationary pressures by improving productivity, the survey found.

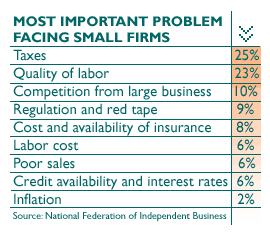

But inflation is not a concern to small businesses. Only 2 percent of survey respondents identified it as the most important problem facing them. In the early 1970s, at the peak, inflation was the No. 1 concern of 42 percent of companies.

|

|

|

|

|

|

|