|

The new kings of 401(k)s

|

|

September 15, 2000: 4:21 p.m. ET

How to make sense of performance data for the biggest retirement funds

By Staff Writer Martine Costello

|

NEW YORK (CNNfn) - If Wall Street were a boxing ring, Janus Twenty Fund would have been the trash-talking heavyweight champion of the world.

The fund pounded its competitors for years, with peak annual returns of 74 percent in 1998 and 65 percent in 1999. Assets ballooned as Janus Twenty became a favorite with 401(k) investors. When the fund closed to new investors from time to time to put a lid on growth, it made competitors look even more like losers.

But those chest-thumping returns have disappeared in 2000, and Janus Twenty has been left bloodied at the bottom of performance charts, a brutal reminder that when it comes to retirement investing, you don't need a knockout.

"Many of the big funds are down this year," said Ron Roge, a certified financial planner and president of R. W. Roge and Co. in Bohemia, N.Y. "Things that get overvalued tend to come back to normal valuations. That's why you need a diversified portfolio."

New winners are in the ring

If nothing else, new fund data show that asset allocation is the best way to keep your nest egg competitive when the market has mood swings.

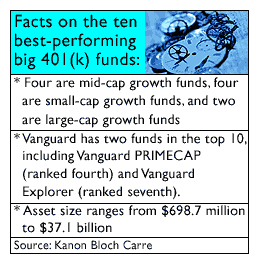

An analysis by Boston fund researcher Kanon Bloch Carre shows that out of the 98 largest mutual funds in 401(k) plans, the winners in 2000 are no longer all large-cap growth funds. The funds have assets of about $672 million to $104 billion.

"The market has broadened out to mid- and small-caps," said Bill Dougherty, an analyst at Kanon Bloch Carre. "People who aren't diversified are really feeling the pinch." "The market has broadened out to mid- and small-caps," said Bill Dougherty, an analyst at Kanon Bloch Carre. "People who aren't diversified are really feeling the pinch."

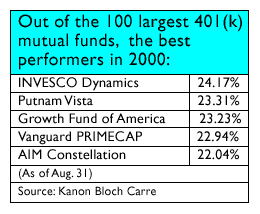

Out of the top ten performers on the list, four are mid-cap stock funds and four are small-cap funds. INVESCO Dynamics, a mid-cap fund, came in first with returns of 24.17 percent year to date as of Aug. 31, according to the data. The top small-cap fund, Vanguard Explorer, ranked seventh with returns of 21.01 percent in the same time.

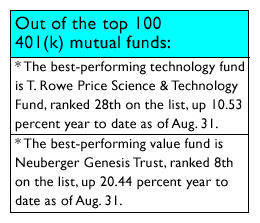

While all of the mid- and small-cap funds invest in high-voltage growth stocks, another top-ten fund, Neuberger Genesis Trust, invests in value stocks. Value investors seek out overlooked stocks, but the style has been out of favor for more than two years as growth stocks have soared.

The Neuberger fund ranked eighth on the list and is up 20.44 percent this year.

Value, active managers do well

Dougherty said value stocks are generally up about 4 percent this year, while growth remains flat. Wall Street pros have been looking for signs of life in value for years, and a sustained turnaround hasn't happened yet.

"If you have a balanced position, a growth fund and a value fund, you stay with them," Dougherty said. "Investors really don't understand growth versus value."

Other top personal finance features on CNNfn.com this week:

The paper they're printed on

Take the fight out of the big chill

A sprinter's portfolio

Good bets for college savings

Active management, which started a comeback last year over index funds, has been a big winner as well, the figures show. An index fund tracks a benchmark such as the S&P 500, while active managers use their acumen to find the best stocks.

For example, Vanguard 500 Index Fund, which tracks the S&P 500, is 68th on the list of top 401(k) fund winners. That means dozens of managers are beating the index, Dougherty said.

Some champs fall off the pedestal

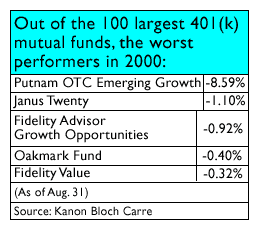

But what a difference a year makes to giant funds such as Janus Twenty, now ranked 97 on the list with losses of 1.10 percent, according to the Kanon Bloch Carre analysis.

The fund was so popular that it closed for the first time in February 1993 to put the break on soaring asset size. It reopened in November 1995, then closed again in April 1999.

Efforts to reach someone at Janus for comment about Janus Twenty were unsuccessful. Efforts to reach someone at Janus for comment about Janus Twenty were unsuccessful.

The fund is a so-called "focused" portfolio of 45 stocks and has a 59 percent weighting in technology, according to Morningstar. Top holdings include Nokia, Cisco Systems and Sun Microsystems.

A recent analysis by Morningstar said the fund suffered this year in part because of Nasdaq volatility and in part because of stocks such as Microsoft, battling a landmark antitrust case. Another top holding, America Online, has also struggled since it announced plans to merge with CNNfn.com parent Time Warner, according to Morningstar.

"A lot of people ignored mid-caps and small-caps and did just large-caps," said financial planner Roge. "Many big funds are down this year ... It's the cycle of the market. Things that get overvalued tend to come back to normal."

Roge recommends a 401(k) portfolio that is 50 percent in large caps, including both growth and value, with the remaining in mid- and small-cap stocks. (Click here for some recommended portfolios for people in different age groups). Roge recommends a 401(k) portfolio that is 50 percent in large caps, including both growth and value, with the remaining in mid- and small-cap stocks. (Click here for some recommended portfolios for people in different age groups).

Fidelity's flagship Magellan Fund, for example, is so huge that it's hard for manager Bob Stansky to move in and out of stocks, Roge said. Magellan is ranked 50th on the Kanon Bloch Carre list, with year-to-date returns of 5.81 percent as of Aug. 31.

"We tend to avoid the mega funds," Roge said.

Fund giants win and lose

Fidelity's best-performing fund on the Kanon Bloch Carre list is Fidelity Retirement Growth. It is one of two large-cap growth funds in the top 10 and is up 21.77 percent year to date as of Aug. 31.

Fidelity also has the best- and worst-performing large-cap value funds on the list. At the top, Fidelity Dividend Growth, ranked 21st, is up 12.52 percent. At the bottom is Fidelity Advisor Growth Opportunities, ranked 96th, down 0.96 percent.

Seven of the 13 worst performers are Fidelity funds, including well-known Fidelity Fund, ranked 85th with returns of 2.88 percent.

Efforts to reach someone at Fidelity to talk about the performance data were unsuccessful. Efforts to reach someone at Fidelity to talk about the performance data were unsuccessful.

Vanguard, known for its index funds, had two actively managed funds in the top 10 -- Vanguard PRIMECAP, ranked fourth with returns of 22.94 percent, and Vanguard Explorer, ranked seventh.

Martha Papariello, principal of Vanguard's institutional investing group, said PRIMECAP is a concentrated portfolio of mid-caps where the top 10 holdings represent about 41 percent of the portfolio.

"There's a lot of good opportunities in the mid-cap range," Papariello said.

Vanguard Windsor and Windsor II, both value funds, moved up the performance charts this year. Windsor II is 45th on the list, with a return of 8.33 percent. Windsor, the former flagship, is 47th, up 8.17 percent.

"It's the other side of the value-growth coin," Papariello said. "Years from now, growth could be out of favor and you could say, look at PRIMECAP."

Vanguard seemed to perform a little bit better on the list than Fidelity. Excluding index funds, the worst-performing Vanguard fund is Vanguard Growth & Income, ranked 56th and up 5.28 percent this year.

Is big always better?

Peter Di Teresa, who writes the personal finance advice column "Ask the Professor" at Morningstar, said size isn't that much of an issue with large-cap funds. But he said size does become a factor for funds that invest in mid- and small-cap stocks.

"It's like a jockey carrying extra weight," Di Teresa said.

The top-performing big 401(k) fund in 1999 was a small growth fund, Putnam OTC Emerging Growth Fund. It earned a robust 126.9 percent last year. But this year, the Putnam fund is dead last on the list, off 8.59 percent. Efforts to reach someone at Putnam for comment on the fund were unsuccessful.

Di Teresa said the most important part of your 401(k) should be a core holding that has broad exposure to the U.S. market, such as Vanguard 500 Index Fund. You might also try a total stock market fund. He recommends the core holding, whether it's one or more funds, to be 40 to 50 percent of a portfolio. Di Teresa said the most important part of your 401(k) should be a core holding that has broad exposure to the U.S. market, such as Vanguard 500 Index Fund. You might also try a total stock market fund. He recommends the core holding, whether it's one or more funds, to be 40 to 50 percent of a portfolio.

You can tailor the rest of the portfolio to suit your risk tolerance and age, Di Teresa said. He recommends 10 to 20 percent in international stocks, though investors with 30 years to retirement may not need any bond exposure.

"Even 20 years out, you could be investing entirely in stocks," Di Teresa said.

Do you need help understanding retirement investing? Click here to read more about 401(k)s on CNNfn.com.

And what if you don't have the largest 401(k) funds in your plan? Di Teresa said you shouldn't worry. You can build a good retirement portfolio with "average" funds, he said.

Making choices

"You can do quite well over the long haul with average funds," Di Teresa said. "The reason they're biggest is because they've been successful in the past. And some funds are big in 401(k)s because the fund companies are better at selling them."

If your 401(k) doesn't have many good choices, you could open an IRA to supplement the plan, said Doug Flynn, a certified financial planner in New York.

"You're never going to get supercharged performance in your 401(k)," Flynn said.

The biggest funds are fine for a 401(k), but don't expect high-octane returns, Flynn said.

Flynn likes MFS funds, which has three funds on the Kanon Bloch Carre list: MFS Capital Opportunities fund, ranked 15th, with returns of 15.04 percent this year; MFS Research Fund, 16th, up 14.93 percent; and MFS Emerging Growth Fund, 38th, up 8.88 percent.

Most 401(k) plans have no more than eight or ten choices, Flynn said. Ironically, the smaller companies often have a better selection than the biggest firms, he said.

"Some of the biggest companies have some of the worst 401(k) plans I've ever seen," Flynn said. "But Joe's Plumbing might have a great 401(k)."

In rare cases, a company might have something called a self-directed 401(k), which allows you to invest in any funds or stocks that you want. But such plans are extremely expensive, he said.

"What happens is most plans aren't that great," Flynn said. "You do the best you can with the choices."

|

|

|

|

|

|

|