SAN FRANCISCO (www.redherring.com) - Public investors have fallen out of love with computer services companies, but private investors are still blowing them kisses.

Headstrong, formerly James Martin+Co., got a big smooch this week, raising a staggering $191 million in a first round of funding from just two investors.

Buyout firm Welsh, Carson, Anderson & Stowe (WCAS) led the round with $173 million, and H & Q Asia Pacific invested $18 million in what is the biggest computer services deal of the year, according to industry research firm Venture Economics.

Not to be stood up, services firm Wheelhouse will announce Monday that it received $52 million in a second round of funding from slew of sweethearts. Those that reinvested are Charles River Ventures, Integral Capital Partners, and Kleiner Perkins Caufield & Byers; new investors include Amerindo Investment Advisors, Chase H & Q, and database software maker Oracle.

VCs invested $4.4 billion in computer services firms in the second quarter, more than double the $1.7 billion they put in such companies in the year-earlier period, according to Venture Economics.

"We think the future continues to be bright for [computer] integration companies," says Scott Mackesy, a principal at WCAS. As part of the deal, the investment firm takes a majority stake in Headstrong, and Mackesy and two WCAS colleagues take positions on the company's eight-member board.

Falling from grace

Lately public investors have been expressing their uncertainty about consulting companies.

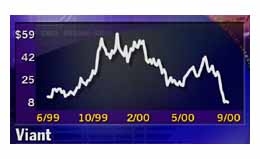

<-[if gte vml 1]>  The stock prices of once-hot computer services firms such as Proxicom, Scient, and Viant have plummeted between 30 and 60 percent in August. On Thursday, shares of Proxicom closed up 81 cents to $22 each. Scient shares were down 75 cents to $27.44, and Viant's were off 22 cents to $8. The stock prices of once-hot computer services firms such as Proxicom, Scient, and Viant have plummeted between 30 and 60 percent in August. On Thursday, shares of Proxicom closed up 81 cents to $22 each. Scient shares were down 75 cents to $27.44, and Viant's were off 22 cents to $8.

Because of the market conditions, several private competitors -- such as Zefer, The Concours Group, and Fort Point Partners -- have postponed or withdrawn their IPOs.

Hitting the brakes

Demand has slowed because dot.com startups on the whole aren't able to raise as much venture capital, and those with money in the bank are spending less, says Tara Knowles, Viant's chief marketing officer. In addition, established companies feel less pressure to initiate expensive technology projects because dot.coms are slowing their charge, she says.

"Essentially the dot.com [sales] channel has shut down," said Barry Chubrik, a research analyst at Credit Suisse First Boston.

Companies that want to avoid the market downdraft and being categorized as just another services firm will need to have extensive computer systems and project management experience, Chubrik said.

"It's no longer HTML and Java stuff," he said. "Creativity was a driver a year ago -- now it's an afterthought. We're done with the first generation of Web sites." Now companies that want help going digital need a consultant with many skills, ranging from networking disparate computer systems to instituting the latest technology, like application hosting and wireless services, he added.

Well-positioned

Headstrong is positioned well because it combines Web site development teams with traditional computer system integration experts, WCAS's Mackesy said.

Headstrong is not a newcomer. Founded in 1981, it has grown to more than 1,000 employees who work in offices spread over 12 countries. The company always has been profitable, and revenue is projected to reach $150 million for this year, up from $100 million in 1999, Headstrong CFO Peter Cowern says.

Fifty-five percent of revenue comes from clients based abroad. It has worked with almost 100 customers, including Bank of Scotland, BellSouth, Chaparral Steel, the Commonwealth of Virginia, Detroit Edison, the Department of Housing and Urban Development, Merrill Lynch and Sprint.

For 17 years, Headstrong made money by doing the heavy lifting of building and integrating large computer systems, but for the past 18 months it has been modernizing its strategy to include heavy doses of Internet technology and phasing out less lucrative clients such as the U.S. government, says CEO Patrick Litré.

Litré said Headstrong uses technology to help businesses in three main areas: performing deep analysis of the business, from call centers to Web site activity; managing relationships with customers; and making sure all divisions of a company can access the same information.

The company may use up to $80 million of its $191 million in venture capital to make acquisitions and leapfrog into new areas of technology. One market in which Headstrong is considering an acquisition is the wireless market, said Nelson Blitz, senior vice president and general counsel.

Learning fast

While Headstrong is a veteran of the computer services industry, Wheelhouse is just getting started. It was founded last year and launched only this past March. It's not profitable and employs 100 people who work in three U.S. offices, a company spokeswoman says.

Not a traditional computer consultancy, Wheelhouse is firmly rooted in the latest technology and Internet marketing ploys. It works with its clients to develop and implement marketing strategies using Internet technology. Wheelhouse has about 20 customers, including 360hiphop and Harvard Business School.

Wheelhouse and Headstrong have the luxury of watching and learning from public companies such as Viant, which has fallen from grace.

After going public in June 1999, Viant shares traded as high as $63.56. But two weeks ago it announced that revenue for the current third quarter will drop 12 to 15 percent from the previous quarter's $38.5 million and that it expects to report a loss for the quarter. That's in contrast to Viant's earnings of 3 cents per share on revenues of $18.8 million in the same period a year ago.

The percentage of Viant's revenue that comes from dot-com clients hovers around 20 percent, and last quarter that figure was 17 percent.

Discuss venture capital in the Venture Capital Funds and Firms forum, or check out forums, video, and events at the home page.

© 1997-2000 Red Herring Communications. All Rights Reserved

|