|

AOL-Time Warner at risk?

|

|

September 18, 2000: 7:22 p.m. ET

European regulators seen ready to block deal, but companies expect to get OK

|

NEW YORK (CNNfn) - The European Commission's antitrust regulators have reportedly circulated a preliminary recommendation to block America Online's pending acquisition of Time Warner, but both players in the $124 billion deal insist the pact will close in coming months.

Officials from both companies hope the "block" proposal - which may hinge on concerns that Time Warner's proposed buyout of entertainment conglomerate EMI Music will hurt music industry competition - doesn't influence the final outcome of regulators' investigations, the Wall Street Journal reported in its electronic edition Monday.

Internet services company America Online (AOL: Research, Estimates) and  media conglomerate Time Warner, the parent of CNNfn.com and CNN.com, have until Sept. 24 to try to save the deal by offering new antitrust concessions to regulators in Brussels, the newspaper said. media conglomerate Time Warner, the parent of CNNfn.com and CNN.com, have until Sept. 24 to try to save the deal by offering new antitrust concessions to regulators in Brussels, the newspaper said.

Representatives for the European Commission in Brussels were not immediately available to comment on the newspaper report.

A New York-based spokesman for the European Commission would neither confirm nor deny the newspaper report, but noted that if such a draft has been drawn up, there is still time for the two companies to take further steps before the full commission decides on the fate of the $124 billion deal.

"[The commission] had concerns from the very start, but it ain't over until it's over," the spokesman added. AOL and Time Warner have already offered concessions on their proposed merger to meet European Union competition concerns.

Representatives for both New York-based Time Warner (TWX: Research, Estimates) and Dulles, Va.-based AOL echoed that sentiment. Any such proposal by the European regulators would be a normal step in the process of negotiations surrounding the deal, they said.

"We are totally comfortable with where we are at this stage in the negotiations," the Time Warner spokesman said.

"As we have said, we are on track to close in the fall," Ken Lerer, senior vice president for AOL, said in a statement.

European antitrust watchdogs have been consistently critical of the merger, worried that after marrying Time Warner's entertainment content with AOL's online strength, the new combined company, AOL Time Warner, would be able to cut out competitors from their broad distribution channels.

But, in the eight months since the AOL-Time Warner deal was announced, both companies have repeatedly responded to criticisms about access with assurances that their online and cable television systems will be open.

Both companies' shares traded higher on Monday afternoon on the New York Stock exchange, despite a steep drop in the overall market. Time Warner shares closed at $80.88 up $1.06, while AOL shares rose 28 cents to $55.53.

Worries about music and competition

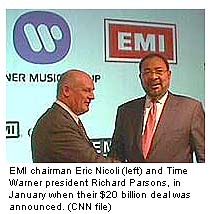

European regulators studying the AOL-Time Warner deal are reportedly concerned about a separate deal, the $20 billion combination of Warner Music with EMI Group, which would shrink to just four the number of companies that dominate the global recorded music business.

The $20 billion pact would combine Time Warner's Atlantic, Elektra and  Warner Brothers record labels with EMI's Virgin, Priority and Capitol labels, bringing under one corporate roof artists such as Madonna, Eric Clapton, Janet Jackson and D'Angelo. Warner Brothers record labels with EMI's Virgin, Priority and Capitol labels, bringing under one corporate roof artists such as Madonna, Eric Clapton, Janet Jackson and D'Angelo.

The commission, the Brussels-based executive arm of the European Union, is concerned the combined company could control the market for downloading music from the Web. A report last Thursday in the Financial Times cited internal commission documents that said the merger would create an oligopoly that could control record prices and have a 50 percent to 60 percent market in the European Union.

The report said that EMI was likely to be pressed to divest several record labels and sign agreements not to restrict the technology used to play its music on the Internet.

EMI on Monday said it plans to submit proposals for concessions in a last-ditch bid to win European regulatory approval for its merger, the European Commission said on Monday.

Seeking to smooth regulatory rough edges, senior EMI executives on Monday met with Competition Commissioner Mario Monti and the Merger Task Force on Monday. EMI faces a Tuesday midnight deadline to submit concessions it might make in order to get the deal passed.

"We will be submitting formal undertakings to the Commission before the deadline tomorrow," a spokeswoman for London-based EMI said. "We believe that our proposed settlement fully addresses all the concerns raised by the Commission."

The spokeswoman declined to detail the proposals that will be presented to the Commission.

In a research note published Thursday, Merrill Lynch Internet analyst Henry Blodget said he expects the AOL Time Warner merger to close in November and does not foresee many concessions that would materially impact future performance.

|

|

|

|

|

|

|